- Antivirus and WiFi Security VPN protection

- Home title & address monitoring

- Fraud alerts in real time

- Save up to 68% today

- Automatic deed change alerts

- Protect against home title theft

- Special offer: Save 73% on Ultra Protection

- Home title monitoring included in family plan

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Individual & family plans

- Home address change monitoring

- Licensed private investigators & 24/7 support

- Instant alerts for suspicious activity

- $1M identity theft insurance

- 3-bureau credit scores & reports

- Advanced dark web surveillance

- Bank and credit card activity alerts

- 3-bureau credit monitoring

- Monitors personal info on over 10K websites

- Home title monitoring protection

- 60-day money-back guarantee

- Tracks 3 credit monitoring bureaus

- SSN protection takeover alerts

- 100% satisfaction guarantee

- SSN tracking with instant alerts

- Fraud monitoring service included

- Detects suspicious & unwanted bank activities

- Antivirus and WiFi Security VPN protection

- Home title & address monitoring

- Fraud alerts in real time

- Save up to 68% today

What Is Home Title Fraud?

Home title fraud, also known as home title theft, involves the fraudulent transfer of a property deed into someone else’s name. This is usually connected to cases of identity theft, where the fraudster poses as the owner of your property to undertake some sort of financial transaction.

Now, home title fraud isn’t always as simple as just transferring a property deed into another person’s name. For example, the person stealing your deed may refinance your mortgage or perform some other action that enables them to steal a large amount of cash. And if you don’t realize it, you may face foreclosure. In some cases, the thief will even attempt to sell the property and walk away with the cash.

How Does Home Title Fraud Happen?

In simple terms, home title fraud happens when a thief somehow transfers a property title into their own or a colleague’s name. This is usually connected to identity theft, where the fraudster poses as the entity who owns a property and is therefore able to transfer the property deed with few problems. This tends to involve the following.

Identity theft

The initial identity theft may be complex and involve the fraudster assuming control of your entire identity. Or it can be as simple as them learning how to forge your signature so that they can complete the relevant legal documents for the transfer of a property deed.

Property ownership transfer

Next, the thief will use a fake bill of sale and a forged signature to transfer ownership of your property to themselves (or a contact of theirs). This is surprisingly simple, and the chances are that you won’t even realize it has happened.

Monetary theft

Once they have assumed ownership of your property, the thief can do a few things. For one, they might attempt to sell your property and disappear with the funds. Or they might take out home equity loans and, once again, run off with the funds. This is surprisingly simple, and home title fraud is becoming increasingly common as a result.

Who is at Risk for Home Title Fraud?

Generally, the criminals committing home title fraud target the most vulnerable people they can find. And unfortunately, this tends to be the elderly, those with multiple properties, and those with mental or physical disabilities who live somewhat isolated lives.

There are a few reasons for this. For one, they tend to be isolated and lonely, which makes them more trusting and more willing to welcome strangers into their lives. In the case of the elderly, they often own multiple properties, are mortgage-free, and sometimes own investment properties that sit vacant and often unattended.

How To Protect Yourself Against Home Title Fraud?

There are a few simple ways to lower your risk of having home title fraud committed against you. Start by keeping a close eye on your bills. If you ever notice someone else’s name on your bills or other mail related to your property, you should treat this as a major red flag. Similarly, if you notice that utility bills aren’t arriving as they should, there could be something wrong.

You can keep an eye on your credit score as well. Credit monitoring is available through various companies that will notify you if there are issues such as overdue bills or unpaid mortgage fees impacting your credit score.

If you have empty vacation or investment properties, check on them from time to time. Unfortunately, it can take months for you to notice that something is wrong if you aren’t regularly checking in. Home title monitoring services can also help, as they will notify you of any changes that require your attention.

What does a home title monitoring service do?

Home title monitoring services are designed to keep you informed about the status of your property title. In short, they will alert you immediately if there are any changes to your title or other activity that might indicate fraudulent activity. In some cases, home title monitoring services will provide assistance if problems do arise.

FAQ

Can a home title monitoring service prevent home title fraud?

No, home title monitoring services don’t usually prevent home title fraud on their own. However, they are designed to notify you of any suspicious activity surrounding your home title, enabling you to take action if fraud does occur. In some cases, your home title monitoring service will provide assistance in resolving issues if fraud or signs of fraud are noticed.

How common is home title fraud?

Hard numbers are difficult to find, but the truth is that home title fraud is extremely uncommon. A 2017 study by the FBI estimated that there are 9,600 cases of home title fraud per year. If we take into account all of the properties owned in the US, this equates to approximately 0.0001% of homes. As you should be able to tell, this is a negligible number.

Our Top 3 Picks

- 1

Exceptional9.8

Exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

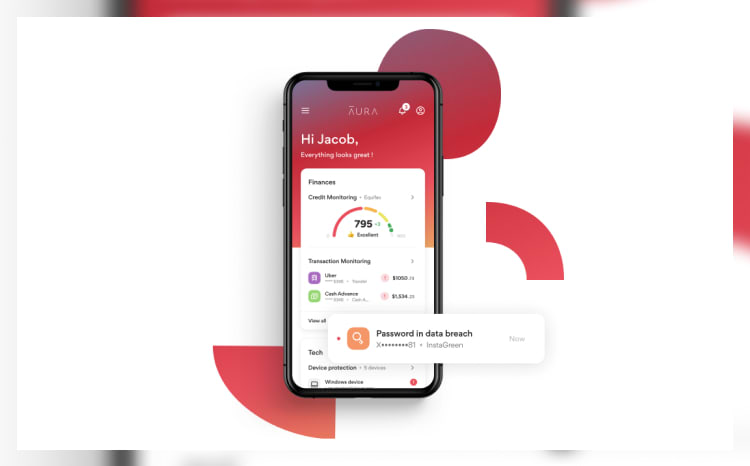

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

Excellent9.0

Excellent9.0 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

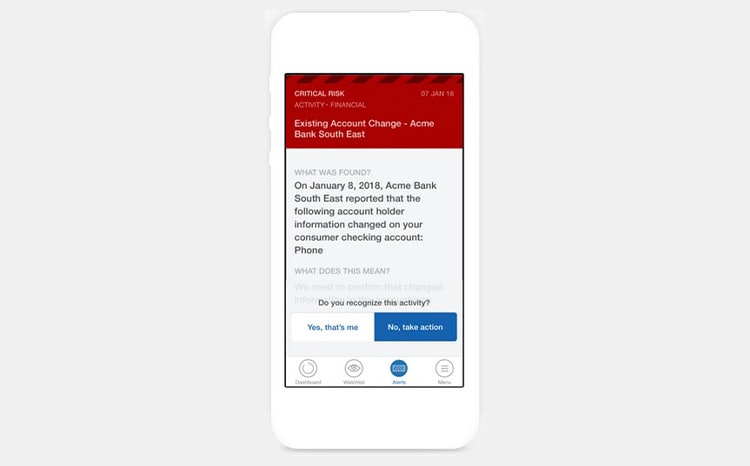

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans - 3

Excellent9.2

Excellent9.2 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

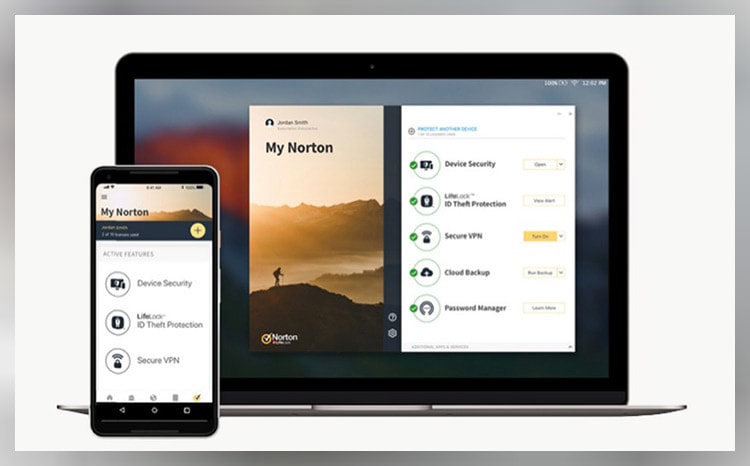

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing