- Free setup

- 24/7/365 customer support

- Zero credit card processing fees

How to Choose a Credit Card Processing Service for Your Business

These are the top credit card processors on the market today. Read on for in-depth details on features, plans, and pricing.

Leaders

Free EMV equipment

Low transaction fees

$500 guarantee you’ll save money on processing

24/7 technical support

Leaders is a merchant service company geared towards businesses that are looking for a one-stop payment processing solution with competitive prices.

While the company has low monthly rates and credit and debit card transaction fees, the exact figure you’ll pay will be customized to your account and you’ll have to speak to a Leaders representative to get these figures. The company provides users with free equipment, including a mobile card reader for a smartphone or tablet and free processing software, and trains users so that they can operate the software and equipment smoothly. The service also integrates with a number of accounting programs including most versions of Quickbooks. You can also use it with the Clover POS system.

In addition, because there is a monthly minimum of just $15 in charges, the company is well-suited to small businesses that don’t have a large volume of sales.

You also get what the company describes as “industry-leading technical support” which is available 24 hours every day of the year.

Approval for a new business is typically given in the same day, so you can get up and running quickly. The company says it has an approval rate of 98% and that approval is not dependent on customers having a good credit rating.

Leaders Merchant Services

Flagship

No setup fees

Free credit card swiper

Cash advances up to $150,000

Rates starting at .38% + $0.19 per transaction

Flagship merchant services is one of the most trusted names in the transaction processing industry and is well-suited to help customers running all types of businesses.

Trying out Flagship for your business is easy and risk free, as the company doesn’t charge any setup fees. You also don’t have to sign up for a long term contract and can quit anytime, so feel free to try out Flagship for a month to see if it’s right for you.

Flagship can supply you with a free credit card swiper as well as a mobile payment processor that can hook up to your iOS or Android device by way of the headphone jack, so you can make wireless transactions for your business from just about anywhere. The company can also supply you with a sales terminal run by Clover, one of the top POS systems on the market today.

If your company comes into some cash flow needs, you can get a cash advance from Flagship for up to $150,000. In addition, the company can provide you with special gift cards that you can use to promote your brand.

The rates for Flagship are also attractive, starting at .38% + $0.19 per transaction.

iPayment

Duplicate transaction prevention

Send receipts via email or SMS

Wide range of integrations with payment software

Low transaction fees

iPayment is the chosen transaction processing company for more than 140,000 merchant customers, who use the service to process payments online, in house, and from all points in between by way of the mobile payment options. The service is best geared towards established businesses that need an easily scalable transaction system. The company’s reputation also speaks for itself: In 2026, it was chosen as the ISO/Merchant Sales Organization of the Year.

iPayment is a top reseller of Clover business hardware, including the mini and mobile consoles made by the company and works seamlessly with Clover POS system and the wide range of integrations that work with the software. The company can also provide customers with a wide variety of transaction terminals for purchase.

iPayment also promises a high level of encryption and tokenization in order to keep your transactions secure.

The platform boasts a wide range of features, including multiple in-app tax rates, check and cash payment recording, a barcode scanner, duplicate transaction prevention, and the ability to send receipts via email or SMS, among others.

iPayment

What is Merchant Services?

Merchant services is a broad terms that refers to merchant processing services giving a business the capability to accept payment using a customer's credit card. The merchant services provider (MSP) is the one who actually makes the transaction happen while complying with security requirements. Merchant services providers are also referred to as credit card processors (CCP). MSPs act as the intermediary between your business and your customer’s credit or debit card account.

This is how it works:

A customer will swipe their credit card or enter their credit card information to make a purchase from your store

Your point of sale software sends the data to your chosen MSP

The MSP contacts the customer’s credit card association to check that they have enough credit to pay for the purchase

The card association checks with the customer’s bank, and then (hopefully) sends the MSP a reply approving the transaction

The MSP completes the transaction and sends you a receipt for the customer

Merchant Services Fees and Rates

Understanding the fees and rates for merchant services providers can be difficult. It seems like every MSP uses a different pricing structure and has a different way of calculating your fees, which makes it hard to compare one MSP to another.

Here are the main fees and rates to look out for:

Interchange fees

These are the biggest fees you'll pay. They're usually a percentage of each transaction plus a flat fee, e.g., 2.5% + $0.10 per transaction. Unusual transactions like foreign currency transactions incur higher interchange fees.

Assessment fees

These are generally a percentage of your estimated monthly sales volume, e.g., 0.1% of sales up to 1,000 sales, then 0.11% of the next 1,000 sales, etc.

Terminal fees

These are the cost of leasing a physical payment terminal for your store, so it doesn’t apply to online stores. Terminal leasing fees can add up to thousands of dollars, so it’s usually best to buy a terminal outright to avoid this extra charge.

A monthly or annual service charge

Not all MSPs charge this fee, but it’s important to know to look out for it.

Payment gateway fees

These only apply to online retailers. They pay for the cost of your online point of sale (POS) software, which is your virtual payment terminal.

Monthly minimum fee

You’ll have to pay a monthly minimum fee if you don't make a certain minimum amount of transactions each year.

Is Your Business Considered High Risk?

One of the main issues that affect how much you’ll pay MSPs is your type of business. Every business is organized into a merchant category and given a merchant category code (MCC). If you have a high-risk MCC, you’ll be charged higher fees than low-risk businesses. High-risk MCCs include those that sell products with a high return rate, need a large amount of capital to get started, or are considered to be in a high turnover industry.

Some high-risk MCCs are:

Online gambling or casinos

Advance bookings in travel and tourism

Magazine or other subscription-based businesses

Online dating services

Debt collection

You could also be considered a high-risk business if:

You have a history of frequent chargebacks

You are all first-time business owners

You have bad credit history

You do a lot of business with international customers in areas that have a high risk of chargebacks (i.e., outside of the EU, North America, Japan, China, Singapore, or Australia)

You are a multi-currency business

How to Find the Best Credit Card Processors

There isn’t one credit card processor that is the best for everyone, because every business is different. What’s best for a large retail store with many branches isn’t necessarily best for a small Ecommerce business. However, here are some things to look for to help you find the best credit card processors for your business:

A CCP that has experience serving your sector.

A CCP that can service all your needs in one—for example, if you have an online store and a brick and mortar store, look for an MSP that can process both face-to-face and online transactions.

Hidden fees. Many companies practice ‘bait and switch’ where the price you see advertised doesn’t include all of the real costs.

Compare fees carefully. Because there are a few different pricing models, it can be difficult to compare like with like. An MSP that seems to offer great value at first glance might actually cost more in the long run due to the pricing model.

Check the minimum monthly transaction amount and make sure that you expect to meet it.

Pay attention to whether the rates go up or down according to your volume of sales. If you make a lot of transactions, you'll want a CCP that lowers the fee as sales increase, but if you make just a few high-value sales per month, you'll want the lowest fees to apply to the lowest sales volume.

Credit Card Processing for Small Businesses

Paying by credit card is the norm these days so adding credit card processing capabilities can be a real boost to your income. Small businesses can choose online credit card processing, a conventional credit card reader, or a mobile credit card processor that integrates with a smartphone or tablet.

Conventional card readers can be best if you make a lot of face-to-face sales. If most of your credit card transactions take place online, then an online CCP and payment gateway will be the most useful. Sole traders and mobile businesses, like electricians or entertainers, might find that a mobile CCP that works with their smartphone serves them best.

What is a Payment Gateway?

A payment gateway is like a virtual terminal for your online business. It works together with the credit card processor (also called a payment processor, which can make it easy to confuse with payment gateways) to authorize online sales. Payment gateways securely encrypt customer data and send it to the payment processor, which then transmits a request for payment to the customer’s credit card association. When the CCP gets approval for the transaction, it sends it to the payment gateway which then sends it securely back to the merchant.

The Best Merchant Services Providers - An In-Depth Look

- 1

Industry-leading CCP with value-added services

Industry-leading CCP with value-added services- Best for - Additional value-added services, low rates

- Rates - Starts at 0.15%

- Contract Length - 3 years

Safe PaymentsIndustry-leading CCP with value-added servicesSafe PaymentsRead Leaders Merchant Services ReviewLeaders is one of the best credit card processing services in the industry. It’s been around for 20 years, and its parent company is the reputable Paysafe Group Subsidiary. Leaders gives businesses a lot of reasons to love it, including some of the best credit card processing rates in the industry. We’re talking about rates that start at just 0.15%. Plus, Leaders has a 98% approval rating. So, businesses having a hard time getting the green flag will find Leaders’ process refreshing.

What's more, Leaders offers a solid $500 Assurance guarantee. This states that if the company can't save you money within the first 6 months of your contract, you'll be awarded $500 in compensation. Leaders works with the reliable Clover point of sale system, and it also integrates with QuickBooks. New SMBs will appreciate the helpful glossary of terms and 24/7/365 customer service for troubleshooting any issues. Additionally, Leaders offers value-added services such as business cash advances, loyalty programs, gift cards, check guarantee services, and point of sale systems.

Leaders Merchant Services Pros & Cons

PROS

$500 Assurance ProgramIntegrates with QuickBooksRates starting at 0.15%CONS

Long contract termsPricey early termination fee - 2

Offers global payments in 17 countries

Offers global payments in 17 countries- Best for - Businesses and corporations looking to scale up

- Rates - Quote-based

- Contract Length - From month-to-month to three years

Offers global payments in 17 countriesRead Paysafe ReviewPaysafe is a comprehensive payment solution that is transforming how businesses handle transactions. It accepts global payments in 17 currencies, including credit cards, debit cards, digital wallets, POS systems, cash cards, and installment payments. The scale-based pricing starts at 15% for low volume, 3.9% per volume, and 9.5% for higher volume. There's also a fixed fee of 1.5 euros per transaction. Paysafe offers various services, including online, digital wallet, and in-person payments, and additional benefits like POS systems, receipt management, and currency conversion. This makes it a versatile choice for businesses of all sizes and types.

Paysafe offers several tools to assist businesses with their in-store payment processing. One of the notable equipment offerings is Paysafe's Android tablet POS (Point of Sale) system, which facilitates on-the-spot payment acceptance. This POS system, combined with Paysafe's sophisticated in-store payment structure, allows businesses to provide their customers with various payment options, including installment payments and mobile purchasing. For detailed pricing, contact Paysafe directly for a tailored quote.

Paysafe Pros & Cons

PROS

Flexible pricingIntegrates with major Ecommerce platforms like ShopifyAdvanced security measures including tokenizationCONS

Customer support response can take up to 24 business hoursNo clear application process mentioned for setup - 3

Custom payment processing and merchant services

Custom payment processing and merchant services- Best for - Businesses seeking merchant and payment processing solutions

- Rates - 0.29%-1.55% per swiped card transaction

- Contract Length - 3 years

Custom payment processing and merchant servicesRead Merchant One ReviewMerchant One is a credit card payment processing company that offers solutions to small and large businesses in various industries. The company partners with Clover to resell its state-of-the-art POS systems, provides its customers with free training on using them, and services the hardware in-house. This ensures a high-quality user experience.

While Merchant One has excellent reviews on Trustpilot, several complaints indicate issues with customer service, billing, and contract terms. Nevertheless, Merchant One’s dedicated managers will respond to queries and guide you on setting up your account and processing transactions.

Why we chose Merchant One - We chose Merchant One because it’s able to process both POS and mobile phone credit card payments.

Our experience - We liked that Merchant One provides a dedicated account manager and offers lower card payment processing fees than some of its rivals.

Merchant One Pros & Cons

PROS

Assigned account managersState-of-the-art technologyTailored solutions for different businessesCONS

Free trial unavailableBilling and pricing issues noted - 4

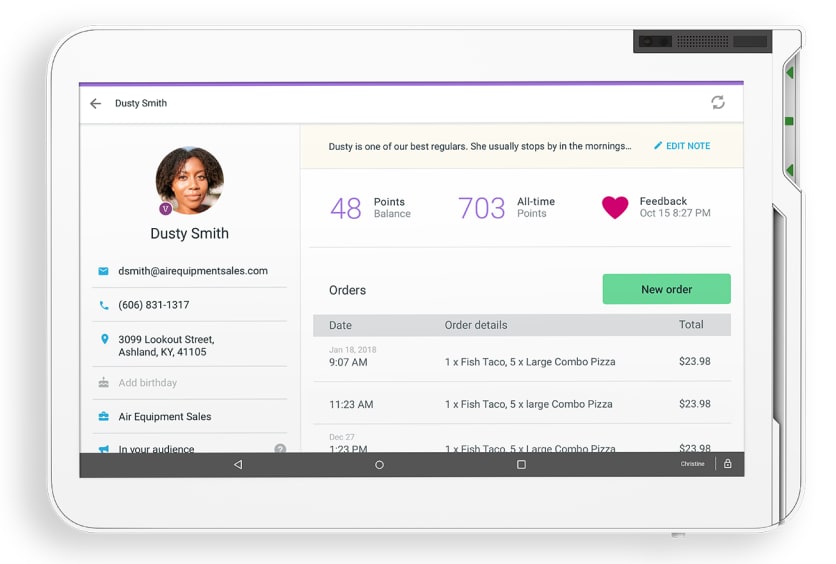

Payment processing + Clover POS apps

Payment processing + Clover POS apps- Best for - Restaurants, retailers

- Rates - 2.3% - 2.7% + $0.10

- Contract Length - Starts from 1 year

Payment processing + Clover POS appsRead Clover ReviewMany top credit card processing companies sell Clover’s point-of-sale systems. But did you know that Clover itself offers credit card processing through parent company Fiserv? That’s right. While Clover is primarily known for its POS hardware, it also offers a range of other services including payment processing, gift cards, invoicing and payroll solution, and working capital financing.

That said, if you’re looking for a payment processor that offers Clover devices, you should compare Clover to the many other payment processing companies that are authorized to resell Clover products. Clover’s flat-rate processing may seem convenient, but it looks less attractive when you consider the hundreds of poor reviews it has received from small business owners that have used its service.

Clover Pros & Cons

PROS

Predictable, flat-rate processingAccess to all Clover hardwareLarge app storeCONS

Poor customer service reputationMonthly fees - 5

.20210623075645.png) Payment processing with a monthly subscription

Payment processing with a monthly subscription- Best for - Small businesses with high transaction volumes

- Rates - No percentage-based transaction fees

- Contract Length - Month-to-month

Payment processing with a monthly subscriptionRead Stax ReviewStax by Fattmerchant offers payment processing for small businesses. It offers a monthly subscription and eliminates percentage-based transaction fees. So it can be a good option for businesses with high monthly transaction volumes.

Stax also has a software dashboard called Stax Pay that includes built-in analytics, an API, and support for e-commerce payments. All Stax customers receive 24/7 customer support by email, and the service doesn’t charge early termination fees.

Stax Pros & Cons

PROS

No percentage-based transaction feesIncludes swiped and keyed-in payments24/7 customer supportCONS

Software requires an additional monthly subscriptionPricing structure is expensive for low-volume businesses - 6

Fast, dependable, affordable mobile processing

Fast, dependable, affordable mobile processing- Best for - Mobile payment processing, lightning-fast

- Rates - 2.6%+15¢

- Contract Length - No contract

Fast, dependable, affordable mobile processingRead Square ReviewSquare revolutionized the industry when it introduced a POS system that was mobile, convenient, and affordable, even for small businesses. Since then, the company continues to make additions and improvements, and the latest one has earned Square a reputation for being the best mobile credit card processing option out there. With a credit card processor that can process all types of payments, including EMV chip cards and contactless payments like NFC and e-wallets like Apple Pay and Google Pay, Square does it one better by packaging this handy reader into a pocket-sized and surprisingly powerful piece of hardware.

The Square credit card processor comes with a flat rate for both dip and tap transactions, zero additional fees, wireless connection, and the ability to process payments in just 2 seconds. The dock allows you to keep the Square reader on your countertop, and it’s also designed to easily come with you wherever you go. Plus, you get a free magstripe reader just in case.

Square Pros & Cons

PROS

Extremely compact, mobile designFlat rate fees and no additional feesFast processingCONS

Not a good fit for high-risk industriesMerchant services are limited - 7

Affordable and user-friendly merchant service

Affordable and user-friendly merchant service- Best for - All business types and sizes

- Rates - From $49 monthly and $0.15 transaction fee

- Contract Length - No long-term contracts

Affordable and user-friendly merchant serviceRead Payment Depot ReviewPayment Depot is a cost- and user-friendly merchant service with comprehensive equipment solutions and features to help you run your business. It uses a monthly subscription membership model and charges wholesale rates to keep your expenses low. Moreover, it saves you money by not marking up the interchange rates or taking a cut from your sales. There’s a custom option for processing annual transactions of $500,000.

All business types and sizes can use Payment Depot, which is highly rated in online reviews. It’s scalable and has several options for customer support. There are no cancellation fees, and its satisfaction guarantee means you can be eligible for a partial refund after 90 days.

Payment Depot Pros & Cons

PROS

Positive online reviews of the serviceExtensive equipment solutionsDoesn’t mark up interchange ratesCONS

Live chat agent took long to respondCan’t view package features without registering - 8

-min.20210215123731.png) Surcharge model–eliminating credit card fees

Surcharge model–eliminating credit card fees- Best for - Businesses looking to save money on credit card transactions

- Rates - Credit card: 3.5% to customer, zero to business; Debit card: 1% + $0.25% to business, zero to customer

- Contract Length - None

Surcharge model–eliminating credit card feesRead Nadapayments ReviewSince 2018, Nadapayments' innovative payments solutions have been helping companies eliminate their credit card processing fees. Instead of forcing the company into credit card fees, it eliminates the credit card fees altogether and offers customers the option of pushing cheaper debit card fees onto the business.

As part of its unique package, Nadapayments offers surcharges displayed as separate line item on customer receipts and a Wi-Fi-enabled EMV terminal as well as surcharge notices to display to your customers and a system that integrates into your eCommerce solution.

Nadapayments Pros & Cons

PROS

Transparent pricing structureYou don’t pay a dime for credit card transactions (really)Allows you to offer customers payment flexibilityCONS

No funding or other merchant servicesMonthly fee for credit card terminal - 9

Transparent, tiered pricing structure

Transparent, tiered pricing structure- Best for - Restaurants, retail, ecommerce

- Rates - Monthly cost - $9.95; Transaction – 0.14-0.29% + $0.07-$0.15 + interchange fees

- Contract Length - Varies

Transparent, tiered pricing structureRead National Processing ReviewNational Processing is a credit card processing company targeted at low-risk merchants. Under its differential pricing structure, restaurants pay the lowest amounts, retailers pay a little more, and ecommerce platforms pay the most. Larger businesses can trade off higher or lower monthly fees for higher or lower per-transaction fees.

All price plans are displayed transparently on the National Processing website, along with information about the various features included in your plan. Highlights include assistance with setup, reprogramming of existing equipment (if you have any), and a free mobile reader. National Processing is an authorized reseller of Clover’s suite of payment terminals and readers.

National Processing Pros & Cons

PROS

Transparent fee structureFree reprogramming of existing equipmentQuickBooks integrationCONS

Not suitable for high-risk businessesCosts vary with interchange fees - 10

Secure and flexible payments for all business types

Secure and flexible payments for all business types- Best for - All business types and sizes

- Rates - 2.90% online rate

- Contract Length - No contract

Secure and flexible payments for all business typesRead Chase for Business® ReviewChase For Business is a merchant service from JP Morgan Chase offering fortress-level security and flexible payments for different business types and sizes. Its various solutions and features enable you to accept in-store, online, or on-the-go payments. Depending on Chase’s policies, you may be eligible for same-day approval and funding. Its business analytics can help boost sales and help you understand your customers.

There are no long-term contracts, and you can get month-to-month contract agreements. Its customer support is available 24/7/365, but you must sign in first to access the support. Other customer resources can be found on the Chase website.

Chase for Business® Pros & Cons

PROS

High-level security24/7 customer supportFlexible payment solutionsCONS

Sign in to receive customer supportConfusing pricing information