Our survey respondents identified their top three providers as Netflix, Amazon Prime, and Hulu, accounting for over 1,800 subscriptions combined.

To better understand consumer streaming preferences, we asked the general public about what attracts them to (and repels them from) a top TV streaming service, how much they’re willing to spend, and how they feel about the prospect of AI-generated content showing up on their screens.

Key Takeaways:

- The most commonly used streaming platforms among survey respondents are Netflix (60%), Amazon Prime (57%), and Hulu (45%).

- Some 44% of streaming viewers are open to watching AI-generated content.

- The spread of misinformation and the potential loss of human jobs are tied for the biggest concerns about AI-generated media content, at 23% each.

- Subscribers of smaller platforms such as Sling TV, fuboTV, DirecTV Stream, and Philo are the happiest with their platforms’ AI-generated content suggestions.

- Almost 50% of streaming consumers sign up based on content quality or platform-exclusive content.

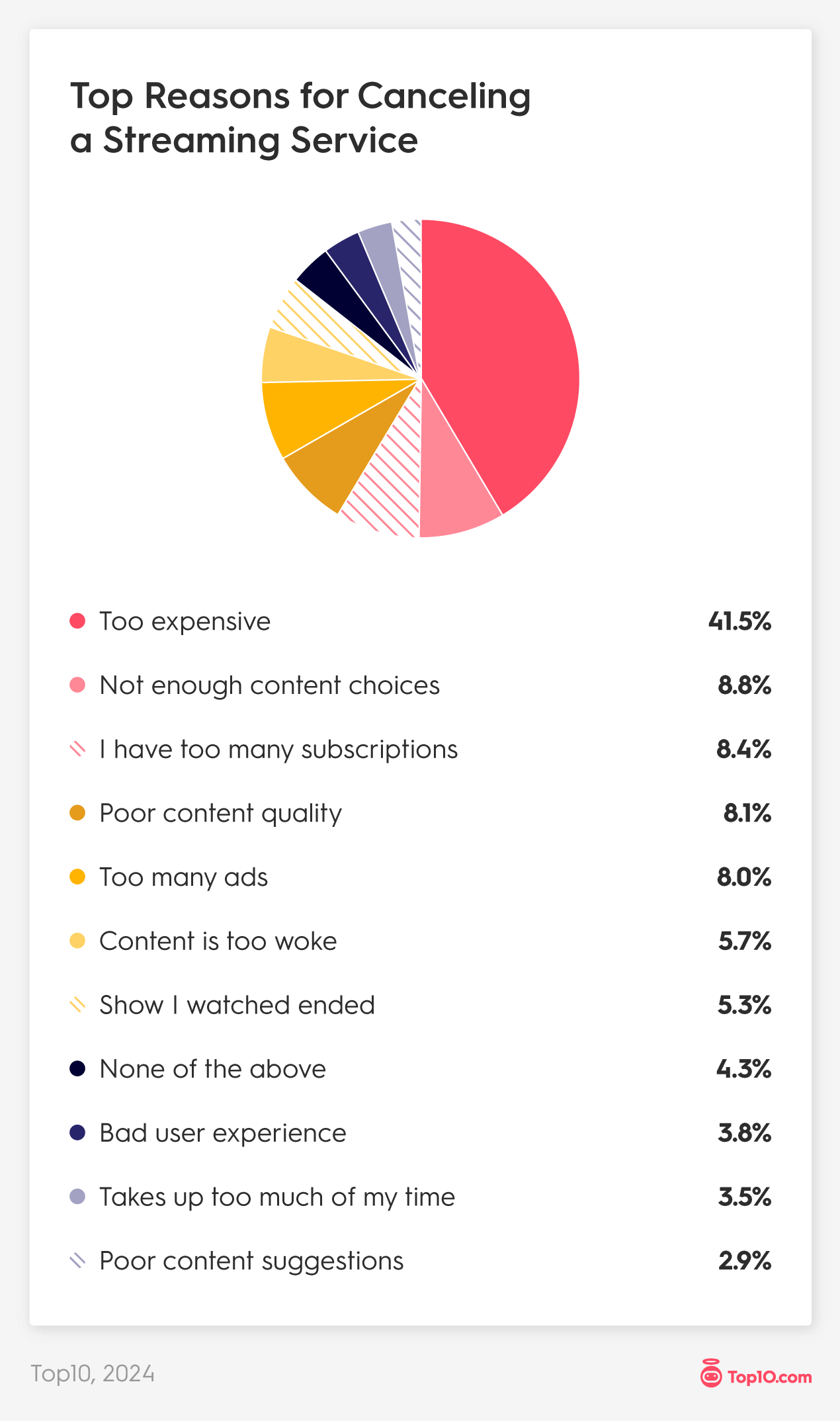

- Two out of five people will cancel their subscription if it feels too expensive.

- High costs (41%) scare off more people than a lack of content choices, poor content quality, “too woke” content, and commercial complaints combined (39%).

- Forty-nine percent of Gen Xers and 48% of Boomers want the option to choose what channels they pay for.

- Eighty percent say they won’t spend more than $50 a month to get new features added.

- Only 27% of Gen Z watch their streaming platforms on a smart TV.

44% Are Willing to Watch AI-Generated Content

While Hollywood screenwriters walked the picket line for 148 days in 2023, they successfully fought for protections against the use of AI in creating scripts for TV, movies, and other streaming content. After months in the headlines, it left the American public wondering about the realities of AI-generated content streaming across our screens.

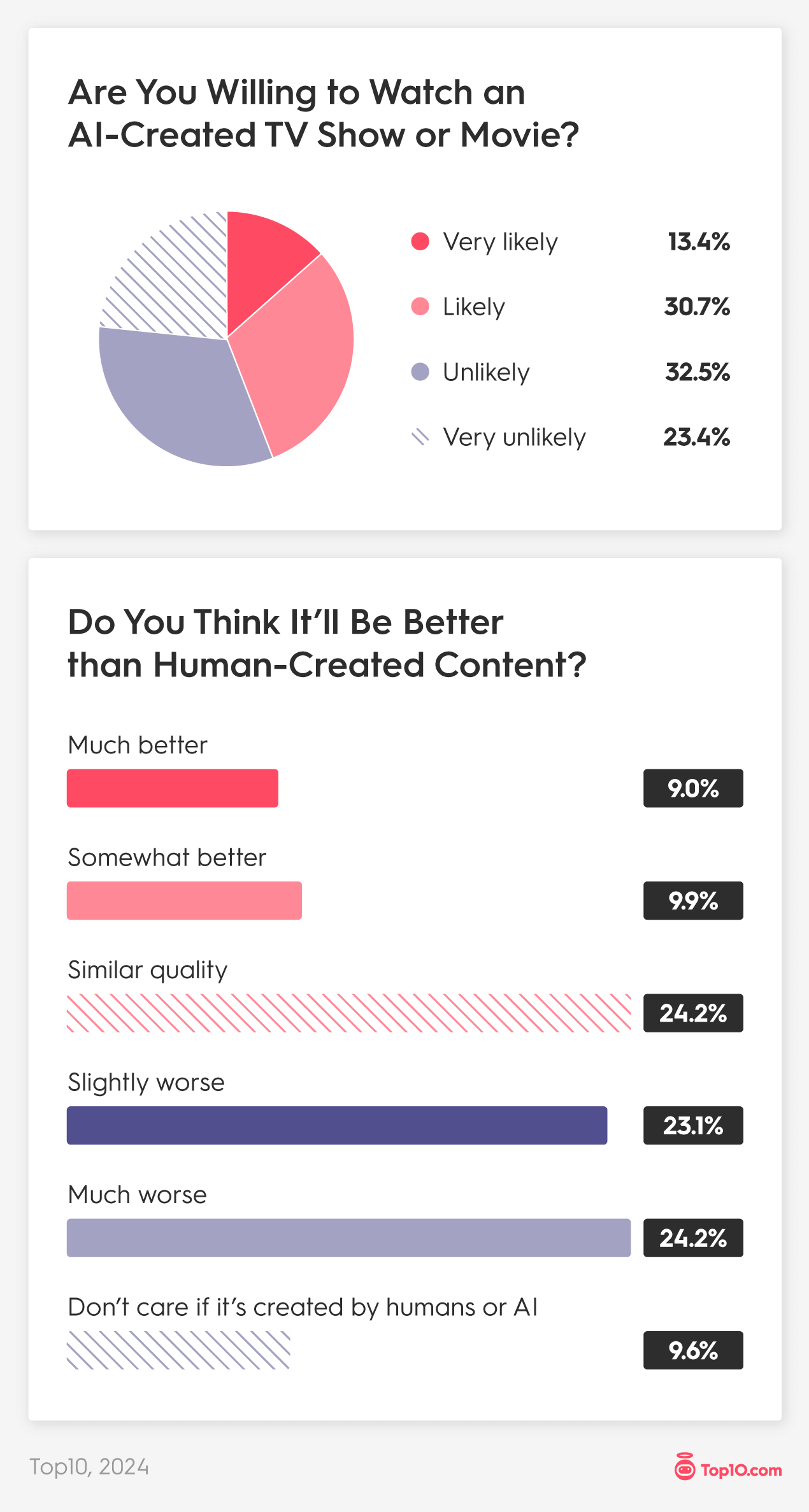

We asked folks how likely they would be to watch a show created by artificial intelligence, and 44% said they were either “very likely” or “likely” to watch, while 56% said they were “unlikely” or “very unlikely” to check it out.

Netflix, Hulu, and Amazon Prime subscribers seem the least interested in giving an AI-generated show or movie a chance. Only 12% of each of them said they were "very likely" to watch.

We also inquired about people’s expectations for the quality level of potential AI-generated content. Most people (47%) feel the resulting shows or movies will be worse than human-created content. Only 19% think it could be better, while 24% believe it will all be of similar quality. And 10% of people said they wouldn’t care if the content was made by humans or AI.

73% Approve of Their Service’s AI-Curated Recommendations

Although some may not realize it, AI has already snuck into our daily streaming lives. Many streaming platforms use an AI algorithm to create a list of suggested programming based on your own interests and streaming behaviors.

We were curious to find out how streaming viewers feel about the AI-generated suggestions they receive. Impressively, we discovered that 73% of people feel satisfied by the personalized programming recommendations their service providers make. Only 8% identified themselves as dissatisfied, and 19% said they were neither satisfied nor dissatisfied.

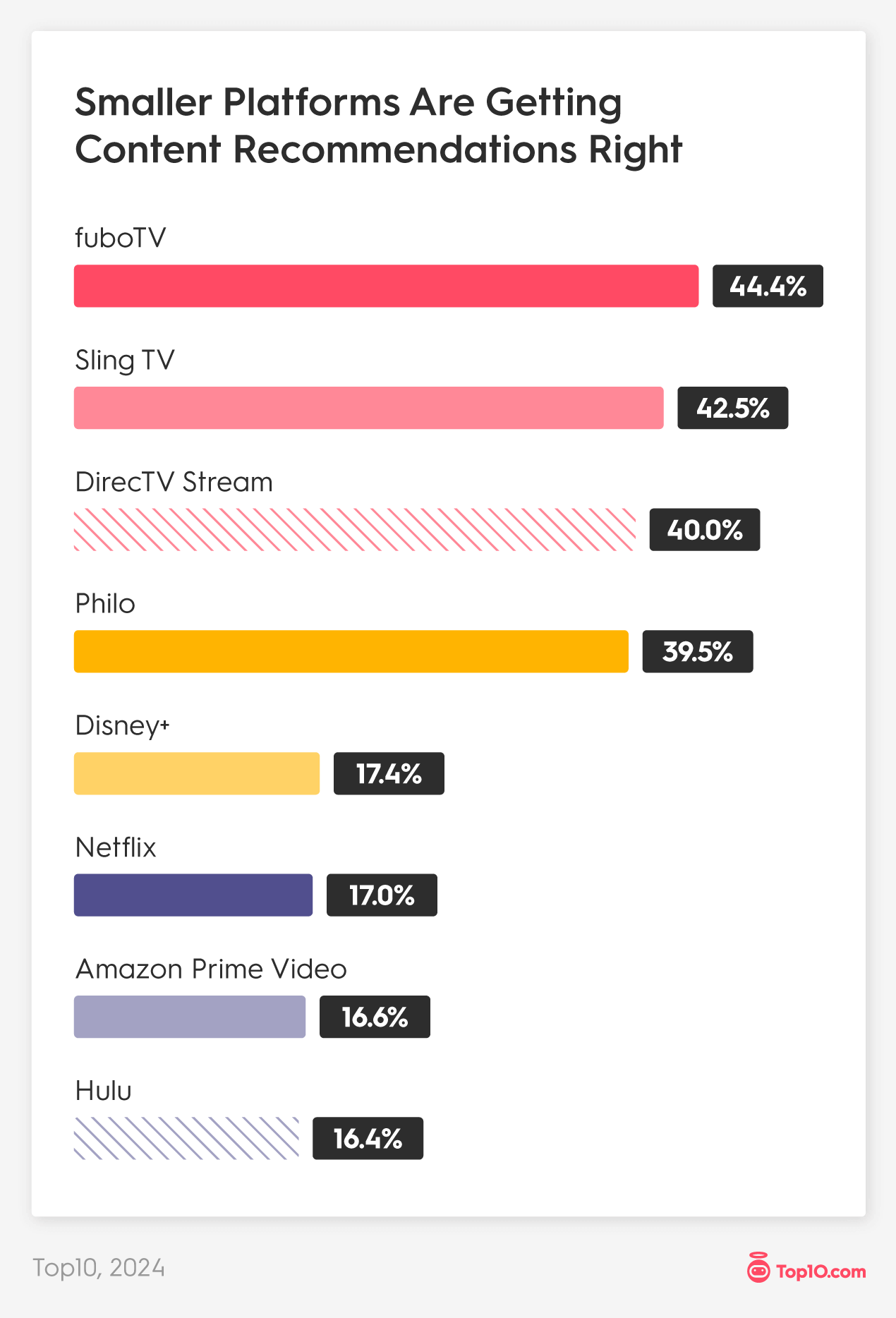

We discovered that smaller streaming platforms stand out with the best content recommendations, according to their subscribers. Sling TV (43%), fuboTV (44%), DirecTV Stream (40%), and Philo (40%) subscribers are the most likely to say they're "very satisfied" with the content suggestions they receive.

In comparison, only 16% of Hulu users are likely to be “very satisfied” with their recommended content. The other industry leaders also struggled to make their subscribers really happy with the suggestions they provide. Netflix, Amazon Prime, and Disney+ customers all tied at 17% for the same metric.

Misinformation and Loss of Human Jobs Are Biggest Concerns for AI-Created Content

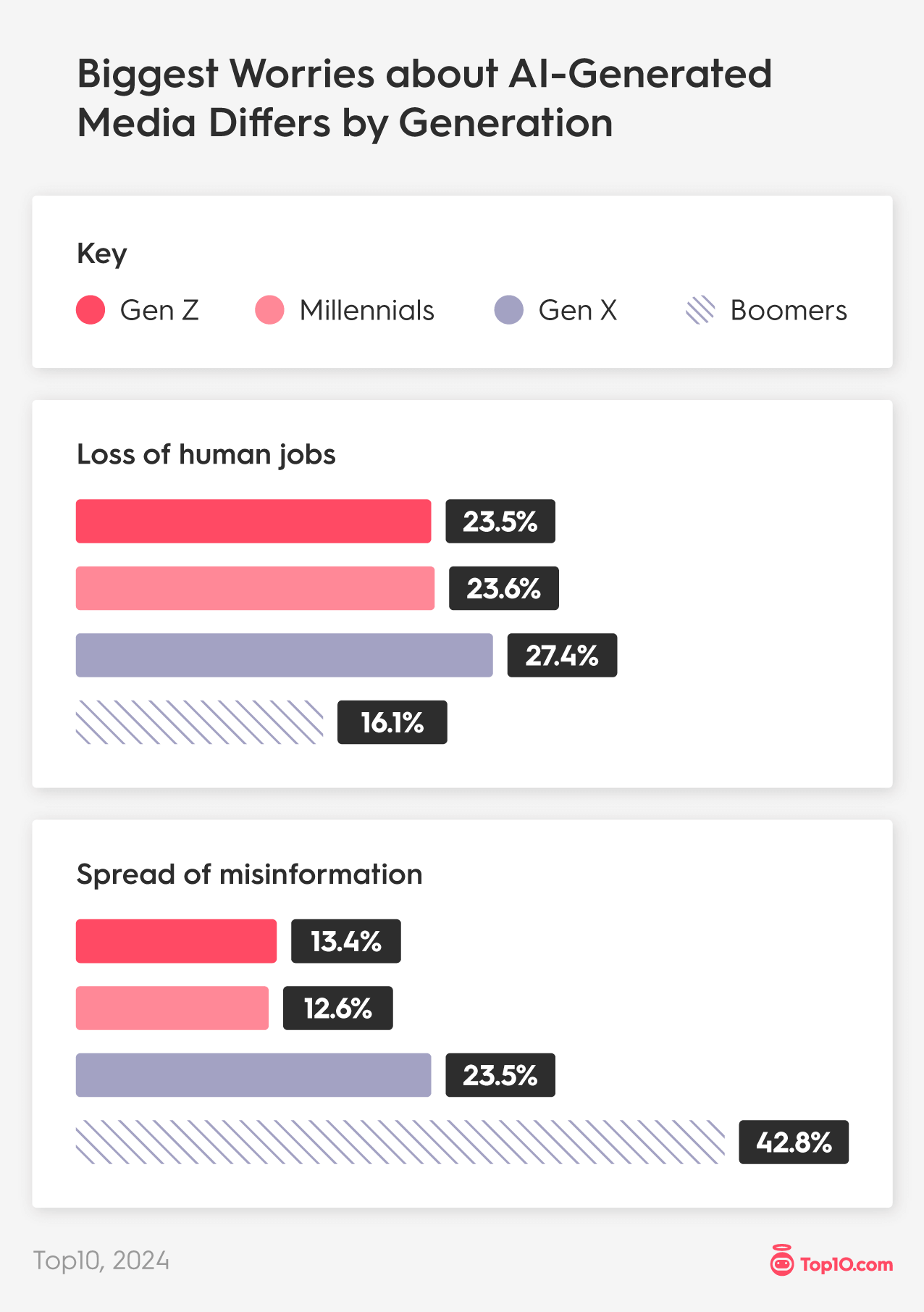

Many concerns remain about artificial intelligence integrating into our daily lives. The biggest concerns survey respondents had about AI-generated content in streaming were the potential for spreading misinformation (23%) and the loss of human jobs (23%).

Gen Z (24%), Millennials (24%), and Gen X (27%) focused most of their worries on the risk of job loss for people in the content creation field. But only 16% of Boomers share that concern.

Boomers are far more concerned about the possible spread of fake news and misinformation, with 43% selecting it as their number one worry. In comparison, 13% of Gen Z, 13% of Millennials, and 24% of Gen X feel the same.

Content Is King: 27% Sign Up for the Platform with the Best Content

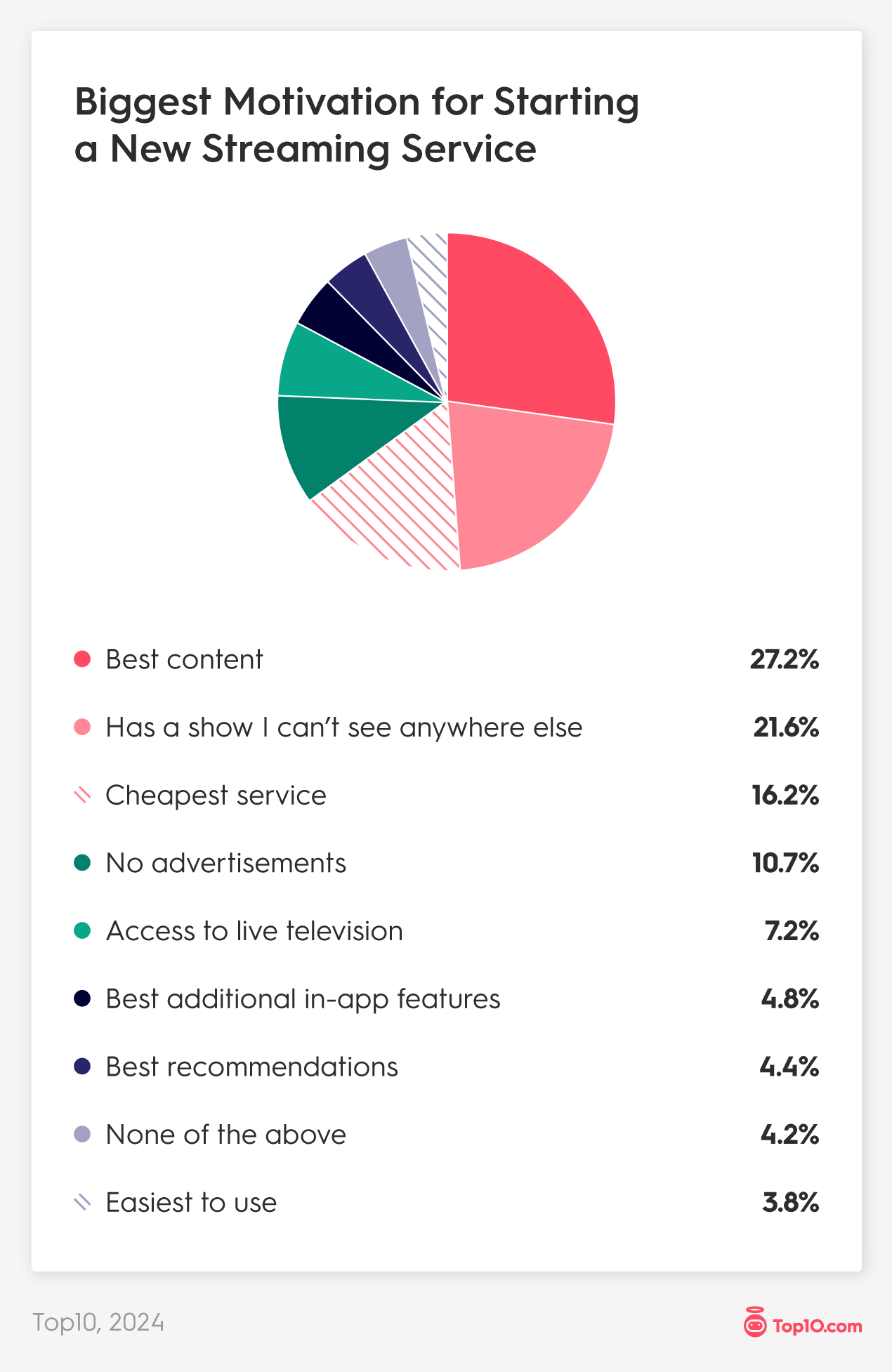

When tasked with choosing the top reason they typically sign up for a new streaming service, content was the biggest motivator. Providing the best content could entice 27% of people to sign up, while 22% said they’d sign up to watch a show, movie, or event that couldn’t be found on any other platform.

We discovered that more people will sign up for those two content-focused reasons than almost all of the other answer options combined, at 49% vs. 47%. Those options included:

- Cheapest service: 16%

- No advertisements: 11%

- Access to live television: 7%

- Best additional in-app features: 5%

- Best recommendations: 4%

- Easiest to use: 4%

41% Will Cancel a Streaming Service Due to High Cost

Forty-one percent of Americans are willing to leave a streaming service if they consider it too expensive. And with 44% reporting that they experienced a streaming subscription price increase within the last year, perhaps providers will reconsider their price hikes or offer more streaming bundles to keep current customers.

In fact, more people will cancel due to cost than a lack of content choices, poor content quality, too woke content, and commercial complaints combined, 41% vs. 39%. Although content is the top reason people sign up for a platform, it’s usually not the primary reason people will cancel their service, with only 8% citing it as their top reason.

Money worries seem to resonate the most with Generation X, according to our findings. 45% of Gen Xers cited the “too expensive” response for canceling a service, while 19% said being the cheapest service would entice them to sign up.

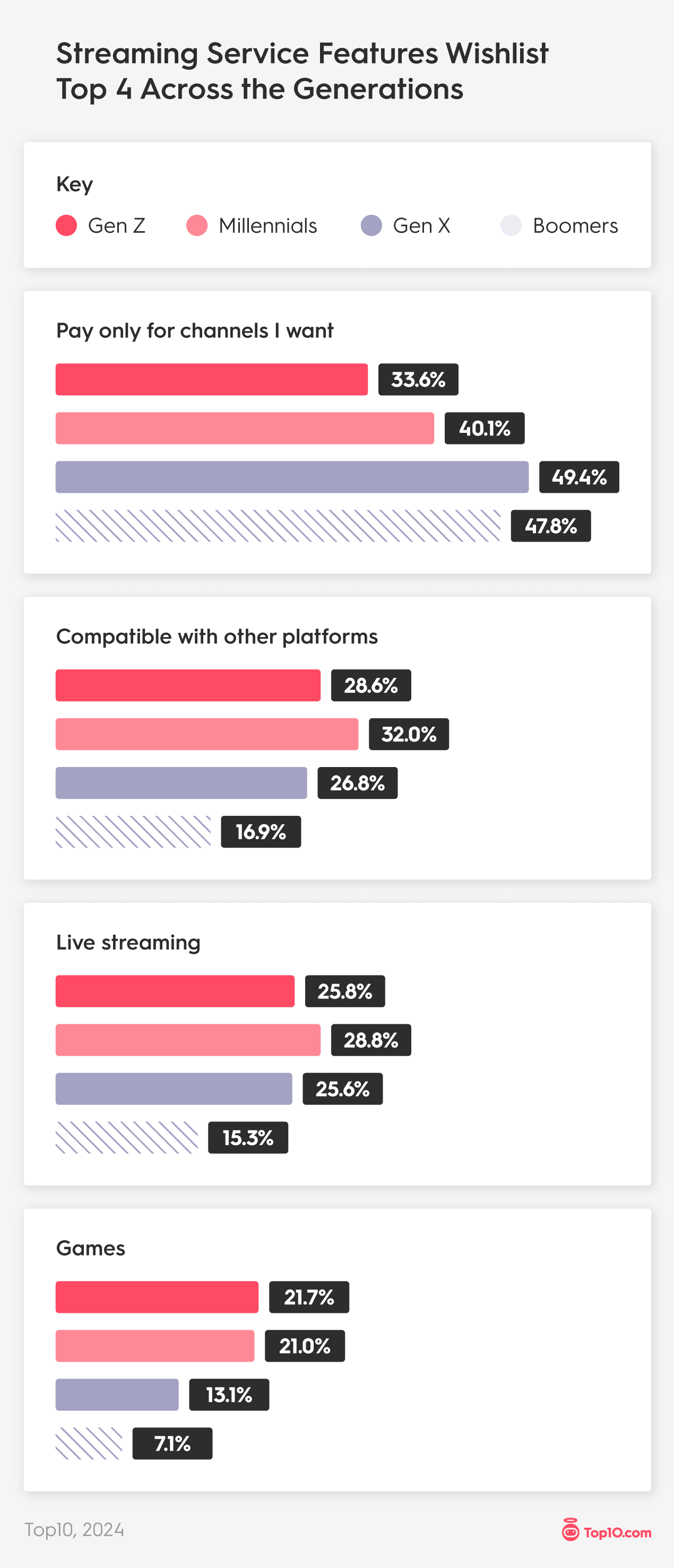

43% of Streaming Viewers Want Control over Their Channel Options

The streaming service feature on most people’s wishlists is the ability to choose the specific channels and/or programming they want to pay for, with 43% of the vote.

We examined the top four answers along generational lines and noticed that Gen Z and Millennials have a few different priorities than Gen X and Baby Boomers. Forty-nine percent of Gen Xers and 48% of Boomers are focused on getting the option to choose what channels they want access to, while only 40% of Millennials and 34% of Gen Z share that focus.

Other top features younger adults want to see added include:

Compatibility with other streaming platforms

- Gen Z: 29%

- Millennials: 32%

- Gen X: 27%

- Boomers: 17%

Live streaming

- Gen Z: 26%

- Millennials: 29%

- Gen X: 26%

- Boomers: 15%

Games

- Gen Z: 22%

- Millennials 21%

- Gen X: 13%

- Boomers: 7%

Having grown up consuming media of all kinds across multiple platforms and devices, it may be no surprise that both Gen Z and Millennials prioritize live streaming, compatibility, and gaming.

ESPN+ subscribers are the most interested in gaining the ability to choose their channels and programming, with 52% of them dreaming of that added feature. Forty percent of Starz users and ESPN+ users want their platforms to be compatible with other streaming platforms.

Starz subscribers are also the most interested in live streaming, with 37% hoping to see it happen. And 32% of viewers of DirectTV Stream and Philo want access to interactive content.

80% Are Not Willing to Spend over $50 a Month on New Features

As we’ve established, cost is a major consideration for all streaming service customers—especially in recent months due to inflation. Survey respondents made that overwhelmingly clear when four out of five noted they wouldn’t be willing to spend more than $50 per month for a streaming service that adds their favorite feature. Sixty-five percent said they wouldn’t even spend more than $25.

We analyzed the data from people who are passionate about which feature they want to see added to their streaming platform and discovered the folks hoping for shopping recommendations or in-app purchases are willing to spend the most to get those options. Fifty-three percent of those respondents would spend over $50 a month for the privilege.

In contrast, the largest group wanting to spend no more than $25 extra each month want control over their channel options. Almost 71% of them said they wouldn’t pay more than the $25 threshold.

Gen Z Relies on Smart TVs the Least for Streaming

While 47% of the general respondents use smart TVs for their streaming needs, only 27% of Gen Z do the same. As generations advance in years, so does their reliance on smart TVs.

- Millennials: 46%

- Gen X: 53%

- Baby Boomers: 55%

But Gen Z takes the lead in using other technologies to satisfy their need for streaming media. They are most likely to use streaming devices such as:

Smartphone

- Gen Z: 22%

- Millennials: 18%

- Gen X: 16%

- Boomers: 6%

Gaming console (such as an Nvidia Shield or PlayStation)

- Gen Z: 15%

- Millennials: 9%

- Gen X: 6%

- Boomers: 2%

Find the Best Streaming Service for You

There are a lot of factors that may influence your own preferences for a streaming services provider. Take some time to consider your specific needs and the cost you’re willing to pay, then check out this list of the best streaming TV services for additional insights and ideas.

Methodology

The survey of over 1,117 adults aged 18+ was conducted via SurveyMonkey Audience for Top10 on Feb. 27, 2024. Data is unweighted and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

Sarah Osman-Mikesell has written about film and pop culture for over a decade. She holds a BA in creative writing and is pursuing her master’s degree in the same field. Aside from her work at Top10.com, Sarah’s writing has been featured in SheKnows, The Huffington Post, Success Magazine, and more.