Best Identity Theft Protection Services 2026

Select a top-rated identity theft protection service & know you're protected no matter what.

- Compare

- Sign Up

- Secure Your Identity

Top10.com is designed to help users make confident decisions online, this website contains information about a wide range of products and services. Certain details, including but not limited to prices and special offers, are provided to us directly from our partners and are dynamic and subject to change at any time without prior notice. Though based on meticulous research, the information we share does not constitute legal or professional advice or forecast, and should not be treated as such.

Identity theft protection is a collection of digital tools designed to safeguard your personal, financial, and online data. These services monitor sensitive information such as your Social Security number, credit score, bank accounts, and online activity for suspicious behavior. When something looks wrong, you receive instant alerts by text, email, or app so you can act quickly.

Most plans include insurance covering legal costs, stolen funds, and recovery expenses, plus cybersecurity tools like VPNs, antivirus software, and password managers to strengthen your defense against online threats.

Quick Answer:Identity theft protection is a service that monitors your personal data, credit reports, and the dark web 24/7 for fraud. It provides instant alerts for misuse and includes up to $1 million in insurance and expert recovery assistance to restore your identity if a breach occurs.

This short video explains how identity theft protection works and compares top services like Aura, LifeLock, and Identity Guard to help you choose the right plan.

Identity theft is growing rapidly and affects millions of people each year, making active protection more important than ever.

Identity theft protection services monitor your personal, financial, and online data across credit bureaus, the dark web, and bank accounts to detect suspicious activity early.

Real-time alerts allow you to act quickly by freezing credit, securing accounts, or contacting your bank before fraud escalates.

Professional recovery assistance and insurance coverage help you restore your identity and recover losses if theft occurs.

Built-in cybersecurity tools such as VPNs, antivirus software, and password managers add strong protection against online threats.

Practicing good digital habits like using strong passwords, enabling two-factor authentication, and monitoring your credit remains one of the most effective ways to prevent identity theft.

Identity theft can happen both online and offline. Criminals use various methods to steal your personal information and exploit it for financial gain.The FBI’s 2024 Internet Crime Report foundthat phishing, spoofing, and data breaches caused more than $16 billion in losses, a 33 percent increase from 2023.

1. Data Breaches

Hackers break into company databases containing personal details such as names, addresses, and Social Security numbers. This information is often sold on the dark web or used to open new accounts in your name.

2. Phishing and Spoofing

Phishing scams use fake emails, texts, or calls that appear to come from trusted sources like your bank, government agencies, or a retailer. These messages often ask you to verify your login or payment details, making phishingone of the FTC’s most reported scams.

Spoofing takes it further by disguising a phone number, text message, or email address to look legitimate. Once you click a link or share information, criminals can instantly steal your personal and financial data.

3. Hacked Accounts

Using the same password across accounts makes you vulnerable. Once hackers access one account, they can reach others. Use a password manager and enable two-factor authentication on important accounts.

4. Unsecured Devices and Public Wi-Fi

Public Wi-Fi networks are vulnerable to data interception. Criminals can install spyware or steal login credentials to access sensitive information. Always use a VPN when connecting to public networks.

5. Physical Theft and Paper Records

Offline theft still happens. Thieves can find personal details in discarded mail, receipts, or bills. Shred or destroy documents before throwing them away.

6. Social Engineering

Scammers manipulate victims into sharing information by pretending to be trusted contacts or officials. Be cautious with personal details shared online or over the phone.

Identity theft can lead to fake loans, tax fraud, and financial loss. Combining good daily security practices with an identity theft protection service helps you catch problems early.

Sources:

Identity theft protection services combine monitoring, alerts, recovery assistance, and cybersecurity tools to help detect and stop suspicious activity before serious damage occurs.

Monitors Your Information:Your service scans credit reports from Experian, Equifax, and TransUnion, as well as public records, bank transactions, and the dark web for signs of misuse. You might receive an alert if your Social Security number appears in a payday loan application or your email is found in a data breach.

Instant Alerts:If unusual activity occurs, you get real-time notifications detailing what was found and where. Quick alerts help you freeze credit, change passwords, or contact your bank before damage spreads.

Fully Managed Identity Restoration: If theft occurs, the service assigns a Dedicated, White-Glove Restoration Specialist. This expert handles the entire complex recovery process for you, including filing FTC reports, contacting creditors, and managing legal disputes. This fully managed service guarantees restoration and uses the policy's insurance to cover eligible legal fees and lost funds.

Protects Credit and Financial Accounts:Comprehensive services include three-bureau credit monitoring, credit locks, lost-wallet assistance, and bank transaction alerts for unusual payments or withdrawals.

Digital Security Tools:Many plans offer VPNs to encrypt online activity, antivirus software to block malware, password managers to create strong logins, and social media monitoring to detect impersonation or data leaks.

Family Protection:Family plans include child Social Security number monitoring, fraud alerts for minors, and parental dashboards for managing household accounts.

Reports and Dashboards:Providers often include dashboards showing identity health, alerts, and progress. Monthly or quarterly summaries highlight changes in credit, dark web findings, and overall risk.

| Feature Category | Example Features | Benefit |

|---|---|---|

Monitor & Detect | Three-bureau credit monitoring, Dark web scans, Investment/401(k) account monitoring, Home Title monitoring, Sex offender registry alerts | Early fraud detection, Comprehensive financial and property protection |

Alert | Email, text, or app notifications | Real-time awareness |

Restore | Recovery experts, legal help, insurance | Fast recovery |

Cybersecurity | VPN, antivirus, password manager | Prevents future attacks |

Extra Coverage | SSN tracking, lost-wallet help, investment alerts | Full protection |

Even with identity theft protection, prevention starts with smart habits. Cybercriminals constantly find new ways to exploit personal data, but these practices can keep you safe.

1. Use Strong, Unique Passwords

Create a unique password for each account with at least 12 characters, combining letters, numbers, and symbols. Store them in a password manager for security.

2. Turn On Two-Factor or Biometric Authentication

Enable two-factor authentication or use biometric login to add an extra layer of protection.

3. Be Cautious with Emails, Texts, and Links

Phishing is a top cause of identity theft. Always verify senders, hover over links to preview URLs, and avoid clicking anything suspicious. Legitimate companies never ask for passwords or personal data by email or text.

4. Only Enter Data on Secure Websites

Ensure sites start with “https://” and display a padlock symbol before entering sensitive information. Check for misspelled or fake domains.

5. Avoid Public Wi-Fi for Sensitive Tasks

Avoid accessing bank accounts or entering personal information on public Wi-Fi. If necessary, use a VPN for encryption.

6. Monitor Your Credit Reports

Check free credit reports at AnnualCreditReport.com and review a different credit bureau report every four months to monitor for fraud. Look for unfamiliar accounts or inquiries and dispute them immediately.

7. Protect Personal Information Offline

Shred mail and bills, and keep checkbooks, sensitive documents with personal identifiable information (PII), or IDs in safe locations.

8. Limit What You Share on Social Media

Avoid posting your full address, birthday, or family details that criminals can use to answer security questions.

9. Freeze Your Credit

Freezing your credit prevents new accounts from being opened in your name. Contact all three credit bureaus (TransUnion, Equifax, and Experian) to set it up.

Specialized Prevention Tips

For Families/Children:Ensure protection includeschild SSN monitoring. Limit what minors share online and use parental controls.

Watch for these warning signs:

Unrecognized charges or withdrawals

Missing mail or unexpected address changes

New credit inquiries or loan applications you didn't authorize

Calls from debt collectors about unknown accounts

Alerts from your identity theft protection service

IRS notification that your tax return was already filed

Healthcare provider notification of maximum benefits reached without filing claims

Unusual account activity: notification of password change/re-set, login alerts and security notification alerts that were not initiated by user

Sudden and significant change in credit score

If you suspect your identity has been stolen, take immediate action.

1. Report to the FTC

Visitidentitytheft.govto file an official report. The FTC will create a recovery plan and provide documentation for banks and credit bureaus.

2. Notify Financial Institutions

Contact banks, credit card issuers, and lenders to freeze or close compromised accounts. Update your passwords and request replacements.

3. Alert Credit Bureaus

Reach out to Experian, Equifax, and TransUnion to place a fraud alert or freeze on your credit. Some identity theft protection services can do this automatically.

4. File a Police Report

If you have evidence such as stolen mail or unauthorized accounts, file a report with local law enforcement. Bring your FTC documentation. This helps with disputes and insurance claims.

5. Keep Detailed Records

Document all communications with banks, credit bureaus, and law enforcement. Make sure to write down names, dates and contact information of those you communicate with. Keep copies of every report, letter, and reference number.

6. Continue Monitoring

Identity thieves may strike again using the same data. Keep up with credit monitoring and dark web scans through your protection service.

1. Financial Identity Theft: Criminals use your financial data to open credit cards, loans, or accounts. Contact your bank immediately and freeze your credit if this happens.

2. Medical Identity Theft: Someone uses your insurance for medical services or false claims. Check statements for unknown charges and request record copies. You can correct inaccurate information under HIPAA.

3. Tax Identity Theft: Criminals file fake tax returns using your Social Security number. Contact the IRS Identity Protection Unit (https://www.irs.gov/identity-theft-central) and complete Form 14039. Request an Identity Protection PIN to secure future filings.

4. Online Identity Theft (AKA: Account Takeover): Hackers take over digital accounts to steal information or impersonate you. Use strong passwords, enable two-factor authentication or biometric authentication, and install antivirus software.

5. Criminal Identity Theft: Someone uses your identity during an arrest. File a police report and request proof of your true identity from law enforcement.

6. Synthetic Identity Theft: Criminals combine real and fake information (usually from data breaches) to create new"synthetic"identities. Comprehensive monitoring services that scan credit and dark web activity are best for detecting this form of theft.

7. Child identity Theft:Someone uses a child's personal information to open new bank accounts, credit cards or loans. Financial activity starts to appear on someone who is too young to have credit. Often this type of identity theft is not detected for years.

Identity theft is one of the fastest-growing crimes in the United States,occurring every 4.9 seconds. It affects millions of people each year and can lead to serious financial and emotional consequences.

TheFederal Trade Commission (FTC) reported over 1.1 million cases in 2024, with most involving credit card fraud and loan scams. As more people turn to online banking, digital shopping, and remote work, cybercriminals have more opportunities to exploit personal information.

Protecting yourself requires awareness and proactive measures. Continuous monitoring, fraud alerts, and strong security practices—like using unique passwords and enabling multi-factor authentication—can make a significant difference. Knowledge and preparation remain some of the best defenses against becoming a victim of identity theft.

Cybercriminals are more sophisticated than ever, and identity theft is on the rise. With millions of cases each year, identity theft protection has become a critical part of modern cybersecurity for individuals and families.

Identity theft protection is valuable for anyone whose information is stored or used online. It provides ongoing monitoring, quick alerts, and professional recovery support. Consider it if you shop or bank online, manage sensitive data, care for dependents, or have a high financial profile.

With dark web monitoring and expert recovery assistance, it acts as both a prevention tool and a safety net if theft occurs.

Organized fraudsters create fake identities to commit financial fraud. That is their day-in and day-out job. It is important to protect yourself by safeguarding your personal data and using identity theft protection tools for monitoring your accounts and data for early alerts and intervention.

When comparing services, look for one that combines monitoring, alerts, recovery, and cybersecurity into a single, easy-to-manage plan. A well-rounded protection service helps you detect, prevent, and recover from identity theft effectively.

Comprehensive Monitoring:Look for a service that goes beyond credit reports to monitor your bank accounts, public records, the dark web, and social media for suspicious activity. Broader coverage helps detect threats wherever your data may surface.

Real-Time Alerts:Quick action can prevent major damage. Choose a provider that sends instant notifications by text, email, or app when unusual activity is detected.

Recovery Assistance:If your identity is stolen, professional help is crucial. The best services include dedicated recovery experts who guide you through disputes, help restore your identity, and recover stolen funds.

Identity Theft Insurance:Strong plans include at least $1 million in insurance to cover legal fees, lost wages, and recovery expenses. This financial safety net can help minimize the lasting impact of fraud.

Cybersecurity Tools:Added features like VPNs, antivirus software, and password managers strengthen your online defenses and reduce the risk of data breaches.

| Service Name | Insurance Max (Per Adult/Policy) | Credit Monitoring | Key Differentiator |

|---|---|---|---|

| Aura | Up to $5 Million (Family Policy) / $1M per adult | 3-Bureau (All Plans) | Highest family insurance maximum and fastest alerts. |

| LifeLock (by Norton) | Up to $3 Million (Ultimate Plus Plan) / $1M per adult | 1-Bureau (Basic) / 3-Bureau(Premium) | Largest feature set, including Home Title & 401k monitoring on top tiers. |

| Identity Guard | Up to $1 Million | None (Value) / 3-Bureau(Ultra Plan only) | Predictive AI monitoring and highly affordable entry-level plans. |

| OmniWatch | Up to $2 Million ($1M per adult) | 1-Bureau (Basic) / 3-Bureau(Elite Plan) | Includes $25,000 in Scam Insurance and $25,000 in Ransomware coverage. |

| Zander Identity Theft | Up to $2 Million ($1M per member) | None (Optional Credit Monitoring Add-on) | Lowest cost for the highest guaranteed recovery assistance. |

| Mozo | Up to $1 Million | Not explicitly advertised as 3-Bureau/Focus is on SSN/Dark Web | Unique AI Scam Scanner (SMS/Web/Email) and included VPN/Antivirus. |

| NordProtect | Up to $1 Million | 1-Bureau (VantageScore only) | Includes $100,000 Cyber Extortion coverage and a dedicated VPN/Security bundle. |

If you’re choosing between Aura, LifeLock, and Identity Guard, you’re already comparing three of the strongest identity theft protection services available. Each takes a different approach: Aura offers complete, all-in-one protection; LifeLock integrates deeply with Norton’s cybersecurity tools; and Identity Guard delivers AI-powered, predictive monitoring at a competitive price.

Aurasimplifies protection, offering three-bureau credit monitoring and a comprehensive security suite (VPN, password manager) on all plans, with insurance covering up to $5 million on its family tier. It’s ideal for users who want complete, full-featured protection without managing multiple tools.

LifeLock, LifeLock, powered by Norton, offers tiered plans that scale protection. While lower tiers offer limited credit monitoring and insurance, premium tiers (like Ultimate Plus) offer three-bureau monitoring and up to $3 million in insurance coverage. Its strength is the deep integration with Norton’s powerful antivirus suite.

Conclusion:Aura is best for users who want seamless, all-in-one coverage and three-bureau monitoring at every price point, while LifeLock suits those seeking the highest-tier insurance coverage or layered device protection from Norton.

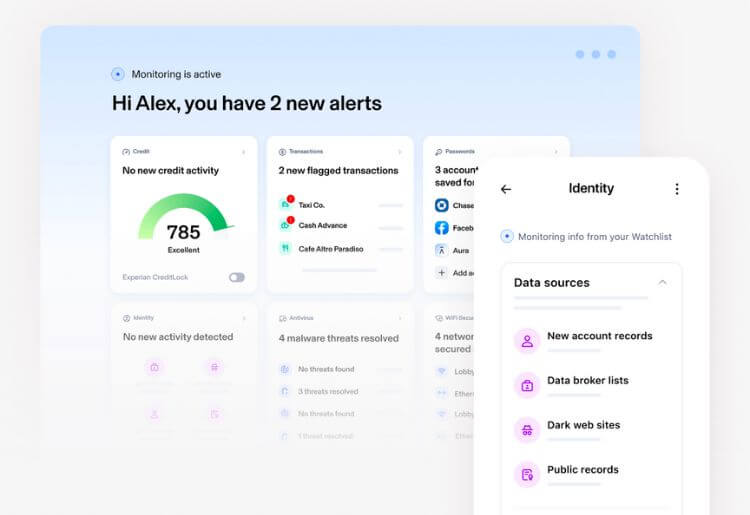

Auraprovides an intuitive dashboard that unites credit and dark web monitoring with financial, device, and social media protection. It focuses on speed, clarity, and convenience.

Identity Guard, powered by IBM Watson AI, specializes in predictive threat detection and personalized alerts. It’s ideal for users who want smart, data-driven protection at a lower cost.

Conclusion:Aura is perfect for simplicity and full-suite protection, while Identity Guard shines for users who value AI-driven insights and affordability.

LifeLockcombines Norton 360’s cybersecurity tools with identity and financial monitoring. Its plans include VPN access, antivirus protection, dark web alerts, 24/7 support, and up to $1 million in coverage—making it great for users who want all-device security in one ecosystem.

Identity Guardfocuses on early detection using AI monitoring and clear, customizable alerts. It offers excellent protection at a lower price, appealing to those who want advanced monitoring without extra cybersecurity tools.

Conclusion:LifeLock is best for users seeking complete identity and device security, while Identity Guard offers strong, affordable AI-based protection.

We evaluated adaptability, cost, monitoring techniques, restoration processes, and customer service reliability. We examined cybersecurity tools like VPN access and antivirus protection alongside fundamental identity safety measures.

Our Evaluation Criteria:

Comprehensive Monitoring and Detection:Incorporates Dark Web, Credit, Social Media, Bank Accounts, and Public Records monitoring to identify threats. Utilizes advanced technologies like AI for predictive analysis of identity theft risks.

Alert System Efficiency:Features real-time alerts with a broad range of notification types and methods (email, text) for immediate awareness of potential threats.

Restoration and Recovery Support:Offers dedicated case management and legal support for identity restoration. Provides insurance and financial compensation to cover losses from identity theft.

User Experience and Accessibility:Boasts a user-friendly interface and accessible customer service. Includes educational resources to empower users with knowledge of identity protection.

Innovative Security Technologies:Offers cybersecurity tools like VPNs, antivirus software, and password managers. Tailors special features to meet the needs of specific user groups (families, seniors, businesses).

Value and Pricing Options:Assessed through customer reviews, expert endorsements, and the company's track record in the industry. Checks for compliance with industry standards and holds relevant accreditations.

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information. We provide a range of services, including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

25 Identity Theft Protection Services Evaluated | 7 Evaluation Criteria | 10 Best Identity Theft Protection Services

What are some ways you can limit or prevent identity theft or fraudulent charges?

Use strong, unique passwords, enable two-factor authentication, review financial statements regularly, and avoid public Wi-Fi. Shred mail with personal details and limit online sharing. Identity theft protection adds real-time alerts to help detect issues quickly.

Is identity theft protection worth it?

Yes. It continuously monitors your credit and personal data, provides early alerts, and covers eligible losses. Even careful users benefit from professional monitoring and insurance.

How much does identity theft protection cost?

Basic plans start around $7 to $15 per month, while premium or family options range from $25 to $40. Higher tiers include broader monitoring, more insurance, and extra cybersecurity tools.

How can identity theft impact your life?

It can harm your credit, cause financial loss, and lead to legal complications. Recovery can take months without expert help, so early detection is critical.

How can social security identity theft occur?

Thieves use your Social Security number to open accounts or claim benefits, often through data breaches or phishing. Check your Social Security and credit reports regularly.

Fraudsters use your personal data as a 'key' to steal your hard-earned money. Be vigilant in protecting your data through awareness, using identity theft monitoring tools, and staying alert to suspicious activity in your accounts.

Using these best practices will help avoid becoming a victim of identity theft: protecting your personally identifiable data, monitoring financial accounts every four months, and using identity theft protection tools.

When shopping for an identity theft protection service, it is important to have a plan that provides for an immediate alert (speed) and secondly, the ability to solve for any issues (recovery) that result from the identity theft.

With any good functional identity theft product, consumer expectation is to have an easy-to-use application that is seamless and excellent customer service when the identity theft service is needed.

As with buying an insurance policy, identity theft protection is the same. The value is helping to minimize your financial exposure if a loss or identity theft occurs.

Identity theft is not going away. With fraudsters becoming more tech savvy in using AI, synthetic identities, and deepfakes to commit financial fraud. It is more important than ever for consumers to protect their personal data.

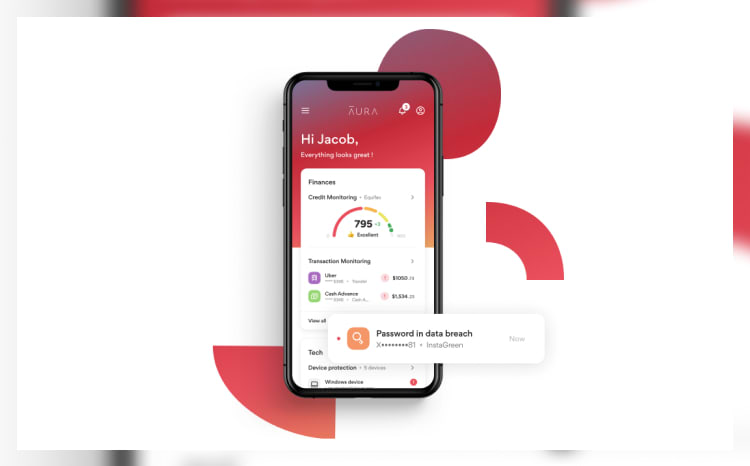

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as theConsumer Financial Protection Bureau(CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura:In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience:We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

August 8, 2025

•

3 min

Aura’s all-in-one solution comprises tools that protect your identity, finances, and devices, making it one of thebest identity theft protection services. Most tools work in the background, alerting you to threats via phone or inbox.

Most of these tools work in the background and don’t require you to do anything except keep an eye out for fast alerts to your phone or inbox (whenever Aura detects a threat) or check into your Aura dashboard whenever you just want some peace of mind.

In addition, Aura now also offers a password manager for all its digital security plans. The password manager lets you store all passwords and login information in one secure place, eliminating the headache of remembering dozens of different passwords. The password manager syncs your information across its browser plugin, web interface, and iOS and Android app, meaning you can safely access your passwords wherever you are.

Depending on which plan you choose, you may need to download a few tools, like antivirus software or VPN.

Aura monitors quite a lot across all plans and prices change based on the level of coverage. This includes various forms of credit monitoring, bank account monitoring, and ID theft monitoring – mostly in real-time with the added benefit of quarterly scores and annual reports for your credit files.

Here’s the full breakdown of what Aura looks out for:

Aura not only monitors for ID theft; it also provides recovery and protection services that kick into action whenever an issue arises.

Here’s the breakdown:

Overall, Aura is fairly simple to use. You can access and control everything from your Aura dashboard at my.aura.com. Aura also has an iOS/Android app that includes all Aura tools except antivirus (although this is coming soon to the Android app). The Windows app offers device and network protection (antivirus and VPN).

Aura offers 24/7 customer service support by phone and email. There is a comprehensive FAQ and an informative blog on its website as well. You can reach the Aura team at 1-833-552-2123 or email them at support@aura.com.

Aura offers three plans, each one containing the same features.

Plans can be purchased on a month-to-month or annual basis. If you select Aura, we recommend choosing a yearly plan due to the 17-25% discount compared to the monthly plan. Also, all annual plans come with a 60-day money-back guarantee.

| Individual | Couple | Family/Group | |

| Price | $9/month | $17/month | $25/month |

Family Plans

Aura's Family plans allow you to add up to 5 family members, kids or adults, to the same plan. All adult members on your plan get their own account and share the same plan benefits as the Family Plan Subscriber who owns the main account.

Each adult member gets $1 million identity theft insurance, adding up to $5 million in identify theft insurance coverage, and Family Plan Subscribers can add children to monitor their Social Security Number and personal information to help protect them from identity theft and fraud. If you're looking for full family protection in one easy-to-manage dashboard, Aura's Family Plans are a good choice.

Here’s a quick comparison chart that sets Aura’s services against other Identity Theft services.

| Aura | Identity Guard | Zander Identity Theft | |

|---|---|---|---|

| Best for | All-in-one protection | Full-spectrum protection | ID theft recovery |

| Price | $9 per month | $6.67 per month | $6.75 per month |

| Free trial | 60-day money-back guarantee | No | No |

| Free trial | Yes | Yes | Yes |

Aura offers an all-in-one solution containing pretty much everything you need to protect your identity, financial accounts, and devices from external threats. Although seemingly on the expensive side, Aura's plans bundle together a wide range of tools that – if purchased separately – would cost significantly more than what they charge. Better yet, you can control almost everything from your Aura dashboard.

* Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group‚ Inc. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions.

¹ The score you receive with Aura is provided for educational purposes to help you understand your credit. It is calculated using the information contained in your TransUnion or Experian credit file. Lenders use many different credit scoring systems, and the score you receive with Aura is not the same score used by lenders to evaluate your credit.

Frequently Asked Questions

Frequently Asked Questions

Nadav Shemer specializes in business, tech, and energy, with a background in financial journalism, hi-tech and startups. He writes for top10.com where he discusses the latest innovations in financial services and products.

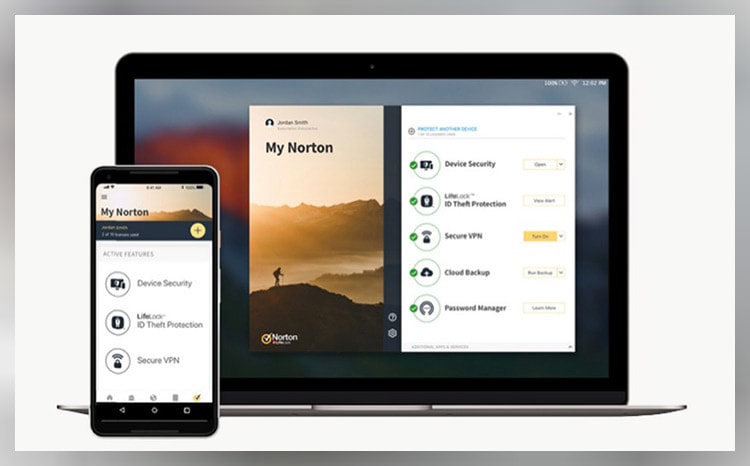

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

August 8, 2025

•

4 min

LifeLock boasts a rating of 4.5 out of 5 stars from 110 reviews, indicating that a majority of customers are highly satisfied with their services. The platform excels in ease of use, brand satisfaction, and service quality, all rated at 4.5.

However, while still commendable, its value for money is slightly lower with a rating of 4, suggesting that while customers appreciate the service, there might be some concerns regarding its cost-effectiveness.

LifeLock is a downloadable software that works quickly and efficiently from the moment you install it. After you sign up for a plan, you will be prompted to download and install the software (this is a click or 2, like any other app you’re used to installing).

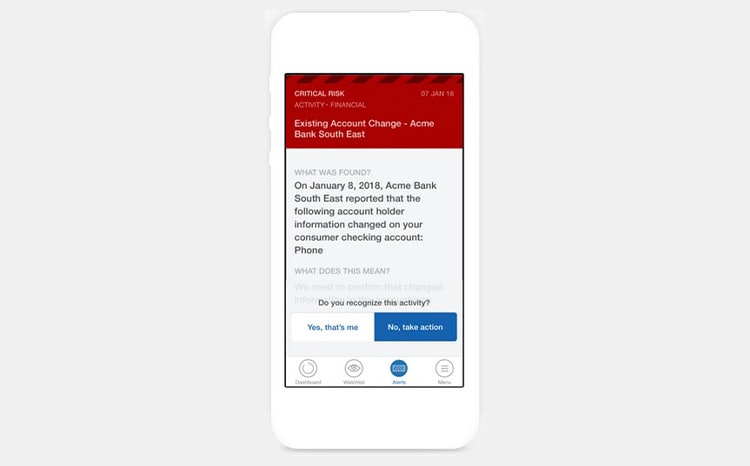

Once installed, the proprietary technology scans databases to see if your personal information is being used. Depending on the plan you choose to sign up for, LifeLock also scans the Dark Web, monitors your accounts, and checks your credit report for any inconsistencies, issues, or possible problems. You will receive notification of any suspicious behavior via the contact method you've chosen. You can choose SMS, phone, or email alerts.

Then, LifeLock starts scanning your devices. Depending on which plan you get, you can install LifeLock on up to 5 devices, including laptops, home computers, and smartphones. Whatever device you have the software installed on will be protected. LifeLock scouts for personal information that you have around that leaves you vulnerable to identity theft. You’ll receive an alert from LifeLock if it finds anything questionable.

LifeLock device scans are continuous, meaning the software scans your devices all the time. Additionally, you’ll receive auto-updates of the software, so you are always protected against new and prevalent threats.

LifeLock offers 3 basic identity theft services (and we’ll dive deeper into each one below):

In terms of monitoring your credit, LifeLock is pretty exhaustive. Depending on which plan you sign up for, it includes monitoring:

At the most basic level, LifeLock monitors your Social Security number for any unusual activity. LifeLock will notify you if your credit changes, if a credit check is run on your name, and if a loan or other financial obligation is made on your accounts. You’ll also receive monthly credit report checks, but only if you’re signed up for the Ultimate Plus plan. Alerts are sent out if any of these flags are set off (i.e., your information triggers any of these scans), again according to your plan.

The Norton Security package includes:

This is a nice bonus since it’ll help keep your online activity safe as well.

Of course, the most important question is what does LifeLock do in the unfortunate event that your identity is stolen. There are several steps LifeLock will take including:

A dedicated restoration specialist

LifeLock assigns a US-based specialist that is familiar with legal and technical procedures to your case immediately to help you take decisive action. The specialist will handle your case from beginning to end to ensure that they see it through properly.

ID theft insurance

LifeLock has a Million Dollar Protection Package to cover all your expenses. This coverage varies based on the plan you get, but even the most basic coverage ensures you get up to $25,000 reimbursement for stolen funds and personal expenses. Additionally, all plans have up to $1M coverage for legal advice and other legal expenses incurred while trying to resolve your case.

Lost wallet replacement assistance

In the unfortunate event that you lose your wallet, LifeLock will help. It will get credit cards replaced and canceled, licenses renewed, and Social Security cards updated.

LifeLock member services are available 24/7. You can get in touch with them via a toll-free live support number.

LifeLock also has a huge information center that is chock full of useful and detailed information about identity theft, online safety, and other things you really need to know. There are blog articles that teach you about credit, finances, fraud, data breaches, and internet security. It’s got everything, so you should definitely check it out.

LifeLock has 3 plans to choose from for individuals. One thing we didn’t appreciate was the lack of a family plan option. You can add your kids to the plan for $5.99/month/kid though, so at least there’s that.

| Standard Package | Advantage Package | Ultimate Plus Package | |

|---|---|---|---|

Price per month, first year | $8.99 | $17.99 | $26.99 |

Price per month, after first year (For Norton) | $11.99 | $22.99 | $34.99 |

Don’t know where to start when comparing Identity Theft Check Providers? Top10’s brand comparisons can help you make the best choice for your personal data security needs.

| LifeLock | Identity Guard | Aura | |

|---|---|---|---|

Starting price | $9.99 Per month | $7.20/monthly or $79.99/year Per month | $9/monthly or $84/year |

Free trial | 60-day money-back guarantee | No | 60-day money-back guarantee |

3-bureau credit monitoring | Yes | Yes | Yes |

Insurance coverage | $1 million | $1 million | $1 million |

LifeLock andIdentity Guard are both industry standards when it comes to identity protection online and beyond. They come in at similar price points for monthly payments and insurance coverage. The difference comes down to the features provided by each brand.

Unlike Identity Guard, LifeLock is much easier to reach with issues through their 24/7 support channels through chat or call with no wait time. Even more so, Norton Security is guaranteed with every package you get on LifeLock. Identity Guard, on the other hand, usesIBM Watson® AI for deep data and identity monitoring.

Both Lifelock and Auramake waves in the identity guard sector, each with their own outstanding features. LifeLock and Aura mostly differ in regards to their prices, as starting prices are less expensive with LifeLock than Aura’s. But. Aura’s prices do not increase in the long term; the price you sign up for with Aura is the one you stay with until you decide to cancel.

LifeLock is one of the oldest brands on the market, with Norton Security integrated into the data scanning. With LifeLock, not all features may be available across all packages, prompting users to purchase the more expensive option for great protection. Aura, on the other hand, offers a full suite of ID theft.

LifeLock brings a lot to the table, including a partnership with a solid brand in the security sector. The Ultimate Plus plan offers the most comprehensive coverage, and that includes things like 5-device coverage, $1M reimbursement insurance, and dark web scanning.

The other plans are good if you just want the basic protection, but honestly, when it comes to identity theft, is there really any price too high to ensure your protection? LifeLock has a good reputation and offers a solid product that’s easy to use and easy to recommend.

Frequently Asked Questions

Frequently Asked Questions

Sarah Pritzker is an accomplished content writer for top10.com. With years of experience, Sarah specializes in the dynamic field of online consumer products, leveraging meticulous research to provide insights into various options on the market. Her expertise is evident in her ability to demystify complex subjects and guide readers in choosing the best solutions tailored to their needs.

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard:With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience:We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

August 8, 2025

•

3 min

Identity Guard’s protection software is a complex algorithm using the latest technology to keep your identity constantly monitored. In fact, Identity Guard monitors billions (you read that correctly) of data points to help keep your identity safe.

Identity Guard monitors most of the usual personal identifiers including:

Credit report monitoring based on data from Experian, Equifax, and TransUnion

Dark Web surveillance

Public records monitoring

Payday loans

Known address monitoring

Credit and debit card account monitoring

Social Security number monitoring

Financial account takeover monitoring

401K & investment account monitoring

Criminal and sex offense monitoring

Home title monitoring

USPS address change monitoring

In addition, Identity Guard protects some lesser-watched areas such as medical insurance cards. Another huge benefit to Identity Guard protection is the extensive device protection it offers.

Let’s not forget the family plan that allows you to help keep your kids’ identities safe and protected as well (did you know thatchildren are 30%-50% more likely to have their identities stolen than adults?).

Identity Guard is an incredibly useful tool in the event that your identity is stolen. They offer tons of recovery assistance including:

ID theft insurance of up to $1 million**

A special hotline to use in the event of an incident

A dedicated case officer to help you navigate the waters of regaining control of your life & restoring your credit

Coverage for eligible lost wages, travel expenses, legal fees, & more

Because it is such advanced technology, Identity Guard is effortless to use. Once you set it in motion, you’re free to go about your life regularly. The software will scan your accounts constantly and notify you at once if anything unusual is detected. With 24/7 monitoring, you can rest assured that you will be notified the moment something is detected.

While there is no 24/7 customer service, Identity Guard actually has longer hours than most other providers with limited support. You can reach a support staff member via telephone from 8am to 11pm ET Monday thru Friday and 9am to 6pm on Saturdays.

You can also send an email tocustomercare@identityguard.comand get a response in 24-48 hours. One thing that is missing from the support team is a live chat, though this is standard for this industry. You’ll have to deal directly on the phone with a service rep if you want assistance. However, Identity Guard does have a tremendous amount of online resources you can take advantage of. From online credit education to fraud protection articles, online tools, and credit specialists, there’s almost nothing you can’t find out by combing through these articles and tools.

Identity Guard offers 3 plans for individuals and another three for families, certainly making it the most comprehensive identity theft protection option available. New customers enjoy up to 33% off. Here’s a breakdown of what you can get for your subscription:

| Value | Total | Ultra | |

|---|---|---|---|

Price per month for individuals | $6.67 | $13.33 | $19..99 |

Price per month for family | $10.00 | $19.99 | $26.67 |

Mobile app | ✔ | ✔ | ✔ |

Risk management score | ✔ | ✔ | ✔ |

Online identity dashboard | ✔ | ✔ | ✔ |

SSN and credit alerts | ✔ | ✔ | ✔ |

Bank and credit card activity alerts | ✔ | ✔ | |

Million Dollar Protection Package | Yes | Yes | Yes |

Lost wallet protection | ✔ | ✔ | ✔ |

Dark web monitoring | ✔ | ✔ | ✔ |

Potential threat detection | ✔ | ✔ | ✔ |

Credit change detection | 3 bureaus | 3 bureaus | |

Annual credit report | ✔ | ||

Bank account take over/newaccount alerts | ✔ | ✔ | |

Anti-phishing mobile app | ✔ | ✔ | ✔ |

Safe browsing extension | ✔ | ✔ | ✔ |

Social insight report | ✔ |

All plans include the basic services like Social Security number monitoring, black market monitoring, and ID verification alerts. Plus, all plans provide you with account takeover alerts, lost wallet protection, password protection, and up to $1 million in identity theft reimbursements.

Identity Guard offers a lot of protection for a nominal fee. Aside from the standard services, Identity Guard Ultra provides an annual credit report and monthly credit scores. This is a unique feature that most other identity theft protection providers don’t offer.

Identity Guard doesn’t send fraud alerts to the credit reporting bureaus, but this is something that you can do easily and for free, so it is definitely worth the tradeoff to get frequent credit score information instead.

With several plans to choose from, there is definite value for money, especially with the Total plan. For just $19.99 per month, you can get credit report monitoring, quarterly updates, and dark web monitoring. Protect yourself today.

*The score you receive with Identity Guard is provided for educational purposes to help you understand your credit. It is calculated using the information contained in your TransUnion credit file. Lenders use many different credit scoring systems, and the score you receive with Identity Guard is not the same score used by lenders to evaluate your credit.

** Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group‚ Inc. The description herein is a summary and intended for informational purposes only and does not include all terms‚ conditions and exclusions of the policies described. Please refer to the actual policies for terms‚ conditions‚ and exclusions of coverage. Coverage may not be available in all jurisdictions.

***Your card will be charged either a monthly or annual fee, depending on the membership plan you choose. You may cancel your membership anytime simply by contacting us.

Sarah Pritzker is an accomplished content writer for top10.com. With years of experience, Sarah specializes in the dynamic field of online consumer products, leveraging meticulous research to provide insights into various options on the market. Her expertise is evident in her ability to demystify complex subjects and guide readers in choosing the best solutions tailored to their needs.