What is a Home Warranty?

A home warranty is a contract that provides customers coverage for repairs and replacements of major household systems and appliances due to normal wear and tear. It offers protection for unexpected breakdowns, including fixing or replacing covered items like air conditioning, stoves, refrigerators, washing machines, and plumbing systems.

How Do Home Warranties Work?

Home warranties help homeowners cover the cost of repairing or replacing appliances, systems, and other home items that break over time. When you purchase a home warranty, it's like having a security blanket for unexpected repairs. If something goes wrong with covered items, the appliance warranty company pays for repairs or replacements up to your plan's limit.

Should you have a problem with a covered item, you can call the warranty company and they'll send a technician to fix it. The technician will use parts from an approved list to repair or replace the item so that it works again.

You usually need to pay a small service fee or deductible for each repair or replacement job. Your plan will cover the rest of the bill up to your policy amount. This is why many people view home warranties as a worthwhile investment—you pay little to nothing if something breaks.

Are Home Warranty Plans Worth It?

Home warranty plans are worth it for most homeowners. They protect you from the steep fees of unforeseen repairs and replacements, especially for major appliances such as fridges or washing machines.

There are many reasons to get a home warranty plan, including peace of mind, and knowing that if something breaks down in your house, you may not have to pay as much to get it fixed. Many companies also offer extra coverage options, like for pools, spas, additional appliances, or systems, so you can customize your plan depending on your needs.

How to Choose the Best Home Warranty Plan for Your Needs

When you're ready to purchase a home warranty plan, follow these steps to ensure you choose the best company for your needs.

- Research different plans and compare features: Read up on the various home warranty contracts available to determine which best meets your needs. Consider coverage limits, service fees, and other benefits each plan offers.

- Ask important questions: Reach out to home warranty companies to ask them any questions you have about their plans. Ensure you understand what's covered and if any restrictions or limitations apply.

- Get home warranty quotes from multiple providers: When you're ready to make a purchase, compare prices and ask for quotes from several providers. Make sure to read the contract's fine print before making a decision.

- Check for credentials: Look for companies certified by organizations such as the National Home Service Contract Association to ensure they're reputable and have proper licenses and regulations.

- Examine customer reviews: Read home warranty reviews from customers who've used the company before. Check how reliable, helpful, and responsive their customer service is, so you know how to submit a claim or repair request in the future.

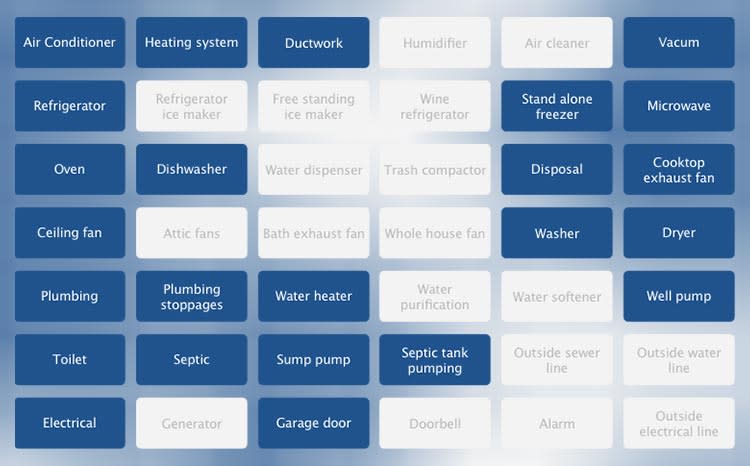

What Types of Home Warranty Plans Are Available?

Home warranty programs are a helpful way to protect yourself from expensive repairs. There are several types of home warranties out there, so it's crucial to understand each plan's coverage. Here's a breakdown of the different types of plans and what they cover:

- Appliance-only plans: Major home appliances such as cooktops, garbage disposals, refrigerators, and ovens.

- Systems-only plans: Home systems, such as plumbing, electrical, and HVAC.

- Comprehensive plans: Both major appliances and home systems.

- Add-on coverage: Items not included in your base plan, such as pools, spas, second refrigerators, septic tanks, sump pumps, and well pumps.

No matter what type of home warranty plan you choose, always read the fine print and ask questions before committing. That way, you can rest assured that the investment in your home is properly protected.

What Is Not Covered Under Warranty?

While home warranty plans provide homeowners with valuable protection, they may not cover everything. You often need a higher-tier plan or specific add-on to get some things covered. Here are a few items and situations that typically aren't covered under most warranties:

- Breakdowns due to improper maintenance: You'll have to pay for damages or malfunctions caused by improper maintenance or a lack of upkeep. For example, if you don’t change the filters in your HVAC system regularly, any resulting issues won’t be covered.

- Damage due to DIY repairs: Repair or replacement costs won’t be covered if you attempt to fix an item yourself, causing further damage. That’s why you should always call a professional if you think something is wrong.

- Pre-existing damage: Warranties won't cover damage that occurs before the start date of your policy.

- Cosmetic issues: Cosmetic issues, such as a scratched countertop or chipped wall paint, are considered minor repairs and aren’t part of standard warranties.

- Code violations: Your home warranty policy won't cover damages associated with code violations, like if you build a home addition without getting the proper permits.

Best Home Warranty Companies By State

Home warranty coverage can vary significantly from state to state, with some companies offering better services and terms in certain regions. We break down the top home warranty providers in five key states: Arizona, California, Florida, Georgia, and Texas. Each state's list is tailored to reflect local regulations, climate considerations, and customer preferences, helping you find the most suitable coverage.

- Best Home Warranty Companies in Arizona

- Best Home Warranty Companies in California

- Best Home Warranty Companies in Florida

- Best Home Warranty Companies in Georgia

- Best Home Warranty Companies in Texas

Additional Home Warranty Companies We Reviewed

In addition to the top home warranty companies outlined above, the following are also worth considering:

- Sears Home Warranty - Best repair guarantee

- HSA Home Warranty - Best for no home inspection

- Landmark Home Warranty - Best pest control coverage

- HomeServe USA - Best budget-friendly packages

- Amazon Home Warranty - Best for a free month of service

We Thought You Might Find These Home Warranty Articles Interesting

Bottom Line - Protect Your Investment with a Home Warranty

Protecting your home doesn't have to be a daunting task. Our research highlights Choice Home Warranty, Select Home Warranty, and American Home Shield as standout options, but the best fit for you may vary. A well-chosen home warranty can be a financial lifesaver, cushioning the blow of unexpected repairs and offering peace of mind.

Beyond covering costs, many plans provide access to vetted technicians and valuable perks like free HVAC tune-ups. Whether you're a first-time homeowner or a seasoned landlord, consider how a warranty can complement your home care strategy. The right coverage can transform stressful breakdowns into manageable hiccups and let you enjoy your home without worrying about what might break next.

Costs vary depending on the company you choose, coverage level, number of add-ons, and size of your home. The average price of a basic home warranty plan is usually between $300 and $600 per year, which breaks down to $25 to $50 per month. In addition, factor in the cost of making service claims, which amounts to roughly $60 to $100 per claim.

Both buyers and sellers can pay for home warranty services. However, it's typical for sellers to throw in a one-year home warranty contract to make their home more appealing to potential buyers.

Most home warranties typically last one year, though some companies offer multi-year plans.

Most home warranties don't cover roof repairs. However, you can add roof leak coverage if you go with a provider like American Home Shield or Select Home Warranty.

A home warranty when selling a house is a service contract that covers repairs and replacements of major system components and built-in appliances, such as HVAC systems, water heaters, and kitchen appliances. This gives peace of mind to both the buyer and seller and can help catch anything overlooked during an inspection.

Home insurance, also called homeowner's insurance, differs from a home warranty. Home insurance rates vary widely by state and home size, but you can expect to pay anywhere from $450 to $4,000 per year, per home. On average, Americans spend about $1,700 per year on this expense.

Homeowners looking for HVAC coverage should consider Choice Home Warranty and Select Home Warranty. Both provide comprehensive protection plans that cover your HVAC system, appliances, and major systems. Choice Home Warranty includes HVAC coverage in its basic plan, while Select Home Warranty requires you to sign up for its Gold plan to get the same.

Homeowners' insurance and home warranties are two different types of coverage that protect homeowners in different ways: Homeowners' insurance protects your property from damage caused by natural disasters, fire, theft, and more. It covers the cost of repairing or replacing your home and personal belongings while providing liability protection if someone is injured on your property. Home warranties cover repairs and replacements of major system components and built-in appliances. They're meant to protect homeowners from unexpected breakdowns and repairs not typically covered by homeowners' insurance. Both types of coverage are valuable and provide different types of protection for your home.