- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Up to 3-Bureau Credit Monitoring

- Dark web monitoring & SSN alerts

- Special offer: Save 73% on Ultra Protection

- Proactive monitoring & real-time alerts

- Unlimited recovery services

- Repays up to $1M for stolen funds & expenses

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Risk-free with a 30-day money-back guarantee

- Up to $1 million in ID theft insurance

- Save 58% on your first term

- Get actionable security alerts and notifications

- Track your credit activity and credit score

- Up to 71% OFF with a 2-year plan

- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

What Is Identity Theft Protection

Identity theft protection is a collection of digital tools designed to safeguard your personal, financial, and online data. These services monitor sensitive information such as your Social Security number, credit score, bank accounts, and online activity for suspicious behavior. When something looks wrong, you receive instant alerts by text, email, or app so you can act quickly.

Most plans include insurance covering legal costs, stolen funds, and recovery expenses, plus cybersecurity tools like VPNs, antivirus software, and password managers to strengthen your defense against online threats.

Quick Answer:Identity theft protection is a service that monitors your personal data, credit reports, and the dark web 24/7 for fraud. It provides instant alerts for misuse and includes up to $1 million in insurance and expert recovery assistance to restore your identity if a breach occurs.

Watch: How to choose the best identity theft protection

This short video explains how identity theft protection works and compares top services like Aura, LifeLock, and Identity Guard to help you choose the right plan.

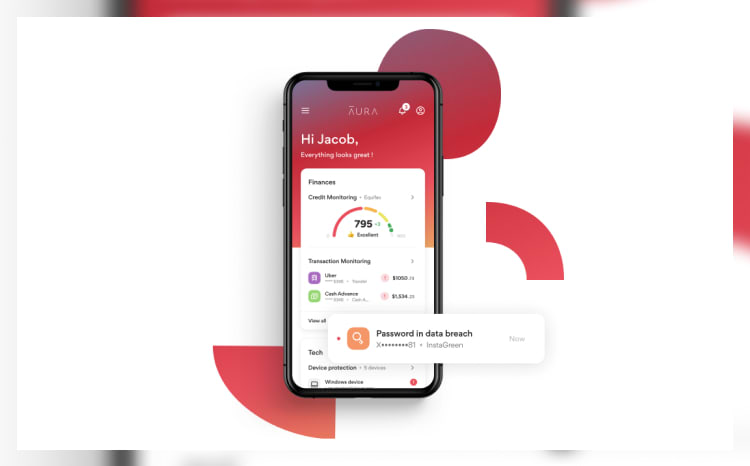

Aura

Key Insights

Identity theft is growing rapidly and affects millions of people each year, making active protection more important than ever.

Identity theft protection services monitor your personal, financial, and online data across credit bureaus, the dark web, and bank accounts to detect suspicious activity early.

Real-time alerts allow you to act quickly by freezing credit, securing accounts, or contacting your bank before fraud escalates.

Professional recovery assistance and insurance coverage help you restore your identity and recover losses if theft occurs.

Built-in cybersecurity tools such as VPNs, antivirus software, and password managers add strong protection against online threats.

Practicing good digital habits like using strong passwords, enabling two-factor authentication, and monitoring your credit remains one of the most effective ways to prevent identity theft.

How Identity Theft Happens

Identity theft can happen both online and offline. Criminals use various methods to steal your personal information and exploit it for financial gain.The FBI’s 2024 Internet Crime Report foundthat phishing, spoofing, and data breaches caused more than $16 billion in losses, a 33 percent increase from 2023.

1. Data Breaches

Hackers break into company databases containing personal details such as names, addresses, and Social Security numbers. This information is often sold on the dark web or used to open new accounts in your name.

2. Phishing and Spoofing

Phishing scams use fake emails, texts, or calls that appear to come from trusted sources like your bank, government agencies, or a retailer. These messages often ask you to verify your login or payment details, making phishingone of the FTC’s most reported scams.

Spoofing takes it further by disguising a phone number, text message, or email address to look legitimate. Once you click a link or share information, criminals can instantly steal your personal and financial data.

3. Hacked Accounts

Using the same password across accounts makes you vulnerable. Once hackers access one account, they can reach others. Use a password manager and enable two-factor authentication on important accounts.

4. Unsecured Devices and Public Wi-Fi

Public Wi-Fi networks are vulnerable to data interception. Criminals can install spyware or steal login credentials to access sensitive information. Always use a VPN when connecting to public networks.

5. Physical Theft and Paper Records

Offline theft still happens. Thieves can find personal details in discarded mail, receipts, or bills. Shred or destroy documents before throwing them away.

6. Social Engineering

Scammers manipulate victims into sharing information by pretending to be trusted contacts or officials. Be cautious with personal details shared online or over the phone.

Identity theft can lead to fake loans, tax fraud, and financial loss. Combining good daily security practices with an identity theft protection service helps you catch problems early.

Sources:

How Identity Theft Protection Works

Identity theft protection services combine monitoring, alerts, recovery assistance, and cybersecurity tools to help detect and stop suspicious activity before serious damage occurs.

Monitors Your Information:Your service scans credit reports from Experian, Equifax, and TransUnion, as well as public records, bank transactions, and the dark web for signs of misuse. You might receive an alert if your Social Security number appears in a payday loan application or your email is found in a data breach.

Instant Alerts:If unusual activity occurs, you get real-time notifications detailing what was found and where. Quick alerts help you freeze credit, change passwords, or contact your bank before damage spreads.

Fully Managed Identity Restoration: If theft occurs, the service assigns a Dedicated, White-Glove Restoration Specialist. This expert handles the entire complex recovery process for you, including filing FTC reports, contacting creditors, and managing legal disputes. This fully managed service guarantees restoration and uses the policy's insurance to cover eligible legal fees and lost funds.

Protects Credit and Financial Accounts:Comprehensive services include three-bureau credit monitoring, credit locks, lost-wallet assistance, and bank transaction alerts for unusual payments or withdrawals.

Digital Security Tools:Many plans offer VPNs to encrypt online activity, antivirus software to block malware, password managers to create strong logins, and social media monitoring to detect impersonation or data leaks.

Family Protection:Family plans include child Social Security number monitoring, fraud alerts for minors, and parental dashboards for managing household accounts.

Reports and Dashboards:Providers often include dashboards showing identity health, alerts, and progress. Monthly or quarterly summaries highlight changes in credit, dark web findings, and overall risk.

| Feature Category | Example Features | Benefit |

|---|---|---|

Monitor & Detect | Three-bureau credit monitoring, Dark web scans, Investment/401(k) account monitoring, Home Title monitoring, Sex offender registry alerts | Early fraud detection, Comprehensive financial and property protection |

Alert | Email, text, or app notifications | Real-time awareness |

Restore | Recovery experts, legal help, insurance | Fast recovery |

Cybersecurity | VPN, antivirus, password manager | Prevents future attacks |

Extra Coverage | SSN tracking, lost-wallet help, investment alerts | Full protection |

How to Prevent Identity Theft

Even with identity theft protection, prevention starts with smart habits. Cybercriminals constantly find new ways to exploit personal data, but these practices can keep you safe.

1. Use Strong, Unique Passwords

Create a unique password for each account with at least 12 characters, combining letters, numbers, and symbols. Store them in a password manager for security.

2. Turn On Two-Factor or Biometric Authentication

Enable two-factor authentication or use biometric login to add an extra layer of protection.

3. Be Cautious with Emails, Texts, and Links

Phishing is a top cause of identity theft. Always verify senders, hover over links to preview URLs, and avoid clicking anything suspicious. Legitimate companies never ask for passwords or personal data by email or text.

4. Only Enter Data on Secure Websites

Ensure sites start with “https://” and display a padlock symbol before entering sensitive information. Check for misspelled or fake domains.

5. Avoid Public Wi-Fi for Sensitive Tasks

Avoid accessing bank accounts or entering personal information on public Wi-Fi. If necessary, use a VPN for encryption.

6. Monitor Your Credit Reports

Check free credit reports at AnnualCreditReport.com and review a different credit bureau report every four months to monitor for fraud. Look for unfamiliar accounts or inquiries and dispute them immediately.

7. Protect Personal Information Offline

Shred mail and bills, and keep checkbooks, sensitive documents with personal identifiable information (PII), or IDs in safe locations.

8. Limit What You Share on Social Media

Avoid posting your full address, birthday, or family details that criminals can use to answer security questions.

9. Freeze Your Credit

Freezing your credit prevents new accounts from being opened in your name. Contact all three credit bureaus (TransUnion, Equifax, and Experian) to set it up.

Specialized Prevention Tips

For Families/Children:Ensure protection includeschild SSN monitoring. Limit what minors share online and use parental controls.

- FFor Seniors:Per the FTC,impersonation scams are on the rise for adults aged 60 and over. Potential victims need to be on the lookout for tech support scams, government imposter scams, family emergency scams, and bank employee scams. The best practice is to contact the organization by locating a verifiable phone number from their website.

Top 10 simple tips to protect your identity:

How to Tell if Your Identity Has Been Stolen

Watch for these warning signs:

Unrecognized charges or withdrawals

Missing mail or unexpected address changes

New credit inquiries or loan applications you didn't authorize

Calls from debt collectors about unknown accounts

Alerts from your identity theft protection service

IRS notification that your tax return was already filed

Healthcare provider notification of maximum benefits reached without filing claims

Unusual account activity: notification of password change/re-set, login alerts and security notification alerts that were not initiated by user

Sudden and significant change in credit score

Aura

How to Report Identity Theft

If you suspect your identity has been stolen, take immediate action.

1. Report to the FTC

Visitidentitytheft.govto file an official report. The FTC will create a recovery plan and provide documentation for banks and credit bureaus.

2. Notify Financial Institutions

Contact banks, credit card issuers, and lenders to freeze or close compromised accounts. Update your passwords and request replacements.

3. Alert Credit Bureaus

Reach out to Experian, Equifax, and TransUnion to place a fraud alert or freeze on your credit. Some identity theft protection services can do this automatically.

4. File a Police Report

If you have evidence such as stolen mail or unauthorized accounts, file a report with local law enforcement. Bring your FTC documentation. This helps with disputes and insurance claims.

5. Keep Detailed Records

Document all communications with banks, credit bureaus, and law enforcement. Make sure to write down names, dates and contact information of those you communicate with. Keep copies of every report, letter, and reference number.

6. Continue Monitoring

Identity thieves may strike again using the same data. Keep up with credit monitoring and dark web scans through your protection service.

Types of Identity Theft

1. Financial Identity Theft: Criminals use your financial data to open credit cards, loans, or accounts. Contact your bank immediately and freeze your credit if this happens.

2. Medical Identity Theft: Someone uses your insurance for medical services or false claims. Check statements for unknown charges and request record copies. You can correct inaccurate information under HIPAA.

3. Tax Identity Theft: Criminals file fake tax returns using your Social Security number. Contact the IRS Identity Protection Unit (https://www.irs.gov/identity-theft-central) and complete Form 14039. Request an Identity Protection PIN to secure future filings.

4. Online Identity Theft (AKA: Account Takeover): Hackers take over digital accounts to steal information or impersonate you. Use strong passwords, enable two-factor authentication or biometric authentication, and install antivirus software.

5. Criminal Identity Theft: Someone uses your identity during an arrest. File a police report and request proof of your true identity from law enforcement.

6. Synthetic Identity Theft: Criminals combine real and fake information (usually from data breaches) to create new"synthetic"identities. Comprehensive monitoring services that scan credit and dark web activity are best for detecting this form of theft.

7. Child identity Theft:Someone uses a child's personal information to open new bank accounts, credit cards or loans. Financial activity starts to appear on someone who is too young to have credit. Often this type of identity theft is not detected for years.

How Common Is Identity Theft

Identity theft is one of the fastest-growing crimes in the United States,occurring every 4.9 seconds. It affects millions of people each year and can lead to serious financial and emotional consequences.

TheFederal Trade Commission (FTC) reported over 1.1 million cases in 2024, with most involving credit card fraud and loan scams. As more people turn to online banking, digital shopping, and remote work, cybercriminals have more opportunities to exploit personal information.

Protecting yourself requires awareness and proactive measures. Continuous monitoring, fraud alerts, and strong security practices—like using unique passwords and enabling multi-factor authentication—can make a significant difference. Knowledge and preparation remain some of the best defenses against becoming a victim of identity theft.

Why Identity Theft Protection Matters

Cybercriminals are more sophisticated than ever, and identity theft is on the rise. With millions of cases each year, identity theft protection has become a critical part of modern cybersecurity for individuals and families.

Identity theft protection is valuable for anyone whose information is stored or used online. It provides ongoing monitoring, quick alerts, and professional recovery support. Consider it if you shop or bank online, manage sensitive data, care for dependents, or have a high financial profile.

With dark web monitoring and expert recovery assistance, it acts as both a prevention tool and a safety net if theft occurs.

What Our Expert Says

Organized fraudsters create fake identities to commit financial fraud. That is their day-in and day-out job. It is important to protect yourself by safeguarding your personal data and using identity theft protection tools for monitoring your accounts and data for early alerts and intervention.

How to Choose an Identity Theft Protection Service

When comparing services, look for one that combines monitoring, alerts, recovery, and cybersecurity into a single, easy-to-manage plan. A well-rounded protection service helps you detect, prevent, and recover from identity theft effectively.

Comprehensive Monitoring:Look for a service that goes beyond credit reports to monitor your bank accounts, public records, the dark web, and social media for suspicious activity. Broader coverage helps detect threats wherever your data may surface.

Real-Time Alerts:Quick action can prevent major damage. Choose a provider that sends instant notifications by text, email, or app when unusual activity is detected.

Recovery Assistance:If your identity is stolen, professional help is crucial. The best services include dedicated recovery experts who guide you through disputes, help restore your identity, and recover stolen funds.

Identity Theft Insurance:Strong plans include at least $1 million in insurance to cover legal fees, lost wages, and recovery expenses. This financial safety net can help minimize the lasting impact of fraud.

Cybersecurity Tools:Added features like VPNs, antivirus software, and password managers strengthen your online defenses and reduce the risk of data breaches.

| Service Name | Insurance Max (Per Adult/Policy) | Credit Monitoring | Key Differentiator |

|---|---|---|---|

| Aura | Up to $5 Million (Family Policy) / $1M per adult | 3-Bureau (All Plans) | Highest family insurance maximum and fastest alerts. |

| LifeLock (by Norton) | Up to $3 Million (Ultimate Plus Plan) / $1M per adult | 1-Bureau (Basic) / 3-Bureau(Premium) | Largest feature set, including Home Title & 401k monitoring on top tiers. |

| Identity Guard | Up to $1 Million | None (Value) / 3-Bureau(Ultra Plan only) | Predictive AI monitoring and highly affordable entry-level plans. |

| OmniWatch | Up to $2 Million ($1M per adult) | 1-Bureau (Basic) / 3-Bureau(Elite Plan) | Includes $25,000 in Scam Insurance and $25,000 in Ransomware coverage. |

| Zander Identity Theft | Up to $2 Million ($1M per member) | None (Optional Credit Monitoring Add-on) | Lowest cost for the highest guaranteed recovery assistance. |

| Mozo | Up to $1 Million | Not explicitly advertised as 3-Bureau/Focus is on SSN/Dark Web | Unique AI Scam Scanner (SMS/Web/Email) and included VPN/Antivirus. |

| NordProtect | Up to $1 Million | 1-Bureau (VantageScore only) | Includes $100,000 Cyber Extortion coverage and a dedicated VPN/Security bundle. |

If you’re choosing between Aura, LifeLock, and Identity Guard, you’re already comparing three of the strongest identity theft protection services available. Each takes a different approach: Aura offers complete, all-in-one protection; LifeLock integrates deeply with Norton’s cybersecurity tools; and Identity Guard delivers AI-powered, predictive monitoring at a competitive price.

Aura vs LifeLock

Aurasimplifies protection, offering three-bureau credit monitoring and a comprehensive security suite (VPN, password manager) on all plans, with insurance covering up to $5 million on its family tier. It’s ideal for users who want complete, full-featured protection without managing multiple tools.

LifeLock, LifeLock, powered by Norton, offers tiered plans that scale protection. While lower tiers offer limited credit monitoring and insurance, premium tiers (like Ultimate Plus) offer three-bureau monitoring and up to $3 million in insurance coverage. Its strength is the deep integration with Norton’s powerful antivirus suite.

Conclusion:Aura is best for users who want seamless, all-in-one coverage and three-bureau monitoring at every price point, while LifeLock suits those seeking the highest-tier insurance coverage or layered device protection from Norton.

Aura vs Identity Guard

Auraprovides an intuitive dashboard that unites credit and dark web monitoring with financial, device, and social media protection. It focuses on speed, clarity, and convenience.

Identity Guard, powered by IBM Watson AI, specializes in predictive threat detection and personalized alerts. It’s ideal for users who want smart, data-driven protection at a lower cost.

Conclusion:Aura is perfect for simplicity and full-suite protection, while Identity Guard shines for users who value AI-driven insights and affordability.

LifeLock vs Identity Guard

LifeLockcombines Norton 360’s cybersecurity tools with identity and financial monitoring. Its plans include VPN access, antivirus protection, dark web alerts, 24/7 support, and up to $1 million in coverage—making it great for users who want all-device security in one ecosystem.

Identity Guardfocuses on early detection using AI monitoring and clear, customizable alerts. It offers excellent protection at a lower price, appealing to those who want advanced monitoring without extra cybersecurity tools.

Conclusion:LifeLock is best for users seeking complete identity and device security, while Identity Guard offers strong, affordable AI-based protection.

Aura

Our Methodology: How We Reviewed the Best Identity Theft Protection Services

We evaluated adaptability, cost, monitoring techniques, restoration processes, and customer service reliability. We examined cybersecurity tools like VPN access and antivirus protection alongside fundamental identity safety measures.

Our Evaluation Criteria:

Comprehensive Monitoring and Detection:Incorporates Dark Web, Credit, Social Media, Bank Accounts, and Public Records monitoring to identify threats. Utilizes advanced technologies like AI for predictive analysis of identity theft risks.

Alert System Efficiency:Features real-time alerts with a broad range of notification types and methods (email, text) for immediate awareness of potential threats.

Restoration and Recovery Support:Offers dedicated case management and legal support for identity restoration. Provides insurance and financial compensation to cover losses from identity theft.

User Experience and Accessibility:Boasts a user-friendly interface and accessible customer service. Includes educational resources to empower users with knowledge of identity protection.

Innovative Security Technologies:Offers cybersecurity tools like VPNs, antivirus software, and password managers. Tailors special features to meet the needs of specific user groups (families, seniors, businesses).

Value and Pricing Options:Assessed through customer reviews, expert endorsements, and the company's track record in the industry. Checks for compliance with industry standards and holds relevant accreditations.

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information. We provide a range of services, including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

25 Identity Theft Protection Services Evaluated | 7 Evaluation Criteria | 10 Best Identity Theft Protection Services

FAQs About Identity Theft Protection

What are some ways you can limit or prevent identity theft or fraudulent charges?

Use strong, unique passwords, enable two-factor authentication, review financial statements regularly, and avoid public Wi-Fi. Shred mail with personal details and limit online sharing. Identity theft protection adds real-time alerts to help detect issues quickly.

Is identity theft protection worth it?

Yes. It continuously monitors your credit and personal data, provides early alerts, and covers eligible losses. Even careful users benefit from professional monitoring and insurance.

How much does identity theft protection cost?

Basic plans start around $7 to $15 per month, while premium or family options range from $25 to $40. Higher tiers include broader monitoring, more insurance, and extra cybersecurity tools.

How can identity theft impact your life?

It can harm your credit, cause financial loss, and lead to legal complications. Recovery can take months without expert help, so early detection is critical.

How can social security identity theft occur?

Thieves use your Social Security number to open accounts or claim benefits, often through data breaches or phishing. Check your Social Security and credit reports regularly.

What Our Expert Says

Fraudsters use your personal data as a 'key' to steal your hard-earned money. Be vigilant in protecting your data through awareness, using identity theft monitoring tools, and staying alert to suspicious activity in your accounts.

Key Expert Insights by Jim Murphy

Using these best practices will help avoid becoming a victim of identity theft: protecting your personally identifiable data, monitoring financial accounts every four months, and using identity theft protection tools.

When shopping for an identity theft protection service, it is important to have a plan that provides for an immediate alert (speed) and secondly, the ability to solve for any issues (recovery) that result from the identity theft.

With any good functional identity theft product, consumer expectation is to have an easy-to-use application that is seamless and excellent customer service when the identity theft service is needed.

As with buying an insurance policy, identity theft protection is the same. The value is helping to minimize your financial exposure if a loss or identity theft occurs.

Identity theft is not going away. With fraudsters becoming more tech savvy in using AI, synthetic identities, and deepfakes to commit financial fraud. It is more important than ever for consumers to protect their personal data.

Our Top 3 Picks

- 1

Exceptional9.8

Exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for -Best identity theft protection company overall

- Starting price -$9/monthly or $108/year

- Free trial -60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as theConsumer Financial Protection Bureau(CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura:In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience:We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

Excellent9.2

Excellent9.2 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for -Best for Norton antivirus users

- Starting price -$9.99

- Free trial -60-day money-back guarantee

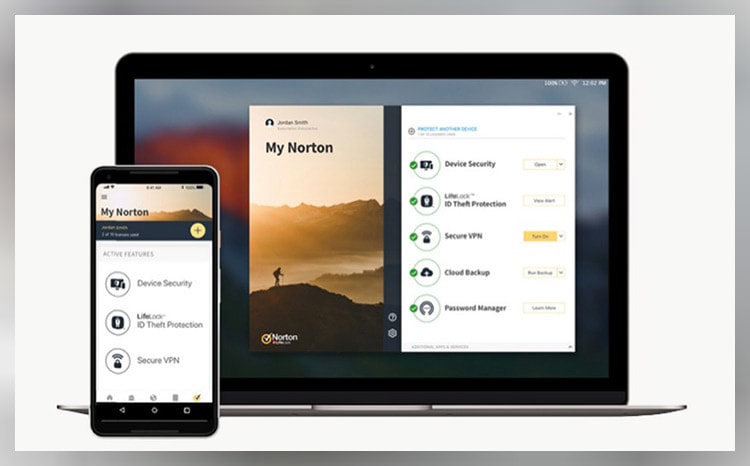

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

Excellent9.1

Excellent9.1 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for -Best for full-spectrum protection

- Starting price -$7.20/monthly or $79.99/year

- Free trial -Free trial: Yes

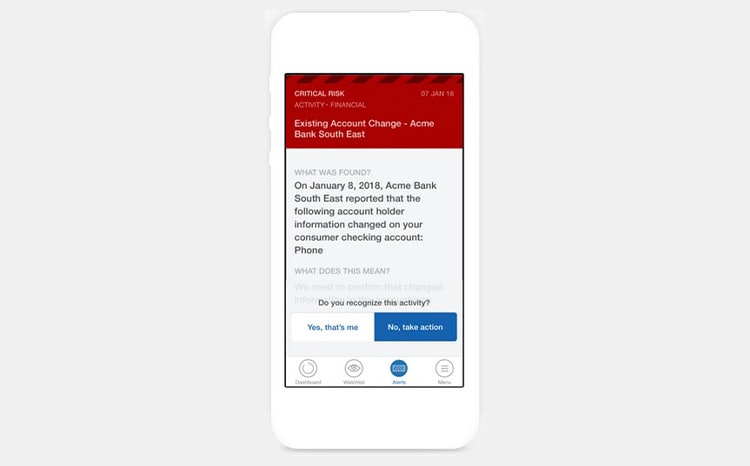

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard:With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience:We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans