- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

“Aura's comprehensive catch-all service gives you the most bang for your buck compared to the competition.“ (Jul 2025)

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Fast alerts for stolen SSN

- Advanced dark web monitoring

- Special offer: Save 73% on Ultra Protection

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Full coverage for social security fraud

- Unlimited recovery services

- Repays up to $1M for stolen funds & expenses

- Risk-free with a 30-day money-back guarantee

- Up to $1 million in ID theft insurance

- Save 58% on your first term

- Get actionable security alerts and notifications

- Track your credit activity and credit score

- Up to 71% OFF with a 2-year plan

- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

“Aura's comprehensive catch-all service gives you the most bang for your buck compared to the competition.“ (Jul 2025)

Why do I need to protect my Social Security number (SSN)?

Your Social Security number (SSN) is more than just an identifier; it's a key to your financial, medical, and legal identity. Many government agencies and private institutions use it to verify who you are, apply for loans, open accounts, register for licenses, and access services. Because of its critical role, protecting your SSN is vital to avoid identity theft, fraud, and long-term financial damage.

Key takeaways

- SSN misuse can lead to tax, credit, and medical fraud; early action is critical.

- You can’t freeze your SSN, but you can freeze your credit to block financial access.

- Locking your SSN is free with SSA’s electronic block and myE-Verify’s Self-Lock feature.

- Proactive SSN protection includes scam awareness, cyber hygiene, and identity monitoring tools.

- Knowing what to do if your Social Security number is stolen helps reduce recovery time and financial harm.

How can someone misuse my Social Security number?

What happens if someone has my SSN?

If someone obtains your SSN, they can impersonate you to commit crimes or gain unauthorized access to services. According to the SSA and recent federal investigations, stolen SSNs are actively sold on criminal marketplaces, sometimes in batches of millions. Knowing what to do if SSN number is stolen can help reduce the damage before it spreads.

Ways your SSN can be exploited

- Financial fraud: Applying for credit cards, loans, or services in your name

- Medical fraud: Receiving medical care or benefits, potentially corrupting your health records

- Tax fraud: Filing fake tax returns to claim your refund

- Employment fraud: Using your SSN to gain employment, affecting your taxes and records

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information.

We provide a range of services including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

What do I do if someone has my Social Security number?

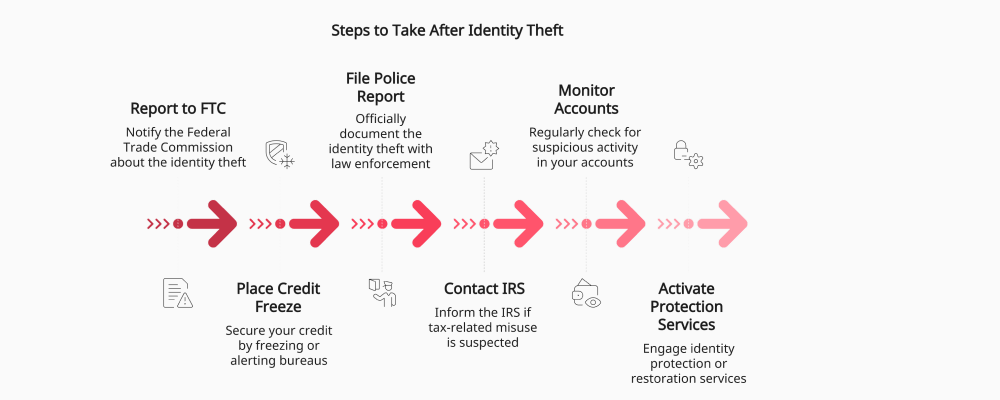

Immediate steps to take:

1. Report to the FTC via IdentityTheft.gov

→ This is the official first step. It generates a personalised recovery plan and identity theft report used for credit disputes.

2. Place a credit freeze or fraud alert with all three bureaus (Equifax, Experian, TransUnion)

→ Prevents further financial misuse immediately while you're still reporting other issues.

3. File a police report

→ Important for supporting credit disputes, insurance claims, and fraud affidavits.

4. Contact the IRS and file Form 14039 if tax-related misuse is suspected

→ Prevents further tax fraud and flags your SSN in IRS systems.

5. Monitor your mail, email, and statements for any suspicious activity

→ Helps detect signs of new fraud or correspondence triggered by misuse.

6. Activate identity protection or restoration services

→ These services help protect social security number usage long-term and guide recovery when misuse occurs.

How do I lock my Social Security number for free?

What does locking your SSN mean?

Locking your SSN prevents others from accessing or verifying your identity through certain government and employment systems. If you're unsure how to lock your social security number settings or where to start, there are secure, free resources available.

Free ways to lock your Social Security number

- SSA Electronic Access Block: Call 1‑800‑772‑1213 to request a block that prevents online access to your SSN records

- myE‑Verify Self-Lock: Prevents employers from verifying your SSN without your permission. The lock lasts 12 months and is renewable

These are the two main ways to lock your Social Security number for free and proactively defend against misuse.

How do I check if my SSN is being used?

Signs of SSN misuse

- Unexpected IRS letters or tax forms

- Credit report entries you don’t recognize

- Bills for services you didn’t use

Steps to verify suspicious activity

- Order free credit reports from all three major bureaus

- Sign up for identity protection monitoring

- Use E‑Verify Self Check to confirm if your SSN is being used for employment fraud

These steps are essential when determining what to do if SSN compromised or validating suspicious activity early.

Is freezing my Social Security number the same as locking it?

No. You can’t freeze your SSN directly like a credit file. A credit freeze stops lenders from accessing your credit report, while an SSN lock limits its use in government systems and employment verification tools. So, while you can’t technically freeze your social security number use directly, you can still lock social security number access to reduce risk.

How can I protect my Social Security number proactively?

Understand and avoid SSN scams

Many identity theft schemes rely on tricking people into giving away their SSN voluntarily. Common scam tactics include fake calls from the "SSA," phishing emails, and fraudulent job applications. Learning to recognize these scams is your first line of defense. Always verify who’s asking for your SSN, and never share it unless it’s absolutely required.

Use Social Security monitoring services

Modern SSN protection services continuously monitor your credit status, bank activity, and public records. If your personal data is breached, these services send alerts and help you respond quickly. Many include identity restoration assistance and stolen fund recovery. Look for services with real-time alerts and 24/7 support.

Strengthen your cyber hygiene

Digital security is essential. Use strong, unique passwords and enable two-factor authentication (2FA) on all sensitive accounts. Avoid using public Wi-Fi without a VPN. Don’t store SSNs in unsecured files or emails. Practicing solid cyber hygiene significantly reduces your exposure to identity theft and contributes to daily social security protection.

Why is it so hard to replace a stolen Social Security number?

Replacing a Social Security card is complex. The SSA only issues a new SSN under rare circumstances with proof of ongoing harm. Even then, previous fraud history may still follow you. That’s why knowing what to do if ssn number is stolen and setting up protection early is essential.

This content was adapted using AI tools and includes human validation to ensure accuracy and quality.

Our Top 3 Picks

- 1

Exceptional9.8

Exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

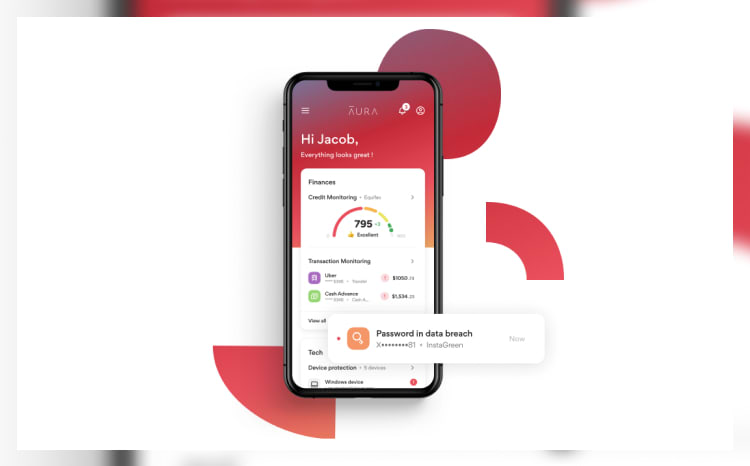

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

Excellent9.2

Excellent9.2 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

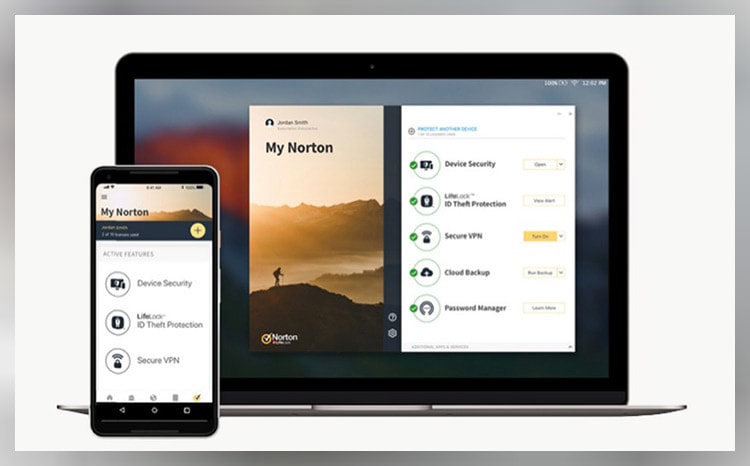

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

Excellent9.0

Excellent9.0 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

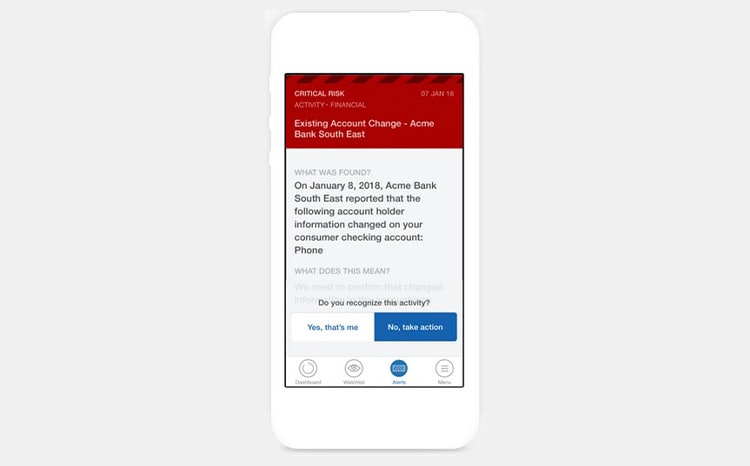

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans