EverSafe Pros & Cons

Pros

Cons

EverSafe at a Glance

Additional Protection

Monitoring

Theft Insurance

Customer Support

Scalable Plans

Overview

EverSafe at a Glance

What is EverSafe?

EverSafe is a specialized identity theft protection service catering mainly to seniors and families. It's designed to safeguard personal information by monitoring financial transactions, credit reports, and the dark web. The service detects potential fraud and irregular activities, such as unusual withdrawals or changes in spending patterns, by analyzing historical financial behavior.

EverSafe has unique features, like the option to add a trusted advocate who will receive alerts, making it particularly beneficial for seniors who may require assistance managing their accounts. It addresses a critical pain point: the financial exploitation of vulnerable populations, providing peace of mind to both seniors and their families.

EverSafe features

EverSafe's protection extends across various fronts, with features such as:

- Dark web surveillance

- Credit report analysis

- Real-time fraud alerts

The service focuses on real-time alerts and a robust monitoring system from credit cards to investment accounts.

You can also choose a "trusted advocate" at EverSafe to help you keep an eye on your money. This could be a family member, a professional, or someone else you trust. They will get alerts if there's any unusual activity with your finances, like unexpected changes in spending or new accounts opened without your permission.

Their job is to act as an extra set of eyes, watching out for any signs of fraud or financial misuse, particularly to protect you from scams, especially if you're older. However, I feel that the effectiveness of EverSafe is undercut somewhat by the absence of medical ID monitoring, which could leave some areas of a user’s identity vulnerable.

Is EverSafe Safe and Reliable?

Security measures

EverSafe employs robust security measures to ensure your information is safeguarded. It uses 256-bit encryption to secure data during transmission and storage, providing a level of security that is on par with financial institutions. No full account numbers are received or displayed, which minimizes risk.

Privacy policies

EverSafe collects necessary personal and financial information but assures users that no funds can be transferred through its system and that full account numbers are not stored.

Reputation

EverSafe's reputation, particularly among families and seniors, is strong. It's been acknowledged for its unique approach to identity protection, focusing on the needs of its target demographic. Reviews from users highlight the peace of mind provided by its trusted advocate feature and its efficient alert system. It’s been accredited by the Better Business Bureau since 2013 and maintains an A+ rating.

Recovery services

Should your identity be compromised, EverSafe steps up with a range of recovery services:

- ID theft insurance: Offers up to $1 million in coverage for expenses associated with identity restoration.

- Restoration support: Provides fraud remediation support with designated specialists to guide you through recovery.

- Customer support: Available 24/7 to assist with urgent recovery needs.

- Alert sharing: You can assign designated trusted individuals to help you monitor and act if needed.

Education and prevention

EverSafe also offers educational content aimed at preventing identity theft. This includes monthly newsletters focused on financial health and scam awareness, providing you with valuable knowledge to safeguard your information.

How EverSafe Works

EverSafe is not a downloadable software but a service that monitors your personal and financial accounts for any signs of irregular activity. It functions by creating a personal profile based on your financial history and then uses daily transaction analysis to detect anomalies. Alerts are promptly sent if unusual activities are detected, allowing for quick action against potential fraud or identity theft.

How to Get Started With EverSafe

To begin with EverSafe, you navigate to its website and select the "start your free trial" option. Sign-up is easy; you answer questions about your protection needs, choose a plan, and provide personal details like your social security number.

Once your identity is verified, you'll enter payment details to activate your account. You'll then access the dashboard to add bank accounts using your online banking credentials, but not the account numbers themselves, ensuring security. The user-friendly setup allows you to quickly benefit from comprehensive monitoring and alerts for your financial safety.

EverSafe Customer Service

EverSafe's customer service can be reached through phone or email. Both are a 24/7 service. In my testing, on average, I received responses from EverSafe’s customer service via email within 1-3 hours.

The main website has a blog and FAQs for additional information, although I think integrating these resources directly into the user dashboard would enhance the experience.

How to Cancel or Pause an EverSafe Subscription

Canceling your EverSafe subscription is straightforward: you do so by emailing or phoning the company. Verification of your identity will be required for security purposes. The company is clear about its no-strings-attached cancellation policy, allowing you to step away from the service if it no longer meets your needs.

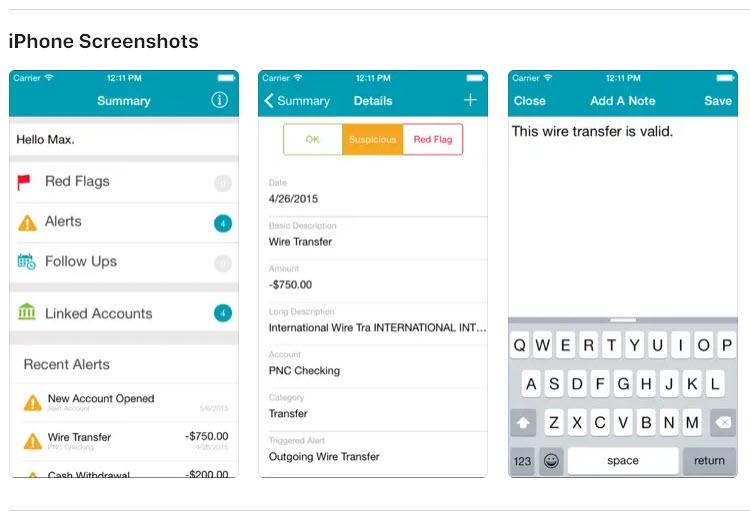

Is There an EverSafe App?

EverSafe offers an app for iOS and Android devices as a convenient extension of its service. Through the app, you can receive alerts on suspicious activities and irregularities detected in your financial accounts.

It's designed to be intuitive, mirroring the simple look and feel of the EverSafe website. I feel the app's effectiveness in delivering timely alerts and its user-friendly interface contribute positively to my overall experience with EverSafe.

EverSafe Pricing

How Much Does EverSafe Cost?

EverSafe delivers identity theft protection through a tiered pricing model, catering especially to families and seniors. It has three main plans: Essentials, Plus, and Gold.

The Essentials plan, starting at $7.49 monthly, focuses on basic financial monitoring services. For more comprehensive coverage, including identity theft insurance and credit monitoring, the Plus plan is priced at $14.99 monthly. At $24.99 monthly, the Gold plan expands services to three-bureau credit monitoring and reports, among other features.

The 20% senior discount is a notable perk, making EverSafe a cost-effective option for older users. Annual payment options afford a 15% saving, reducing the monthly cost further. And, at the final stage of the signup process, you can enroll family members at a 30% discount.

| Essentials | Plus | Gold | |

|---|---|---|---|

Cost Per Month | $7.49 | $14.99 | $24.99 |

Credit and Debit Card Monitoring | ✓ | ✓ | ✓ |

Bank Account Monitoring | ✓ | ✓ | ✓ |

Dark Web Scan | ✓ | ✓ | ✓ |

Single Bureau Credit Monitoring | ✕ | ✓ | ✓ |

Three Bureau Credit Monitoring | ✕ | ✕ | ✓ |

Identity Theft Insurance | ✕ | ✓ | ✓ |

Considering the industry standards, EverSafe's rates are competitive, especially for users prioritizing family and senior-focused services. The Essentials plan could appeal to those seeking a basic credit card and bank account monitoring service. In contrast, higher tiers offer enhanced protection suitable for those with more complex financial profiles looking for greater peace of mind.

What can you do with EverSafe for free?

During the 30-day free trial, EverSafe allows you to experience its identity monitoring service without a financial commitment. You can set up your profile, link your bank accounts, and begin receiving alerts on suspicious activities.

The trial offers a glimpse into EverSafe's capabilities, including credit and debit card monitoring, bank account surveillance, and even a dark web scan. It's a valuable period to assess the service's effectiveness before deciding to subscribe.

Optional add-ons

EverSafe has one optional add-on to its highest-tier Gold plan—real estate monitoring. At $4.99 per month per property, this service tracks any changes in the title and liens of your properties.

The real estate monitoring service by EverSafe offers a vigilant eye over your property records, providing alerts for any unauthorized or unusual changes that could indicate potential fraud. It looks for modifications in property titles or liens, which can be early warning signs of identity theft, allowing for prompt action to secure your real estate assets.

EverSafe Alternatives

How Does EverSafe Compare to Other Identity Theft Services?

| EverSafe | Aura | LifeLock | Identity Guard | |

|---|---|---|---|---|

Price | $7.49 - $24.99 per month | $12.00 - $32.00 per month | $9.99 per month | $7.20 per month |

Free trial | 30 days | 14 days | 30 days | No |

3-bureau credit monitoring | Yes | Yes | Yes | Yes |

Family package | Yes | Yes | Yes | Yes |

Insurance coverage | $1 million | $1 million | $1 million | $1 million |

Mobile app | iOS and Android | iOS and Android | iOS and Android | iOS and Android |

EverSafe vs Aura

EverSafe focuses on ID theft protection for families and seniors, offering family discounts, an easy-to-use interface, and competitive pricing. Aura, while slightly pricier, presents similar services but offers additional features that cater to a broader audience, such as social media monitoring, malware protection, and virtual private server (VPN) services for online privacy. Choosing between the two may come down to whether you need these additional services.

EverSafe vs LifeLock

Where EverSafe is mostly an ID monitoring service, LifeLock adds wider-ranging identity theft protection services like Norton 360 antivirus software and a VPN for devices. While more complex to set up at first and more expensive, LifeLock does offer a more comprehensive set of tools that help avoid ID theft.

EverSafe vs Identity Guard

While EverSafe excels with easy-to-use features for seniors, Identity Guard blends artificial intelligence with traditional protection, catering to a tech-savvy demographic seeking comprehensive security. Identity Guard provides a risk management score to assess the likelihood of personal information being stolen and uses a Safe Browsing tool to add a layer of proactive defense. It combines these tools with a dedicated case manager, offering a well-rounded protection package.

Bottom Line (Is EverSafe Worth It?)

EverSafe stands out with its easy-to-use ID theft monitoring service tailored towards older adults. It excels in financial health monitoring, offering peace of mind for those concerned about subtle signs of fraud. While it may not have the extensive cybersecurity tools of Aura or the branded antivirus of LifeLock, the ability to quickly set up financial transaction and credit monitoring alerts provides a robust yet uncomplicated defense against identity theft.

Top10.com's editorial staff is a professional team of editors and writers with dozens of years of experience covering consumer, financial and business products and services.