Thrive is a handy payroll processing tool that automates time and attendance tracking, calculates tax payments, and helps employees save for retirement with 401(k) plans. What’s more, it offers HR and compliance tools, supports remote hiring and onboarding, and monitors vacation time.

It’s intended for businesses of all sizes, from small startups to large enterprises. However, it’s especially useful for those with hourly paid employees who are looking for an affordable and convenient payroll management tool.

Its ability to automate tax payments and tax filing ensures accurate and timely tax calculations, reducing the risk of errors and potential fines. Even better, it covers any fines or penalties incurred as a result of errors on its part, so you don’t need to worry about things going wrong on the technical side.

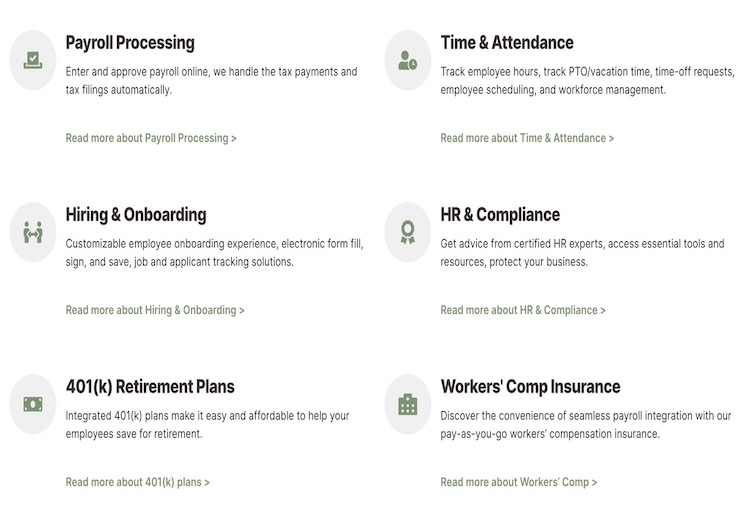

Thrive automates payroll processing by allowing you to enter and approve payroll hours online. You can also automate tax payments and fill in tax forms online, including Form 941 and Form 940. You can also file and issue both federal and state W-2 and 1099 forms, as well as create payroll stubs, pay workers by direct deposit, manage employee benefits, and reimburse employees for their expenses.

Reimbursements and direct deposits are available on a two- or four-day turnaround, meaning you can pay employees quickly and on time.

Time and attendance management

Thrive simplifies your time and attendance tracking by removing the need for paper time sheets. This means you can say goodbye to the hassle of manual data entry, the risk of lost or inaccurate records, and the time-consuming task of decoding handwritten notes.

What’s more, you can geo-track your employees’ clock-ins to ensure they’re on site when they clock in, enhancing your workforce's accountability and security. Plus, Thrive tracks PTO allowance, sick leave, and unauthorized absence. You can also view and approve PTO requests to ensure your workplace is fully staffed at all times.

Thrive offers an integrated 401(k) plan to help employees plan for retirement. You get 3% cashback on employee contributions, easy sync to your payroll, zero transaction fees, and award-winning customer service.

Thrive enables you to post custom job adverts, track applications, schedule interviews, retain notes, and onboard new employees. You can easily add these employees to your payroll and save relevant documents to Thrive’s secure database.

In addition, employees can digitally sign tax forms and contracts to prevent lost documents and streamline the administrative burden of paperwork. Plus, you can enroll employees into benefits programs through Thrive’s intuitive interface.

Thrive offers a range of handy HR tools, including on-demand access to certified HR professionals, a central HR compliance library, and access to tailor-made employee handbooks for a fully customizable employee experience.

You can also simplify the complexities of the Affordable Care Act (ACA) using Thrive’s automatic data collection and reporting tools. Additionally, you can train employees with custom training tools, expedite HR paperwork with ready-to-use templates, and ensure a streamlined and compliant HR process from recruitment to retirement.

Thrive allows you to offer employees worker's compensation insurance on a pay-as-you-go basis, making it the most cost-effective way to offer your team this protection. Pay-as-you-go insurance means you only pay for what you actually need, reducing the financial strain on your business and ensuring that you're not overcommitting resources.

Thrive uses a combination of secure servers, data encryption, and password protection to ensure employee data is kept safe. It employs Transport Layer Security (TLS) encryption and other safety protocols to comply with both state and federal data protection regulations. Plus, all data and hardware is stored in an SSAE 18 audited facility to ensure its safety.

Thrive gives employees access to their data through a self-service portal, making them responsible for keeping their information up to date. Login is through a username and password.

Thrive is available on desktop, iOS, and Android. The mobile app has buttons on the home screen to help you find your way around. For example, you'll find a clock-in and clock-out button, along with options to access paystubs, submit PTO requests, and check work hours directly through the time clock interface.

However, many users complain about the layout of the app, saying it’s buggy and difficult to navigate. They also complain that it’s hard to log in and that you can’t save your login details for future use. There’s also no option for biometric log-ins like fingerprint or facial recognition.

The desktop version has a similar layout to the app, with buttons to lead you to saved documents, employee learning, employment law information, an on-demand HR service, and more. Reviewers state that the website is also hard to navigate, although easier to log in to than the app.

Thrive allows users to set up custom reporting to get important information, including insights into employee attendance, payroll costs, and benefits uptake. You can find the reporting tools through the home screen under the “Tools” section.

Finally, it integrates with business tools such as Xero, TurboTax, and QuickBooks for seamless data sharing and enhanced functionality.

To get started with Thrive, click on the sign-up link on its website. You’ll need to give your name, email address, phone number, and company name, then wait to hear back from the team. A dedicated payroll expert will set up your account to ensure accuracy and compliance.

You can contact Thrive’s customer service through phone and email, but it doesn’t offer a live chat feature. Thrive operates in US time zones, so you can expect a response within US business hours, but not on weekends.

The customer service lines are staffed by payroll experts who will help you find a solution to your problem. They have either a five-year tenure with Thrive or a PayrollOrg FPC certification, meaning they understand the software inside out.

The website has an FAQ section but it’s somewhat lacking, only answering general questions like “Do I have to sign a contract,” as opposed to specific, user-generated questions.

You can cancel or pause your Thrive subscription at any time without incurring a penalty. This is great for businesses that may experience seasonal fluctuations, changes in staffing needs, or simply want the flexibility to adapt their HR and payroll solutions as their organization evolves.

We contacted Thrive to ask about canceling a subscription, who said you can cancel by calling or emailing the support team. It asks for a 30-day notice period to cancel for tax purposes but will honor earlier cancelation wherever possible.

Thrive offers both an iOS and Android app for payroll management on the go. The app is called MyGo, which can be confusing.

It also has generally poor reviews, with an overall rating of 1.7 stars out of 5. Users complain about the difficult user interface and being unable to track time properly or save their password.

Thrive operates a three-tier pricing model with optional add-ons. You pay a flat fee per month, and then extra for each employee who uses the service.

| Essentials | Enhanced | Enterprise | |

|---|---|---|---|

Cost Per Month | $39 + $6 per person | $59 + $9 per person | $99-$199 + $12-$19 per person |

Full-service payroll processing | Yes | Yes | Yes |

Two-day and four-day direct deposit | Yes | Yes | Yes |

Hiring and onboarding tools | Yes | Yes | Yes |

Electronic form fill, sign, and save | No | Yes | Yes |

Online document storage | No | Yes | Yes |

Applicant tracking system | Yes | Yes | Yes |

Time and attendance tracking | No | Yes | Yes |

Custom PTO policies | No | Yes | Yes |

HR compliance and law library | No | Yes | Yes |

“Ask the Pro” on-demand certified HR experts | No | No | Yes |

Professional policy customization | No | No | Yes |

Pay-as-you-go workers’ comp | Yes | Yes | Yes |

Integrated 401(k) retirement plans | Yes | Yes | Yes |

Tax preparation integrations | Yes | Yes | Yes |

The Essentials package is best for smaller businesses or those just getting started with payroll software. In addition, your first month of the Essentials plan is completely free, meaning you can see whether Thrive is a good fit before you pay for further months.

The Enhanced package best suits businesses looking to streamline their payroll and tax processes by moving them online. It’s particularly time- and cost-saving for a business with a lot of hourly paid employees.

The Enterprise package is intended for those who need a full-service payroll and HR system. It’s especially for large businesses that need reliable access to an audit trail, cost reduction through minimized errors, and access to customized reporting tools.

You can get a month of the Essential package completely for free.

There are a number of optional add-ons which come at an extra cost. These include:

Next-day wire-funded direct deposits

Same-day wire-funded direct deposits

Payroll funding loans

Background searches

I-9/e-Verify management

Drug screening

Free job board postings

Premium job board postings

Prices will change depending on which plan you select and the size of your business.

| Thrive | Gusto | ADP | Paychex | |

|---|---|---|---|---|

Price | $39-$199 per month | From $6 | From $39 | Quote-based |

Benefits & HR | Yes | Yes | Yes | Yes |

Automatic tax filing | Yes | Yes | Yes | Yes |

Apps | Yes | Yes | Yes | Yes |

Gusto is considerably cheaper than Thrive but offers fewer payroll and HR management features. Its mobile app has much better reviews than Thrive’s, and it’s praised for its simplicity and great customer service. Both have a one-month free trial so there’s no risk in trying both to see which is better for you.

ADP is considerably cheaper than Thrive and offers 24/7 customer service which Thrive doesn’t. However, Thrive has considerably better reviews than ADP, with many people saying ADP’s online tool is slow and buggy.

Paychex offers a wide range of payroll reporting tools and has much better reviews than Thrive. It’s difficult to compare their pricing as Paychex only offers prices on a quote basis. Paychex also offers business insurance, which Thrive doesn’t. This means the former might be better for highly regulated industries such as finance, healthcare, or legal services.

While Thrive is one of the more expensive payroll options on the market, it offers a great range of features and automated services. What you pay in the cost, you make up for in time savings, reduced compliance risks, and the peace of mind that comes with a comprehensive HR and payroll solution.

I particularly like that Thrive allows you to cancel your subscription at any time without penalty. This is rare in payroll providers and gives you the flexibility to use Thrive during busy periods and then cancel your subscription when the budget is tight.

Frequently Asked Questions

Frequently Asked QuestionsMedi is a freelance writer with a passion for astrology, psychic phenomena, and new-age science. She is particularly skilled at reading birth charts and enjoys sharing her extensive personal experience of online psychic readings, crystals, and mediumship with others who share her enthusiasm for the psychic realm.