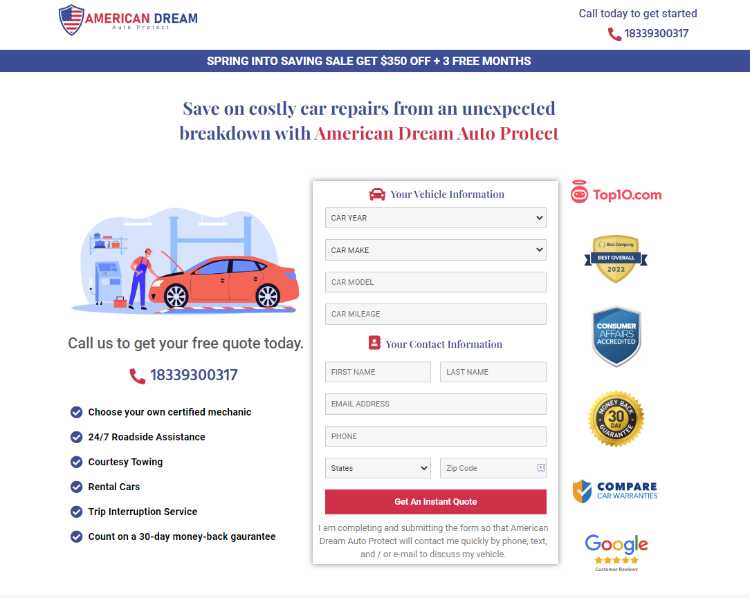

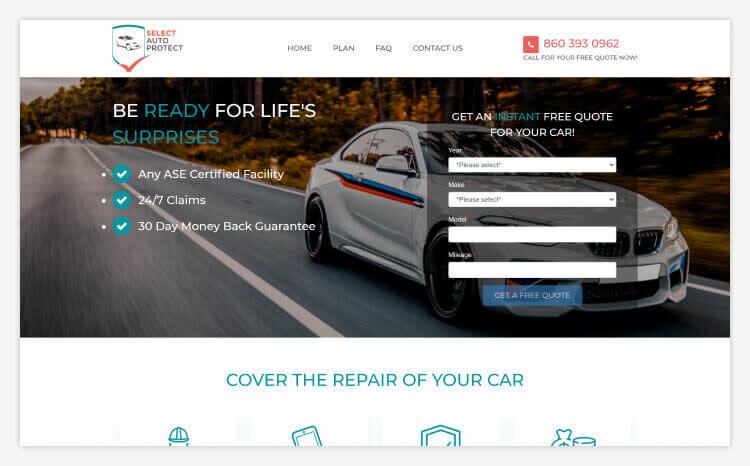

10 Best Extended Car Warranty Companies 2023

When you purchase a car, whether you buy one that’s new or used, it’s natural to think about the reliability of your vehicle and consider the potential cost of repairs. At some point in the purchase process, it’s likely you’ll be offered an extended car warranty.

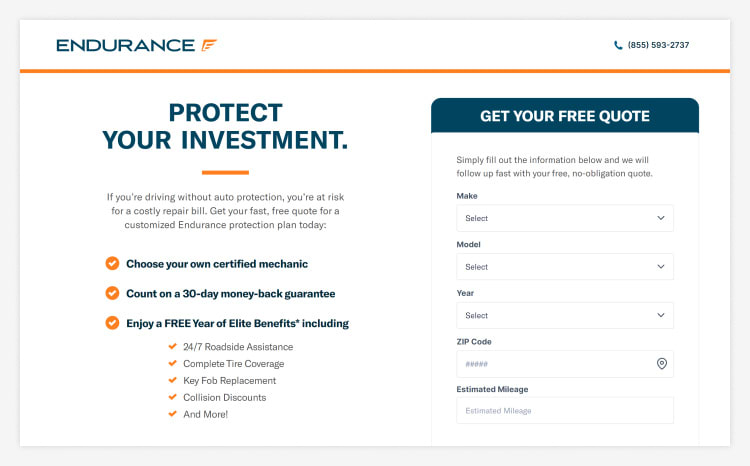

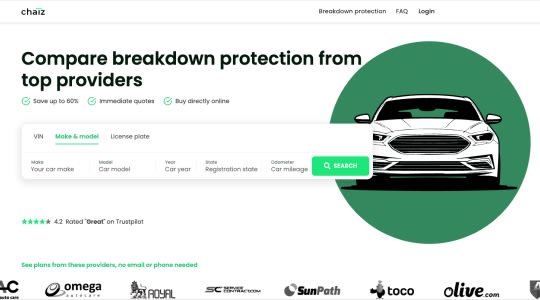

An extended vehicle warranty protects your car after your manufacturer’s coverage has expired. It can also protect you in the event of repairs and services that may not be covered by your manufacturer. Not all warranties are created equally. To help you navigate them, we’ve compiled a list of the top 10 best extended vehicle warranties available.

What Is an Extended Warranty for Cars?

An extended auto warranty is basically a contract that covers your vehicle in case it needs repairs or breaks down due to normal use. Different types of plans may cover the car’s powertrain, air conditioning, electrical system, and more. The best extended warranties for cars provide comprehensive coverage for repairs to your vehicle and may offer some added perks as well.

What Types of Extended Warranties Are There?

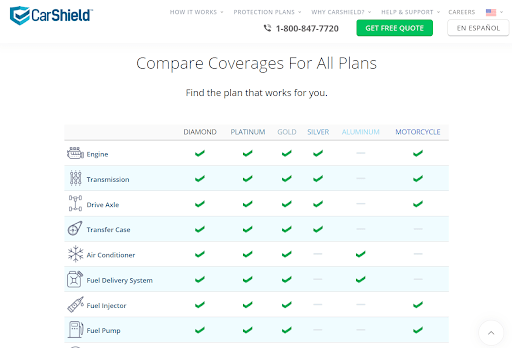

Extended car warranties fall into 5 main categories:

1. Bumper-to-bumper warranties offer the most comprehensive coverage around. Most bumper-to-bumper plans include repairs to a car’s major mechanical systems. Any exclusions to a bumper-to-bumper plan should be listed in the contract.

2. Powertrain warranties cover most internal parts of your engine and transmission. If your vehicle is older or has a lot of mileage on it, this type of coverage may be a good bet.

3. Drivetrain warranties cover the parts that make your vehicle move, like the transmission, driveshaft, axle shafts, and wheels. The car’s engine is not covered in a drivetrain warranty.

4. Named component warranties cover only the specific parts listed in the contract. Unlike a bumper-to-bumper warranty, which covers everything except what’s listed, a named component warranty details the items that are under warranty.

5. Wrap policies extend a bumper-to-bumper warranty to cover the parts of your vehicle after the bumper-to-bumper policy has expired.

What Are the Advantages of an Extended Warranty?

An extended car warranty has numerous advantages that far outweigh the costs of the warranty itself:

- It covers your car even after the manufacturer’s warranty has expired in terms of time or mileage.

- It protects your car’s various, complex parts that tend to get damaged, like smart systems.

- It allows you to make a claim for parts that fail or get worn out. These are things not typically covered by the manufacturer’s warranty.

- It offers convenient benefits like replacement rental coverage, towing services, and roadside assistance.

- It will give you the assurance and peace of mind to know that you’ve set up thorough protection for your car.

- It provides you with useful coverage for repairs so you can keep your vehicle running smoothly.

- You won’t be caught off guard by sudden expenses if you need repairs.

- If you choose to sell your car one day, having an extended warranty in place shows responsible ownership and makes it more likely that your car’s condition has been kept up to date. These are things that go a long way towards improving your car’s resale value.

What Car Warranties Won’t Cover

When shopping for an extended car warranty it’s important to know that an extended warranty won’t cover things like damage to a vehicle from a car accident, or anything that was already wrong with the car before the warranty was bought—in other words, pre-existing conditions.

If you wait until you really need the benefits provided by an extended warranty, you may not qualify for one, or you’ll pay more for lower-level coverage. This drives home the point about locking an extended plan in place before you ever need to make a claim.

What Should You Look for When Choosing an Extended Warranty?

- Look for a plan that makes a payment directly to the car mechanic, rather than one in which you lay out the money and then get reimbursed.

- Read the fine print to learn whether there are exclusions or limitations that may void your warranty.

- Ask questions to find out more about a plan’s flexibility.

- Verify whether the warranty contract can cover anyone else who drives your car.

- Don’t forget to check customer reviews to find out what others had to say.

How Can You Avoid Getting Scammed When Purchasing an Extended Warranty?

- The level of coverage you choose

- One-time or recurring fees

- Deductibles or other extra charges you may incur, like paying for an insurance adjuster

- Your maximum payout amount

How Can You Avoid Getting Scammed When Purchasing an Extended Warranty?

Unfortunately, extended car warranties have gotten a bad rap due to scam robocalls and swindlers who are out to defraud customers. Here’s how you can stay safe and avoid the scammers, while still getting access to reputable coverage.

- We’ve done your homework for you. The providers we recommend here have all been vetted by us, and you can trust their safety.

- Auto warranty robocalls are a known scam. More than merely annoying, these harmful calls can misuse your personal information. Always ignore spam calls.

- Be sure that any company you have dealings with is reputable and accredited by the Better Business Bureau.

- Remember, when shopping around for the best deal, if it sounds too good to be true, it probably is.

Scammers are sophisticated, and you need to be proactive to avoid being a victim.

FAQs

What Is an Extended Car Warranty?

An extended car warranty goes beyond your car’s factory warranty to cover the cost of repairs for a number of years or amount of miles. The warranty may cover repairs to the entire car (bumper-to-bumper) or to specific car systems (powertrain, drivetrain, etc.).

Is an Extended Car Warranty the Same as Car Insurance?

While both protect you, an extended auto warranty and auto insurance are two very different types of coverage. An extended warranty for cars pays for parts and labor costs in the event of a mechanical breakdown. Car insurance may pay to repair damage to your vehicle in case of a collision, theft, fire, or other disasters.

What’s the Difference Between Manufacturer and Third-Party Extended Warranties?

A new car usually comes standard with a manufacturer’s factory or dealership warranty. This coverage tends to be limited as it covers your car only in case of a manufacturing defect or malfunction. If the factory that produced the car caused the issue, it will be covered by your manufacturer’s warranty. A manufacturer warranty generally covers a car for three years and 36,000 miles.

A third-party extended warranty is protection you can purchase for longer or more extensive coverage. Also called a vehicle service contract, this type of warranty offers different advantages than the manufacturer’s coverage. For this reason, some car buyers opt to get an extended warranty plan for their vehicle even before the manufacturer’s warranty runs out.

Third-party extended warranties can offer you benefits like coverage for towing costs, and a replacement rental car while your vehicle is being repaired. They may allow you to choose your own repair facility or set up a monthly payment plan for repair costs, or reimburse you for the costs of certain repairs not covered by a manufacturer’s warranty.

.20211220140009.png)

.20210921093552.png)

.20211220140009.png)

.20211004105817.jpg)