What is a home warranty?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances due to normal wear and tear. It's essential for homeowners seeking financial protection against unexpected breakdowns, offering peace of mind and potentially saving thousands in repair costs.

Key Insights

- Home warranties cover repair costs for major appliances and systems to prevent unexpected expenses.

- When filing claims, homeowners pay only a service fee while warranty companies arrange repairs.

- Choice Home Warranty offers simple plans with $100 fees and up to $3,000 coverage per claim.

- Warranties typically protect heating, AC, electrical, plumbing systems and essential home appliances.

Why a home warranty matters in 2026

A home warranty is especially important in 2026 due to rising repair costs, aging home systems, and increased financial uncertainty for many homeowners. With inflation driving up the price of parts and labor, a single unexpected breakdown, like a failed HVAC or plumbing issue, can quickly strain a household budget. For first-time buyers or those without a robust emergency fund, a home warranty provides a reliable safety net, offering predictable costs and faster access to vetted service professionals. In an era where peace of mind and financial stability matter more than ever, having home protection in place is a smart and timely decision.

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information.

We provide a range of services including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

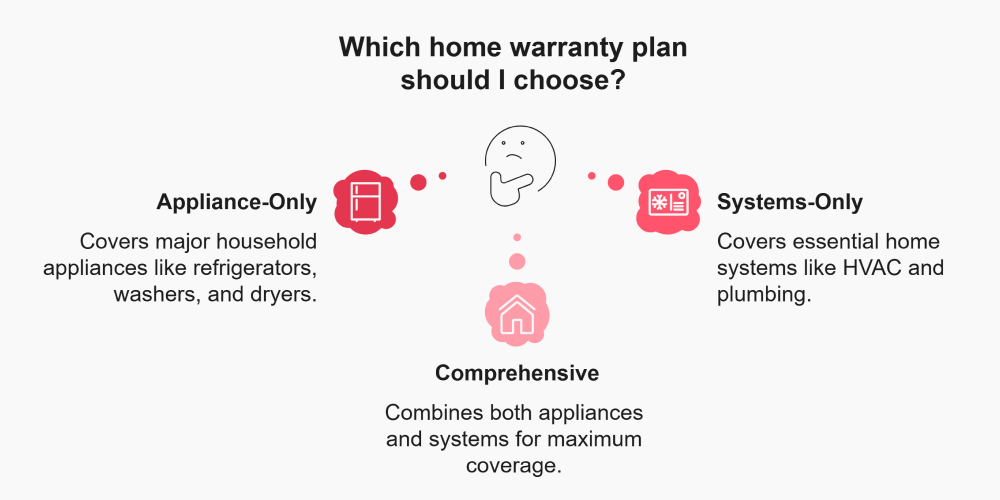

What does a home warranty cover?

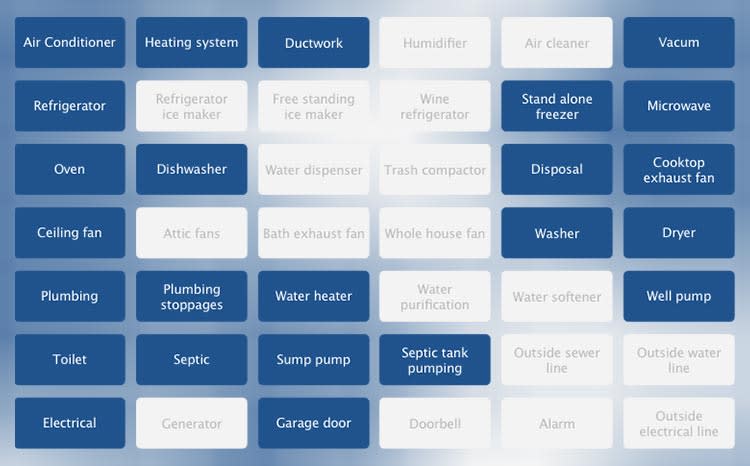

Home warranty plans typically offer coverage for:

Home Systems: HVAC (heating, ventilation, and air conditioning), electrical systems, plumbing systems, water heaters, and ductwork.

Appliances: Refrigerators, ovens, cooktops, dishwashers, built-in microwaves, washers, dryers, and garbage disposals.

Additional Items: Garage door openers, ceiling fans, and sometimes roof leaks (limited coverage).

Coverage varies by provider and plan, so it's crucial to review the specific terms of your home protection plan.

How does a home warranty claim process work?

Review Your Contract: Ensure the item in question is covered under your home warranty plan.

File a Claim: Contact your home warranty company via phone or online portal.

Schedule Service: The company assigns a licensed contractor to assess the issue.

Diagnosis and Repair: The technician diagnoses the problem and performs the necessary repair or replacement.

Pay Service Fee: You pay a predetermined service fee, typically ranging from $75 to $125.

What do home warranties exclude?

Pre-existing Conditions: Issues known before the warranty start date.

Improper Maintenance: Failures due to lack of maintenance.

Cosmetic Damages: Non-functional issues like scratches or dents.

Secondary Damages: Consequential damages resulting from a covered item’s failure.

Coverage caps may apply, limiting the amount payable per item or per term.

When should you consider a home warranty?

Purchasing an Older Home: Older systems and appliances are more prone to breakdowns.

Limited Emergency Funds: A home warranty can mitigate unexpected repair costs

First-Time Homeowners: Provides a safety net during the initial years of homeownership.

- Landlords: Simplifies maintenance for rental properties.

Our Top 10 Best Home Warranty Companies - Quick Reviews:

- 1

Get full coverage and round-the-clock support

Get full coverage and round-the-clock support- Best for - Homeowners seeking affordable full-home coverage

- Average annual premium - $562 - $657

- Service requests - 24/7 online and by phone

Get full coverage and round-the-clock supportRead Choice Home Warranty ReviewChoice Home Warranty offers straightforward plans with uniform pricing. Both the Basic and Total plans bundle systems and appliances, eliminating the need to choose between coverage types. The company provides coverage up to $3,000 per claim and includes a 60-day workmanship guarantee, double the industry standard 30-day term.

Coverage highlights:

All plans bundle systems and appliances

49 states (excluding Washington)

24-48 hour technician dispatch

First month free with annual payment

60-day workmanship guarantee (2x competitors)

What to consider: The $3,000 cap works well for standard systems but may not fully cover high-end replacements. Keep dated HVAC maintenance receipts to avoid "improper maintenance" claim disputes, which are common with high-volume providers.Expert perspective: Best value for homeowners with average-value systems who prioritize predictable pricing over customization. The 60-day workmanship guarantee provides superior protection. Ideal for first-time warranty buyers.

Choice Home Warranty Pros & Cons

PROS

Offers 30-day guarantee on covered repairsFirst month free with purchase of any single payment planEasy online claims processCONS

Limited add-on coveragesNot available in Washington - 2

Customizable plans with adjustable service fees

Customizable plans with adjustable service fees- Best for - Older homes with aging systems

- Average annual premium - $500–$700

- Service requests - 24/7 online and by phone

Customizable plans with adjustable service feesRead American Home Shield ReviewAmerican Home Shield, operating since 1971, is the largest provider in the market with over two million members. Three customizable plans (ShieldSilver, ShieldGold, ShieldPlatinum) range from 14 to 23+ covered items, with the top tier offering free HVAC tune-ups, unlimited A/C refrigerant, and coverage up to $5,000 for HVAC systems.

Coverage highlights:

Choose your service fee to optimize monthly premium

Covers undetected pre-existing conditions and maintenance issues

Covers duplicate items, rust, and corrosion

47 states, plus Washington DC

Highest HVAC limit ($5,000)

Key advantage: Undetected pre-existing conditions coverage shifts the burden of proof away from homeowners, potentially saving thousands in disputes. Most competitors require you to prove systems were working at enrollment.What to consider: Service fee strategy matters. Higher fees ($125), lower monthly premiums for infrequent claims. Lower fees ($75) increase monthly costs but reduce per-incident expenses. No guaranteed repair timeframes, and contracts are required for best pricing.

Expert perspective: Strongest choice for homes 8+ years old where pre-existing condition disputes are likely. The $5,000 HVAC limit and established contractor network provide superior reliability for aging systems.

American Home Shield Pros & Cons

PROS

Highly customizable plansIncludes undetectable pre-existing conditionsCovers older items, including rust and corrosionCONS

No guarantee for repair timesNot available in Alaska, New York City, or Hawaii - 3

Live chat customer service

Live chat customer service- Best for - Homeowners looking for reliability, reviews & quick claims process

- Average annual premium - $365–$699.99

- Service requests - 24/7 online and by phone

Live chat customer serviceRead Liberty Home Guard ReviewWith high ratings and great reviews, Liberty Home Guard has a reputation for delivering reliable service to customers.

They have three plans available (Systems Guard, Appliance Guard, and Total Home Guard) with optional financial protection for roof leaks, standalone freezers, generators, carpet cleaning, and power washing. New policyholders also get free limited roof leak protection and two free months of coverage.

Liberty Home Guard's exceptional claims process sets them apart from other home warranty providers. They have a 24/7 call center and guarantee to assign a contractor to a claim within 24 to 48 hours. They also have a network of over 10,000 qualified technicians in all 50 states.

Liberty Home Guard has launched a comprehensive mobile app, revolutionizing how homeowners manage their home warranty accounts, file claims, and access real-time information. The app offers features like effortless access to warranty details, efficient claims management, streamlined payment tracking, seamless communication with technicians, real-time notifications, and a wealth of knowledge on home maintenance.

Why we chose Liberty Home Guard: Liberty Home Guard's rates start at just $1/day, and their technicians arrive within 24 to 48 hours of claim submissions.

Our experience: We were pleased with Liberty Home Guard's reliability, rapid claims processing, and excellent customer service.

Liberty Home Guard Pros & Cons

PROS

Excellent customer serviceCurrently offers two free monthsHighly rated by customersCONS

Not available in WisconsinFewer technicians compared to other companies - 4

Comprehensive coverage for all your appliances

Comprehensive coverage for all your appliances- Best for - Comprehensive appliance coverage

- Average annual premium - $550-$720

- Service requests - 24/7 online, by phone during normal business hours

Comprehensive coverage for all your appliancesRead Home Warranty of America ReviewHome Warranty of America has comprehensive policies that cover most appliances and indoor systems. Offering up to $15,000 in annual coverage for repairs and replacements, they also have 24/7 online or phone service requests and a 30-day money-back guarantee.

They may be a little pricier than some competitors, but you get a lot for your money—all plans come with a deductible per-service visit.

Why we chose Home Warranty of America: Home Warranty of America provides nationwide service and is good value for money when covering all appliances.

Our experience: We were impressed with Home Warranty of America's extensive coverage and efficient customer service. It was easy to set up a plan, and we appreciated their 30-day money-back guarantee.

Home Warranty of America Pros & Cons

PROS

Covers most home appliancesHigh coverage limits30-day money-back guaranteeCONS

30-day waiting period10% cancelation fee - 5

Covers items regardless of age

Covers items regardless of age- Best for - High-end appliance protection

- Average annual premium - $360–$546

- Service requests - 24/7 phone and online claims service No limit on number of service requests

Covers items regardless of ageRead First American Home Warranty ReviewFirst American Home Warranty specializes in appliance coverage with industry-leading limits up to $7,000 per appliance under premium plans. Operating since 1984, the company has saved homeowners over $219 million. Items are covered regardless of age, with brand-new replacements when repair isn't possible.

Coverage highlights:

Up to $7,000 per appliance (vs. $2,000-$4,000 competitors)

HVAC coverage up to $3,500 (some plans higher)

Brand-new replacements for unrepairable items

24/7 claims with vetted tradespeople

Covers code violations and improper installation (Advantage upgrade)

Key advantage: The $7,000 appliance limit is crucial for luxury kitchens with Sub-Zero refrigerators, Wolf ranges, or Miele dishwashers. Standard plans cap at $2,000-$4,000, leaving significant gaps for high-end equipment.

What to consider: Available in only 36 states. Verify HVAC coverage matches your system's replacement cost since the company focuses more on appliances than systems. The mobile app has lower ratings than the web platform.

Expert perspective: Definitive choice for homeowners with luxury appliances who need coverage matching actual replacement costs. Best for those who've upgraded HVAC but have aging premium kitchen equipment. Verify adequate HVAC protection for your specific plan.

First American Home Warranty Pros & Cons

PROS

24/7 claims serviceFully vetted tradespeopleLow pricing and service feesCONS

Difficult to understand pricing breakdown without a personal quoteTheir app is poorly rated - 6

HSC offers unique coverage options nationwide

HSC offers unique coverage options nationwide- Best for - Homeowners looking for extensive coverage options

- Average annual premium - $552-$799

- Service requests - 24/7 online, by phone during normal business hours

HSC offers unique coverage options nationwideRead Home Service Club ReviewHome Service Club (HSC) offers two service plans: Standard and Comprehensive. The Standard plan covers 18 basic appliances and systems, while the Comprehensive plan covers 33. Optional add-ons, such as pool and roof coverage, are available for an extra fee.

HSC's unique plans include pest damage and utility line cover, setting them apart from other home warranty services. You can also choose your service fee amount from three options ($65, $95, and $125), and all repairs have a 90-day guarantee.

However, HSC charges higher service fees and premiums than average. You must also live in a single-family residence, condo, townhouse, or multi-family property to qualify for a plan.

Why we chose Home Service Club: HSC has a broad selection of optional add-ons, including coverage of gas lines, grinder pumps, ductwork, pools, and spas. Additionally, the company's services are available nationwide with no exclusions.

Our experience: We appreciated that HSC provides coverage for pest damage, which many competitors don't.

Home Service Club Pros & Cons

PROS

Provides coverage for pest damageAvailable nationwide90-day workmanship guarantee on all repairsCONS

High base premiums and service feesDon't list pricing on the website - 7

Build your own custom home warranty policy

Build your own custom home warranty policy- Best for - Customizable warranty policies

- Average annual premium - From $500

- Service requests - 24/7

Build your own custom home warranty policyRead Elite Home Warranty ReviewElite Home Warranty offers highly customizable home warranty policies. You can choose from three warranty packages and dozens of optional add-ons, or build a completely custom policy that protects the appliances and home systems you’re most concerned about. You can also customize your coverage limits and service visit copay. Overall, Elite Home Warranty policies are comprehensive and affordable.

Elite Home Warranty is one of only a handful of home warranty providers that lets you choose your own service technician. The company also has a nationwide network of contractors and can dispatch them within 24-48 hours of your claim. You can file a claim 24/7 online, over the phone, or through the Elite Home Warranty mobile app.

Elite Home Warranty Pros & Cons

PROS

Choose custom coverage limitsIn-network service technicians or choose your ownFile claims 24/7, online, by phone, or through the appCONS

Copay for service visits can be up to $130 each timeWorkmanship guarantee for service visits is only 30 days - 8

High annual coverage limit in 48 states

High annual coverage limit in 48 states- Best for - Customers seeking high coverage limits and fast service

- Average annual premium - $239.88-$720

- Service requests - 24/7 online and phone

High annual coverage limit in 48 statesRead 2-10 Home Buyers Warranty Review2-10 Home Buyers Warranty has 40 years of experience in the home warranty industry. It offers 3 plan tiers for $19.99 per month, $51 per month, and $60 per month. Service fees are adjustable, ranging from $65–$100 per visit, but the base fee is $85. 2-10 HBW offers a generous $25,000 annual coverage limit, so you’re protected in case of multiple appliance or system failures.

To start, simply visit 2-10 HBW’s website or call customer service. You can purchase a warranty anytime, whether you are buying, selling, or currently living in your home. Support is available 24/7, and you can expect a service call within 24–48 hours of submitting your claim.

Benefits:

Annual coverage limit up to $25,000

Covers everyday wear and tear

Refund for service fee if an item isn’t covered

Customers receive discounts on GE and Whirlpool appliances

Plans and Pricing:

2-10 Home Buyer’s Warranty offers three plans and optional add-on coverage.

Simply Kitchen: Covers six kitchen appliances

Complete Home: Covers 22 appliances and home systems, including all those covered by the Simply Kitchen plan

Pinnacle Home: Covers 32 appliances and home systems, including all those covered by the Complete Home plan

States Serviced:

2-10 Home Buyers Warranty is availalbe in 42 states, but is not available in Alaska, Hawaii, Montana, New Hampshire, North Dakota, Oklahoma, South Dakota, and Wyoming.

2-10 Home Buyers Warranty Pros & Cons

PROS

Available in 48 contiguous statesPurchase a plan anytime$25,000 annual coverage limitCONS

Expensive annual premiumHigh base service fee - 9

Reasonably priced cover for your home

Reasonably priced cover for your home- Best for - Lower service fees

- Average annual premium - $420-$540

- Service requests - 24/7 by phone or email

Reasonably priced cover for your homeRead First Premier ReviewFirst Premier Home Warranty provides affordable services to homeowners across 32 states. Their Premier Plan covers 15 appliances and systems and is priced lower than some competitors. There's also a $75 deductible per claim.

You can get a free quote quickly by entering your contact details and property type. And if you pay annually, you get roof leak coverage and two months for free.

Why we chose First Premier: Their customer service is highly rated, with customers reporting quality and timely repairs. They also have a wide range of add-on coverage options.

Our experience: We found that First Premier had some of the lowest service fees in the industry. We liked that they aim to respond to all claims within 48 hours, and that customer support is available 24/7.

First Premier Pros & Cons

PROS

$75 deductible per claimTwo free monthsQuick customer service responseCONS

Full details aren't included on the websiteNot many plan options - 10

Choose your own contractor

Choose your own contractor- Best for - Choose your own contractor

- Average annual premium - From about $350/year

- Service requests - Online or phone 24/7

Choose your own contractorRead AFC Home Warranty ReviewOffering coverage for a wide range of systems and appliances, AFC Home Warranty could provide essential peace of mind if one of the key items in your home were to fail. It offers 4 plan types (Systems, Silver, Gold, and Platinum), with each providing 24/7 in-house claims support.

Although its prices are roughly in line with industry standards, the provider does have a number of advantages over its rivals, including the longest workmanship guarantee in the industry and a range of attractive benefits.

Benefits:

Guaranteed repairs for the life of your plan

24/7 customer service and claims service

Choose your own contractor for services

Multiple plan options and add-ons

Plans and Pricing:

AFC Home Warranty offers four plans and optional add-on coverage.

Systems Plan: Covers six home systems

Silver Plan: Covers eight appliances

Gold Plan: Covers all appliances and home systems included in the Systems and Silver Plans

Platinum Plan: Covers 17 appliances and home systems, including all those covered by the Gold Plan

States Serviced:

AFC Home Warranty services all states except Hawaii.

AFC Home Warranty Pros & Cons

PROS

Home inspection/maintenance records not requiredUnlimited number of service requestsFreedom to choose own contractorCONS

Live chat not availableApp not available