What Are Payroll Services and Software?

Payroll is the process of paying employees for their work. It typically involves calculating wages, withholding deductions, and depositing money into employee bank accounts. No matter the size, all companies need to process payroll for their employees.

Payroll services and software handles the important task of calculating and distributing employee salaries, wages, and benefits. This includes calculating gross wages, deductions such as taxes, health insurance premiums and 401(k) contributions, as well as net pay. It helps ensure compliance with federal, state, and local tax laws.

Payroll software can also help generate reports for audits and other purposes. Reports generated by payroll software enable a business to keep accurate records of its financials and employees’ compensation information easily accessible from one place.

Types of Payroll Services

There are four types of payroll services: In-house payroll, payroll managed by a bookkeeper or accountant, payroll managed by an agency, and software-managed payroll.

In-house payroll

In this case, the employer manages payroll, which can be done manually or through online software. In-house payroll is suited for companies with a small number of employees. It is unsuitable for businesses with complex payroll needs or employees in multiple states.

Payroll managed by bookkeeper or accountant

In this option, an outside bookkeeper or certified public accountant (CPA) manages the payroll for a company. This option is best suited for companies who want to avoid the responsibility of managing payroll themselves or those with many employees and complex payroll requirements. It is also suitable for companies with employees in multiple states.

Payroll managed by an agency

Using a specialist agency to manage the payroll has all the advantages of bookkeeper or CPA-managed payroll with the added bonus of having an entire team of experienced payroll professionals managing your system. This increases the amount of specialist knowledge available and is a good—though expensive—option for large companies.

Software-managed payroll

Payroll software is becoming increasingly popular with small businesses due to its cost-effectiveness and ease of use. It is usually cloud based and can be accessed from anywhere with an internet connection, making it ideal for companies with employees in multiple locations.

What Are the Stages of Payroll Processing?

Payroll processing involves several stages, from collecting employee information to filing tax forms. Here is a quick rundown.

Choose a pay cycle: Determine how often you will pay your employees.

Collect data: Gather employee information, such as employee names and addresses, Social Security numbers, salary information, and withholding allowances.

Calculate wages: Use online payroll software or a manual calculation to calculate gross wages, deductions, taxes, and net pay for each employee.

Deduct taxes & benefits: Calculate taxes and deduct benefits if applicable.

Deliver payroll funds: Print checks, make online payments, or directly deposit funds into employee bank accounts.

File reports & payments: File the necessary reports with state and local agencies and remit required tax forms, Social Security/Medicare payments, etc.

Reconcile accounts: This includes reconciling the payroll account with company financial records to ensure the accuracy of all payments made during the payroll period.

How do You Process Payroll?

Processing payroll involves several steps: calculating wages, withholding taxes on behalf of the government, issuing payments, filing the employer's portion of taxes with the appropriate state and federal agencies, and providing employee W2s at year’s end.

It can be done manually by a business employee, via outsourcing, or by using a payroll service platform.

Processing payroll manually

This is often time-consuming, labor-intensive, and error-prone. The calculations must be recorded accurately to avoid penalties or fines from the government.

Outsourcing payroll processing

This option can benefit businesses that want the convenience of online payroll processing and access to customer service staff experienced in handling complex payroll issues.

Using a payroll service platform to process payroll

With a payroll service platform, information is automatically calculated using employee data, such as hours worked and salary. Online platforms can also generate payroll reports quickly.

How Do Payroll Services Work?

A payroll service is an online platform that helps businesses process their payroll needs. Payroll services are provided by multiple providers, but most online payroll services offer the same sorts of services.

Services typically handle the entire payroll process from start to finish with proprietary software or a website. Employers can use online payroll software to calculate each employee's gross wages, deductions, and taxes.

This software can also assist with deducting taxes and benefits from employees' paychecks, paying workers compensation, filing online reports and payments for taxes, and producing employee W2 forms at year’s end.

Online payroll services are great for companies with employees in multiple states, as online service providers handle the complexities of managing taxes, filing reports, and payments in different states. Online software also makes it easy to access employee data across multiple locations.

Most payroll services have a portal to enable employees to input their own information, such as their addresses, Social Security numbers, and bank account details. Some services also include online timesheets so that employees can record their hours.

In addition to basic payroll processing, some online payroll services may also provide additional features, such as online contractor tracking and managing retirement plans.

Online services can also integrate with other online platforms, such as accountancy packages or online human resources (HR) features that manage training and employee benefits administration.

Payroll Software Management Features

Online payroll services come with a variety of features that make managing your employees' pay easier. Features you should look for include the following.

Accurate calculations

Accurate payroll calculations ensure that employees are paid correctly and the business complies with state tax laws. Most software is less prone to errors than employees making these calculations manually.

Automation

Most payroll software can automate administrative processes, such as calculating deductions, filing online reports and payments, and processing employee W2 forms at the end of the year.

Tax payments

Most software will assist with filing quarterly and annual taxes and making online payments to state tax authorities.

Compliance updates

Online payroll services often provide updates on changes to state and federal laws regarding payroll taxes.

Direct employee payments

Look for payroll software that enables you to pay employees via direct deposit to ensure that employees receive their payments promptly and accurately.

Customizable features

The customizable features of many payroll solutions allow business owners to tailor their payroll solutions to their specific needs.

Employee portals

Employee self service online portals can make onboarding, managing information, and accessing online timesheets easy and take less time for HR.

Security

A good online payroll service should have secure data encryption measures in place to protect sensitive information from external threats.

Reports and analytics

Some platforms offer reports and analytics to help track and manage payroll data and measure overall productivity and performance.

Interface integration

Many payroll services integrate with other online platforms, such as accounting packages.

Mobile apps

Some online payroll services offer mobile-friendly interfaces so that employees can access their information from anywhere, anytime.

How Much Do Payroll Services Cost?

The cost of online payroll services varies widely depending on the brand and the number of features included. Most online payroll companies offer a range of monthly plans so businesses can choose the option that best fits their needs and budget.

Additionally, online services typically charge a lower rate than traditional payroll providers, making it an attractive option for small business owners.

Costs can range from $20 to $300 per employee per month, depending on the features included. With cheaper plans, businesses can access basic online payroll features, although other services may be available at an additional fee. Full-service payroll solutions will cost more.

Some systems include a global employer of record package for an additional fee. Employer of record means that the online payroll provider is responsible for filing the necessary reports and documents related to hiring employees in international jurisdictions.

This is essential for businesses that need to manage payroll in more than one country.

How Do You Use a Payroll Service?

How you use your payroll service will depend on the size of your team and the features offered by the online platform.

With most providers, the initial setup is straightforward, regardless of whether you have two or 200 employees. You will need to set up an account with the online payroll provider and then upload your employees’ details, including employee pay deductions, like federal income tax, Social Security tax, and Medicare tax.

Payroll services are designed to automate the majority of the payroll process. This includes calculating employee paychecks, making direct deposits into employees’ bank accounts, and many other tasks, depending on your chosen system.

The Difference Between a Payroll Software and a Payroll Service

At first glance, payroll software doesn’t appear any different than the payroll services you are used to. Upon closer look, however, you’ll notice some important differences that could make the choice of which type of payroll you want to invest in easier.

Here are a few key areas where these two options diverge:

Security

Probably the most important aspect where payroll software and services differ is in security. Payroll services require you to send them all your employee information in order to run payroll. This includes highly sensitive data like employee identification numbers, bank information, and employee records.

Of course, all of this is done through highly secure channels with the strongest levels of encryption. But the fact is that you are still sending over your extremely sensitive data.

Payroll software, on the other hand, lets you handle all of your payroll requirements without having to shift any sensitive data over to anyone else. You keep all of your information on your own servers, and only your eyes ever see these details. So, it’s a safer option to be sure.

Convenience

Payroll services has an edge over payroll software on this one. While it’s laughably simple to run payroll from most of the top payroll services online today, being able to hand over all the information for someone else to click those buttons is one step easier. So, if you’re looking for total hands-free, payroll services is a better bet.

Price

Of course, one of the biggest factors most companies will look at when comparing payroll options is the price tag. Hands down payroll software wins this battle.

That’s because you simply can’t compare a software pricing structure with a service one. So, if money is an important factor, payroll software will win the war.

The Benefits of Using a Payroll Service

Payroll used to be the bane of any manager or employer's existence. Once a month (or possibly more, depending on the company’s payment structure), they'd have to sit with the painful task of calculating, checking, complying, and organizing payroll for each employee.

This included time off, sick leave, vacation days, salaried, hourly, temp employees, the works. Everyone gave a huge sigh of relief when payroll services and software came onto the scene.

The obvious benefit of using a payroll service is that this time-guzzling task is taken off your shoulders and your mind. In addition to that, though, there are other benefits a savvy business owner can glean using a reliable payroll service like:

Removes human error

Thousands of dollars are lost every year to businesses just because of a misplaced period or a forgotten zero. When people are crunching numbers, errors can happen. When machines do the work, that margin of error is reduced to negligible figures or erased altogether.

Tax compliance

Most good payroll services providers will also offer tax compliance and filing within their packages. This includes calculating, filing, reporting, and any other tax requirements needed. It also means that you’ll stay fully compliant since these services stay up to date with the ever-changing legal requirements for each state and business.

Keep employees in the loop

Payroll services keep all the important payroll data in one secure but easy to access location for all employees. So, your workers can quickly print out pay stubs, get a birds’ eye view of their annual payouts, or add information as necessary.

Other benefits include saving money with reporting and data analysis, better time efficiency, and human resource management like new-hire onboarding, vacation days calculating, and benefits management.

How to Choose the Right Payroll Service for You

While there is no telling a business which software or service will be the best fit for them, there are a few key features to look out for when doing your comparison shopping.

Before signing up for any service, like full service payroll software, make sure it’s got these all-important checkboxes ticked off:

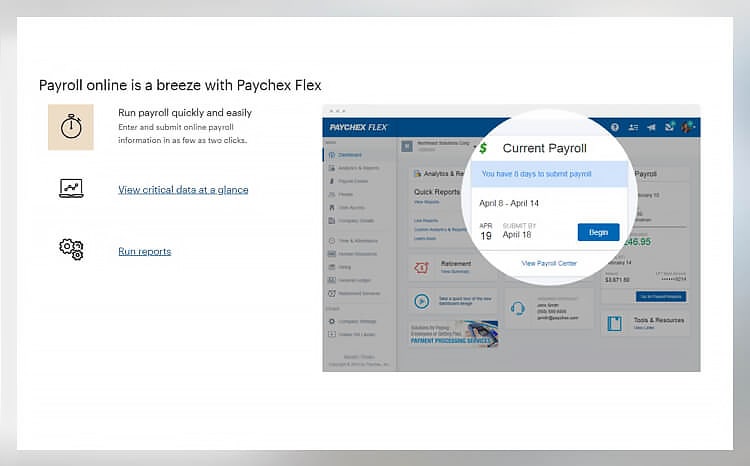

- Full payroll management: Today, you really shouldn’t have to do anything but click a button or two to get payroll underway.

- Easy payment methods: Whether you prefer direct deposit, pay cards, or business checks, make sure your payroll software has the options you want, so you can pay your employees quickly and with ease.

- Tax filing: This is one of the biggest perks of using payroll software today. Make sure the payroll service providers you’re looking at are fully tax compliant, meaning they file all your federal state and local taxes, keep up to date with changes, and will send out forms and files like W-2s and 1099s for all of your employees.

- Compensation management: Taxes aren’t the only thing that need managing. Make sure your payroll services online take care of things like workers’ comp, bonuses, adjustments, and any other extras required by law.

- HR benefits management: What benefits are included in the HR features of your payroll service, and does it include HR services at all? Will they handle health like dental or vision care? Are there added perks like fitness and mental wellness packages? The more you can give your employees, the happier and more productive they'll be.

- Employee self-serve: This isn't an essential feature, but it sure is useful. Employee self-serve means your employees can submit information for themselves. This way, you don't have to spend valuable time inputting all that data. It also means your employees can access their own information, so your workers can print their own pay stubs or check how many vacation days they have left without bothering you for this simple data search.

- Reporting: Reporting is an important feature that lets you gain valuable insight into the inner workings of your organization. From taxes and budget overviews to employee information like employee productivity evaluations, reporting is an essential form of business intelligence you don’t want to do without.

Why Payroll Services Are Crucial for Small Businesses

For a small business owner, online payroll services offer an efficient solution that saves time, money, and effort. Payroll tasks, such as calculating and filing taxes on time, can be time-consuming and require expert knowledge. Payroll services enable business owners to focus on the main areas of their business.

Online platforms are much more reliable and accurate than manual payroll calculations and also make it easier for businesses to stay compliant with state and federal laws regarding payroll taxes.

Our Methodology: How We Rated Our Top Payroll Services

We take an in-depth look at each payroll service provider when writing our reviews. Our team visits each provider’s website to find out what features the platform offers, what differentiates it from other payroll software, and how much it costs.

To assess usability, we use software demos whenever they are available. When they are not, we thoroughly review product videos and chat with providers’ customer service teams to learn more about what each software can do.

We also conduct a thorough peer analysis to compare payroll software platforms against one another. That includes reviewing which features you get at what price point for different providers and identifying the unique aspects of each platform.

Finally, our team conducts an extensive analysis of customer reviews to evaluate how businesses of different sizes are using each payroll service. We also check peer reviews and contact each provider’s customer service team to ensure we’ve thoroughly covered all aspects of each payroll software.

Other Payroll Services and Software We Reviewed

Can't find what you're looking for on this page? Here are some other payroll services and software we reviewed, so you can find one that perfectly suits your business' needs.

The Bottom Line

Online payroll services are becoming more and more popular with small businesses. They offer an efficient way to manage payroll online, saving businesses time and money.

The payroll company you choose should provide all your required features and be affordable for your business, so it's important to do your research.

The first step is to find the right service for your business' size and needs. Then all you need to do is sign up, choose a plan, download the necessary software if applicable, and familiarize yourself with its tools and features.

Payroll takes a relatively short time to process. Depending on what services you use, it could take anywhere from a few hours to a few days.

The most popular online payroll service is Intuit QuickBooks Online Payroll, which offers a wide range of features and integrates with QuickBooks accounting software. Another commonly used payroll service is Paychex, which is good for small businesses and has a comprehensive employee portal. ADP GlobalView is another of the most popular providers for businesses with global reach.