What Is a Home Warranty?

A home warranty is a service contract that helps protect your budget from costly repairs when key home systems or appliances fail due to normal wear and tear. Unlike homeowners' insurance, which covers damage from disasters such as fire or storms, a home warranty focuses on everyday breakdowns and repairs.

When a covered item stops working, you file a claim online or by phone, and the warranty provider arranges a repair or replacement through a licensed technician. You pay a service fee, and the plan covers the rest up to your policy limit.

This type of protection can save time, money, and hassle, especially as repair costs continue to rise. The U.S. home warranty industry is projected to grow at approximately 6.3% annually through 2030, driven by aging housing stock and increasing repair costs. This steady growth reflects how essential this financial safeguard has become for homeowners.

- Home warranties safeguard against costly breakdowns: They protect you from unexpected repair expenses by covering systems and appliances that fail over time.

- Every plan includes some out-of-pocket costs: Expect a monthly premium plus a service fee per claim. The Federal Trade Commission (FTC) advises consumers to fully understand service fees, deductibles, and coverage limitations before entering into any service contract.

- Coverage can be tailored to your home's needs: Options range from appliance-only to comprehensive plans with optional add-ons.

- A home warranty complements home insurance: It fills the gap that home insurance leaves by covering wear-and-tear damage instead of disasters.

- The best companies combine reliability and value: Choosing wisely ensures fast claims processing, licensed technicians, and dependable repairs.

What Does a Home Warranty Cover?

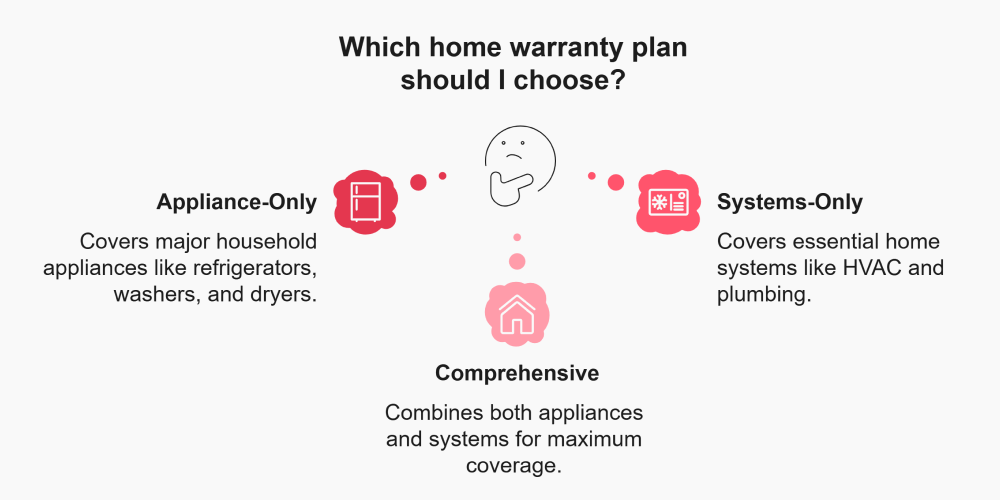

A home warranty provides financial protection for essential home systems (plumbing, electrical, HVAC) and major appliances (refrigerators, ovens, dishwashers) when they fail due to normal wear and tear. Coverage varies by plan: appliance-only, systems-only, or comprehensive combinations.

Each plan has coverage limits per item. A $6,000 repair might only be covered up to a $3,000 cap, leaving you responsible for the difference. Add-ons are available for specialized items like pools or sump pumps. Always review your contract for these limits and specific exclusions before enrolling and do your research to find the best home warranty plan that fits your needs.

How Much Does a Home Warranty Cost?

Home warranty costs vary depending on the provider, coverage level, and location. Most plans range between $40 and $80 per month, with service fees of $75 to $150 per claim.

Many providers offer discounts for annual or multi-year plans. It's important to balance premium costs against potential repair expenses. To put this in perspective, typical out-of-pocket repairs in 2024-2025 include:

Major refrigerator repair: Up to $1,300

Furnace repair: Up to $5,600

Central AC replacement: Over $8,000

According to the Joint Center for Housing Studies at Harvard, a single major repair for critical components can easily exceed the typical annual premium. These cost trends illustrate how quickly a breakdown can justify the annual investment.

While a home warranty adds an ongoing expense, it often pays off by covering repairs you'd otherwise pay for yourself.

Is a Home Warranty Worth It?

A home warranty can be a smart financial decision for many homeowners, especially if your appliances or systems are aging or you value convenience over DIY repairs. It helps you budget for unexpected costs and takes the stress out of finding reliable service providers.

Who Benefits Most

Homeowners with older systems (8+ years): Systems aged 8 years or older are most prone to wear-and-tear failure and represent the highest risk of expensive breakdowns.

New homeowners without cash reserves: If you lack $10,000 to $15,000 set aside for emergency repairs, a warranty converts unpredictable costs into manageable monthly payments.

Busy professionals: The main convenience is vetting and dispatching a licensed contractor within 24-48 hours, a non-monetary benefit many busy people find essential.

The Self-Insurance Alternative

For homeowners financially able to set aside $10,000 to $15,000 for emergency repairs, a high-yield savings account (self-insurance) is a valid alternative strategy. However, this doesn't provide the immediate contractor access that warranties offer.

What to Consider

Service fees can add up, and not every claim gets approved. The FTC recommends that consumers weigh the initial cost, service fees, and coverage limitations against the likelihood of expensive repairs.

Whether a home warranty makes sense depends on your budget, the condition of your home's systems, and how much peace of mind you want when something breaks.

Why a Home Warranty Matters

Rising Costs and Labor Shortages

The increasing relevance of home warranties stems from two external pressures facing homeowners today:

Rising maintenance costs: With the median age of U.S. homes approaching 36 years, systems are failing more frequently due to normal wear and tear. Major repairs that once cost hundreds now cost thousands.

Severe contractor labor shortages: Finding a licensed, qualified technician can take weeks or months when you're on your own. Long wait times leave you without essential systems during the search.

Financial Planning Benefits

Predictable monthly costs: A warranty converts the risk of a $5,000 HVAC failure into a predictable monthly premium and fixed service fee, making budgeting easier.

Immediate contractor access: The warranty provides access to a pre-vetted, licensed technician within 24-48 hours, bypassing wait times that can stretch for weeks when securing an independent contractor.

Top-Rated Provider Options

Some of the best home warranty companies such as Choice Home Warranty, American Home Shield, and First American Home Warranty offer reliable coverage and flexible plan options that fit different budgets. For homeowners who want to minimize risk, a well-chosen warranty ensures predictable costs and smoother repairs.

This predictability and streamlined access to service are the core reasons a well-chosen warranty matters for risk minimization and home upkeep.

What Our Expert Says

The real, non-monetary value of a warranty is the immediate convenience of access to pre-screened, licensed contractors. In a market with severe labor shortages, having a company commit to dispatching a technician within 48 hours is a priceless benefit that a personal savings fund can’t offer.

How Does a Home Warranty Claim Process Work?

Filing a home warranty claim follows a straightforward process, but knowing what to expect and what to document can help you avoid denials and disputes.

Step-by-Step Claim Process

Step 1: File your claim. Contact your provider online or by phone when a covered item breaks. Top companies dispatch service within 24-48 hours.

Step 2: Pay the service fee. You pay a fixed service fee when the technician arrives (similar to a copay). The warranty covers remaining costs up to your policy limit.

Step 3: Understand "similar or equivalent" replacement. If replacement is necessary, your high-end stainless refrigerator might be replaced with a standard model of comparable capacity, not necessarily the same brand or finish.

How to Prevent Claim Denials

Keep dated maintenance receipts: "Improper maintenance" is a common exclusion. Have dated receipts for annual HVAC maintenance to prove you've met maintenance requirements.

Document the failure: Take photos of the failed system before any repair work begins, especially if the failure seems maintenance-related (flooded pan, broken pipe). This serves as evidence if a dispute arises.

Prepare before the visit: Have your policy number ready and be prepared to pay the service fee when the technician arrives.

Request written denials: If a claim is denied, request the denial reason in writing so you can properly dispute it if needed.

What Do Home Warranties Exclude?

Even the best plans have limits. Home warranties generally exclude:

Improper maintenance (neglecting HVAC filters)

DIY repairs or unlicensed work

Pre-existing issues found before your policy began

Cosmetic damage (scratches, dents)

Code violations and unpermitted work

Home warranties increasingly exclude high-cost, specialized components like solar systems, whole-home battery backups, and certain smart appliance parts due to complexity and specialized repair costs.

The most common and frustrating exclusion dispute centers on the pre-existing condition clause. Most companies place the burden of proof on the homeowner to demonstrate the item was working when the policy began. American Home Shield's unique policy for undetectable pre-existing conditions is highly valuable, as it shifts that dynamic.

When filing a claim, the most important documentation is dated receipts for annual HVAC maintenance. This proves you've met the company's "proper maintenance" requirement and makes it difficult to deny a claim on those grounds.

How to Choose a Home Warranty Company

Selecting the best home warranty company for you starts with understanding your coverage needs and comparing key factors. Always read the fine print so you know exactly what’s covered and what’s excluded.

Key Selection Criteria

Check for NHSCA accreditation: The National Home Service Contract Association (NHSCA) accreditation means the company adheres to a strict Code of Ethics and is a registered, established provider. It's not a guarantee of flawless service, but it signifies commitment to ethical business practices.

Watch for red flags in contracts: Extremely low, non-negotiable coverage caps on critical systems and complex, vague language surrounding "pre-existing condition" or "improper maintenance" definitions are warning signs.

Ask about specific coverage limits: Always ask: "What is the maximum payout for my specific model of AC unit?" This reveals whether the cap will actually cover your replacement costs.

Compare service fees: Service fees vary significantly between companies (typically $75 to $150 per claim). Factor these into your total cost calculations.

Review online feedback: Check reviews for insights into claim response times, denial rates, and customer support quality. Look for patterns in complaints.

- Get multiple quotes: Comparing quotes from several providers helps you identify reliable, transparent companies and avoid overpriced plans.

What Our Expert Says

Always scrutinize the dollar limit for your most expensive system, like HVAC. If the maximum payout is only $3,000 but the replacement cost is $6,000, you're still personally responsible for a major, unsheltered $3,000 expense. The coverage cap is the true ceiling of your protection.

When Should You Consider a Home Warranty?

A home warranty makes the most sense if your systems or appliances are older and more likely to break down. It can also be valuable for first-time homeowners or landlords who want predictable maintenance costs and easy access to repair professionals.

The best timing for purchase is when systems are aging or during a real estate transaction for added security. If you're buying or selling a home, consider negotiating a seller-paid warranty to make the transaction smoother. Some homeowners prefer asking for a credit toward closing costs instead of taking the policy itself.

The right time to consider a warranty is when you want to reduce financial surprises and simplify home upkeep.

Home Warranty Companies Comparison

When comparing top home warranty companies, it’s essential to look beyond pricing and consider how each provider performs in terms of coverage, service quality, and claims responsiveness. The table below helps you identify which option may be the best home warranty company for your needs:

Comparison Table

Feature | Choice Home Warranty | American Home Shield | First American Home Warranty |

Monthly Premium | $50-$60 | $40-$100 (varies by plan & fee) | $55-$75 (varies by plan) |

Service Fee (Per Claim) | $65-$100 (fixed or negotiated) | $75, $100, or $125 (customer chooses) | $75-$125 (varies by plan) |

Key Coverage Focus | All plans bundle Systems & Appliances | Tiered plans (Systems only, Systems + Appliances, Premium) | High-Value Appliances + Systems |

Max HVAC Coverage Limit | Up to $3,000 per system | Up to $5,000 per covered system | Up to $3,500-No cap (varies by plan) |

Max Appliance Coverage | Up to $3,000 per item | Up to $2,000-$4,000 per item | Up to $7,000 per appliance (certain plans) |

Unique Benefit | Consistent, predictable pricing regardless of location | Covers damage due to lack of maintenance and undetected pre-existing conditions | First American Advantage upgrade for code violations and improper installation |

Service Response Time | Dispatches technician within 24-48 hours | Dispatches technician within 24-48 hours | Dispatches technician within 24-48 hours |

Workmanship Guarantee | 60-Day guarantee on repairs | 30-Day guarantee on repairs | 30-Day guarantee on repairs |

Availability | 49 states (excluding Washington) | 49 states (excluding Alaska) | 36 states |

Key Takeaways from the Chart

Customization vs. simplicity: American Home Shield offers flexibility by allowing you to choose your service fee (affecting monthly premium), while Choice Home Warranty provides simpler, consistent pricing.

High-value protection: First American Home Warranty is a strong choice if you have expensive, high-end appliances, as top-tier plans offer the most generous limits (up to $7,000).

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information.

We provide a range of services including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

Methodology

Our Review Methodology: Evaluating the Best Home Warranty Companies

To ensure you get accurate, helpful insights, we use a detailed evaluation process that looks at coverage, service quality, customer feedback, and overall value. This approach helps you identify which providers truly qualify as the best rated home warranty companies, giving you a clear foundation for choosing the right plan.

Evaluation Criteria

Coverage details: Policy coverage, payout limits, add-ons, exclusions, and customization options.

Claims process: Ease, speed, and transparency of filing and resolving claims. High-performing companies assign service providers within 48 hours, a key benchmark for quality.

Service quality: Reliability of service providers, repair timeliness, and contractor network size.

Pricing and value: Plan affordability, premium structures, service fees, and overall value relative to coverage limits.

Customer service: Communication quality, support availability, and issue resolution based on verified reviews.

Reputation: Company reputation, accreditation, and standing within the industry. Companies with patterns of unresolved BBB complaints are flagged for lower reliability.

Customer experience: Reviews from platforms like Trustpilot and BBB to understand real policyholder satisfaction.

Contract transparency: Renewal terms, cancellation policies, and associated fees.

This methodology ensures every provider we recommend is evaluated fairly and consistently, with focus on what matters most: coverage quality, responsiveness, reliability, and overall customer value.

FAQs about Home Warranty Companies

Do I need a home warranty?

Yes, if you want protection from unexpected repair costs. A home warranty helps cover expensive system or appliance breakdowns and connects you with qualified contractors. It's especially valuable for homes with systems aged 8 years or older, as these are most prone to wear-and-tear failure.

Does a home warranty cover plumbing?

Usually, yes, for leaks, clogs, and pipe issues inside the home. Most plans exclude external sewer lines and outdoor spigots; coverage is typically limited to issues within the home's foundation. Always check specific policy language for exclusions related to pre-existing issues or poor maintenance.

Does a home warranty cover the roof?

Only partially, and usually as an add-on. Some providers offer roof-leak protection for minor repairs, but full roof replacements or structural work are rarely included in standard plans.

Does a home warranty cover HVAC?

Yes, most comprehensive plans include HVAC coverage. Heating, cooling, and ductwork repairs are typically covered. Eligibility is strictly dependent on providing dated evidence of regular, professional maintenance. Lack of this documentation is the most common reason for HVAC claim denial.

Do I need a home warranty if I have home insurance?

Yes, because they cover different risks. Home insurance protects against fire, theft, or natural disasters, while a home warranty covers normal wear-and-tear breakdowns. Many homeowners choose both for complete protection.

How long does a home warranty last?

Most contracts last one year. You can renew annually or choose multi-year options at a discounted rate. Review renewal terms to avoid lapses in coverage.

Key Expert Insights by Sunday Odudu

- Prioritize coverage limits: Focus on the maximum payout for major systems like HVAC or refrigerators, as these often exceed typical plan limits and represent your biggest financial risk.

- Understand pre-existing conditions: Policies covering pre-existing issues typically require the problem to be non-symptomatic or undetectable by a simple mechanical test at enrollment. Read the fine print carefully.

- Service fee vs. premium matters: Higher service fees mean lower monthly premiums. Run a break-even analysis based on your anticipated claim frequency to find the right balance.

- Contractor quality drives satisfaction: The biggest point of customer satisfaction or dispute involves the expertise, responsiveness, and availability of the warranty company's assigned technician network.

- Warranties complement, not replace: Never confuse a home warranty (mechanical failure) with homeowners insurance (catastrophic losses). You need both for complete protection.

Our Top 3 Picks

- 1

Get full coverage and round-the-clock supportVisit SiteCall732-907-4849732-907-4849

Get full coverage and round-the-clock supportVisit SiteCall732-907-4849732-907-4849- Pricing - $50-$60/month

- Service Fee - $65-$100 per claim

- Best for - Homeowners seeking affordable full-home coverage

Get full coverage and round-the-clock supportRead Choice Home Warranty ReviewChoice Home Warranty offers straightforward plans with uniform pricing. Both the Basic and Total plans bundle systems and appliances, eliminating the need to choose between coverage types. The company provides coverage up to $3,000 per claim and includes a 60-day workmanship guarantee, double the industry standard 30-day term.

Coverage highlights:

All plans bundle systems and appliances

49 states (excluding Washington)

24-48 hour technician dispatch

First month free with annual payment

60-day workmanship guarantee (2x competitors)

What to consider: The $3,000 cap works well for standard systems but may not fully cover high-end replacements. Keep dated HVAC maintenance receipts to avoid "improper maintenance" claim disputes, which are common with high-volume providers.Expert perspective: Best value for homeowners with average-value systems who prioritize predictable pricing over customization. The 60-day workmanship guarantee provides superior protection. Ideal for first-time warranty buyers.

Choice Home Warranty Pros & Cons

PROS

Offers 30-day guarantee on covered repairsFirst month free with purchase of any single payment planEasy online claims processCONS

Limited add-on coveragesNot available in Washington - 2Customizable plans with adjustable service feesVisit SiteCall888-928-2359888-928-2359

- Pricing - $40-$100/month (varies by plan)

- Service Fee - $75, $100, or $125 (you choose)

- Best for - Older homes with aging systems

Customizable plans with adjustable service feesRead American Home Shield ReviewAmerican Home Shield, operating since 1971, is the largest provider in the market with over two million members. Three customizable plans (ShieldSilver, ShieldGold, ShieldPlatinum) range from 14 to 23+ covered items, with the top tier offering free HVAC tune-ups, unlimited A/C refrigerant, and coverage up to $5,000 for HVAC systems.

Coverage highlights:

Choose your service fee to optimize monthly premium

Covers undetected pre-existing conditions and maintenance issues

Covers duplicate items, rust, and corrosion

47 states, plus Washington DC

Highest HVAC limit ($5,000)

Key advantage: Undetected pre-existing conditions coverage shifts the burden of proof away from homeowners, potentially saving thousands in disputes. Most competitors require you to prove systems were working at enrollment.What to consider: Service fee strategy matters. Higher fees ($125), lower monthly premiums for infrequent claims. Lower fees ($75) increase monthly costs but reduce per-incident expenses. No guaranteed repair timeframes, and contracts are required for best pricing.

Expert perspective: Strongest choice for homes 8+ years old where pre-existing condition disputes are likely. The $5,000 HVAC limit and established contractor network provide superior reliability for aging systems.

American Home Shield Pros & Cons

PROS

Highly customizable plansIncludes undetectable pre-existing conditionsCovers older items, including rust and corrosionCONS

No guarantee for repair timesNot available in Alaska, New York City, or Hawaii - 3

Covers items regardless of ageVisit SiteCall888-319-2254888-319-2254

Covers items regardless of ageVisit SiteCall888-319-2254888-319-2254- Pricing - $55-$75/month (varies by plan)

- Service Fee - $75-$125 per claim

- Best for - High-end appliance protection

Covers items regardless of ageRead First American Home Warranty ReviewFirst American Home Warranty specializes in appliance coverage with industry-leading limits up to $7,000 per appliance under premium plans. Operating since 1984, the company has saved homeowners over $219 million. Items are covered regardless of age, with brand-new replacements when repair isn't possible.

Coverage highlights:

Up to $7,000 per appliance (vs. $2,000-$4,000 competitors)

HVAC coverage up to $3,500 (some plans higher)

Brand-new replacements for unrepairable items

24/7 claims with vetted tradespeople

Covers code violations and improper installation (Advantage upgrade)

Key advantage: The $7,000 appliance limit is crucial for luxury kitchens with Sub-Zero refrigerators, Wolf ranges, or Miele dishwashers. Standard plans cap at $2,000-$4,000, leaving significant gaps for high-end equipment.

What to consider: Available in only 36 states. Verify HVAC coverage matches your system's replacement cost since the company focuses more on appliances than systems. The mobile app has lower ratings than the web platform.

Expert perspective: Definitive choice for homeowners with luxury appliances who need coverage matching actual replacement costs. Best for those who've upgraded HVAC but have aging premium kitchen equipment. Verify adequate HVAC protection for your specific plan.

First American Home Warranty Pros & Cons

PROS

24/7 claims serviceFully vetted tradespeopleLow pricing and service feesCONS

Difficult to understand pricing breakdown without a personal quoteTheir app is poorly rated