In a Nutshell

pros

- No term contracts or cancellation fees

- Next-day funding for fast cash flow

- 24/7 customer support

cons

- Requires passing credit card fees to customers

What Is Kibo Pay?

Kibo Pay is a credit card processing service that deserves its spot among the best merchant services providers. For $29.99/month, you can process unlimited transactions without the usual fees eating into your profits. It's an excellent fit for businesses like restaurants, retail shops, salons, and even food trucks—any business where credit card payments are frequent and cutting costs is a priority.

What makes Kibo Pay appealing is how easy and flexible it is to use. You don’t have to worry about long-term contracts or sneaky cancellation fees, and it throws in free equipment too. With next-day funding and secure, PCI-compliant transactions, Kibo is a low-risk way to improve your bottom line. Plus, with its dual pricing model, you can pass credit card fees to customers, which could save your business thousands each year.

Ideal For

Kibo Pay is a great fit for business owners who want to simplify payment processing and keep more of their revenue. Here’s who benefits most:

Small businesses looking to eliminate credit card processing fees

Businesses with high credit card transaction volumes

Owners wanting no-contract, low-commitment payment solutions

Highlights

- Unlimited sales & unlimited transactions

- First 3 months free!

- No term contracts or hidden fees

Kibo Pay Features

Kibo Pay offers a range of features designed to simplify payment processing and save you money. Here are the key features that can make a difference for your business:

Credit card processing: Kibo Pay eliminates up to 100% of your credit card processing fees. You keep the full amount of every sale without having to pay a percentage to the credit card companies. This is great for businesses that rely heavily on card payments and want to stop fees from eating into their profits..

EMV-compliant terminals & POS systems: Kibo offers free, fully pre-programmed EMV-compliant terminals to get you started right away. POS systems from providers like Clover and Revel are also available, with pricing based on your setup needs.

Dual pricing model: This feature lets you pass credit card processing fees directly to customers who choose to pay with a card. It’s a smart way to avoid absorbing those fees yourself while still offering the convenience of credit card payments. This can add up to significant savings over time.

Unlimited transactions & sales volume: There’s no limit on how many transactions you can process or how much revenue you can generate. Whether you’re processing a few transactions or thousands, you pay the same flat monthly fee.

Next-day funding: Kibo Pay ensures that you get access to your sales funds quickly, with next-day deposits into your account. This helps improve your cash flow, which is especially important for small businesses that need fast access to working capital.

Online account management portal: Kibo provides an easy-to-use online dashboard where you can track transactions, view reports, and manage your account. It’s a one-stop shop for monitoring your business’s performance and staying organized.

Automatic qualification for working capital advance: When you sign up with Kibo, you're automatically pre-approved for a working capital advance based on your future sales. This gives you quick access to extra cash without a lengthy application process.

Kibo Pay stacks on plenty of other perks, too. Its system includes 24/7 customer support, robust security with PCI compliance, and the flexibility of no long-term contracts or cancellation fees. Plus, it throws in extra benefits like free equipment upgrades and industry-specific solutions for a wide range of businesses, from restaurants to e-commerce.

Is Kibo Pay Safe and Reliable?

Kibo Pay takes security seriously, ensuring that both your business and customers are protected throughout every transaction. One key aspect is PCI compliance, meaning Kibo follows Payment Card Industry data security standards to safeguard sensitive information and prevent fraud. While Kibo handles your in-store and mobile payments securely, it’s up to you to choose the right payment gateway for your online transactions to maintain overall security.

In addition, Kibo provides EMV-compliant credit card terminals for free. EMV technology, which uses chip cards, reduces the risk of fraudulent card-present transactions by adding an extra layer of protection during payment processing.

Kibo Pay also goes the extra mile to protect your personal data. It uses a combination of firewall barriers and SSL encryption techniques to protect your information from loss, theft, or unauthorized access. These measures help secure both your business and customer data, ensuring reliable and safe transactions every time.

With a solid 4.9/5 rating on Trustpilot, Kibo Pay is trusted by many small businesses for its secure and dependable service. And with next-day funding, you can count on getting your money fast, without delays.

How Kibo Pay Works

Kibo Pay makes credit card processing simple and cost-effective. When you sign up, it provides you with free, pre-programmed terminals or POS systems so you can start accepting payments immediately. Kibo works with all major credit cards—Visa, Mastercard, AMEX, and Discover—whether you're processing in-store, online, or via mobile.

You have two options for how you handle processing fees. With dual pricing, you can pass the credit card fees directly to customers who choose to pay with a card, helping you keep more of your revenue. If you prefer a more traditional model, Kibo also offers low-rate traditional processing, where you absorb the fees yourself.

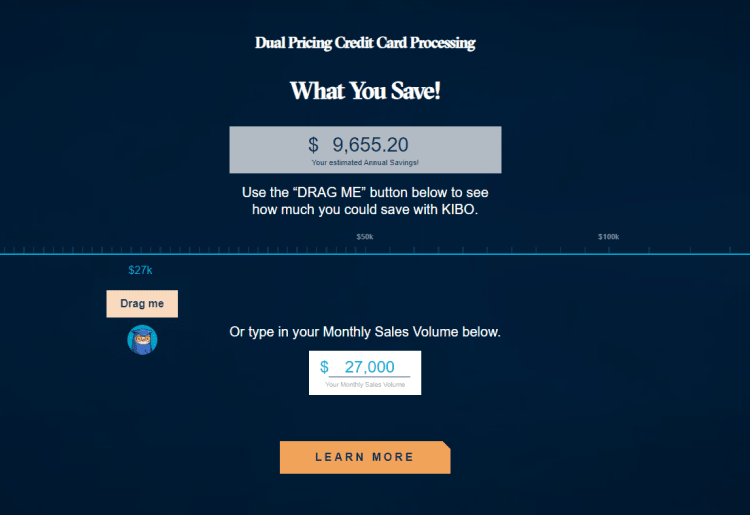

Kibo Pay features an interactive savings calculator on its website. Using a simple slider, you can input your monthly sales volume to estimate your potential annual savings with the dual pricing model. This tool gives you a clear idea of how much money your business could save by switching to Kibo Pay.

In either case, Kibo securely processes transactions, and you’ll see your funds deposited by the next business day. In short, Kibo Pay runs smoothly behind the scenes, letting you focus on your business while simplifying your payment process.

How to Get Started With Kibo Pay

Signing up for Kibo Pay is quick and hassle-free. You can either apply online by filling out a simple one-step form with your basic business details (like your name, company name, and monthly credit card volume) or contact its team directly over the phone. Once you've submitted the form, a Kibo Pay representative will get in touch to help finalize your account.

After approval, Kibo provides you with free, pre-programmed credit card terminals or POS systems, so there’s no complicated setup on your end. From there, you can start accepting payments immediately and benefit from its cost-saving processing options right away. It’s designed to be an easy and efficient process, ensuring you're up and running with minimal effort.

Application Process

With so many payment processing companies, choosing a merchant service account can give you a headache. Thankfully, Kibo Pay makes the application process as simple as possible. To get started, you'll only need to provide some basic information like your name, company name, monthly credit card volume, and contact details. There’s also an option to include an offer code if you have one.

Once you submit the online form or apply over the phone, a Kibo Pay representative will reach out to guide you through the final steps.

Kibo Pay Customer Service

Kibo Pay ensures you're supported around the clock with 24/7 customer service. They've been rated as Best in Card Processing Services 3 years in a row on Trustpilot, earning a 4.9 star rating.

Here’s how you can get in touch:

Phone:

General Inquiries: +1-844-383-9001

Support: +1-877-298-6524

Email:

support@kibopay.com

Every merchant is assigned a dedicated account executive, so you always have someone familiar with your business to provide personalized assistance.

While Kibo doesn’t offer live chat or additional resources like blogs or guides, the 24/7 availability and tailored support make its customer service both reliable and accessible.

How to Cancel or Pause a Kibo Pay Subscription

Kibo Pay makes canceling your subscription simple and stress-free. There are no term contracts, so you're never locked in. You can cancel anytime without facing cancellation or termination fees, giving you the flexibility to leave if the service no longer fits your business needs.

To cancel, just contact Kibo Pay's customer support team, and it will handle the rest. The process is straightforward, so you won’t have to jump through hoops or worry about hidden fees.

Is There a Kibo Pay App?

No, Kibo Pay does not have an app.

Kibo Pay Pricing

How Much Does Kibo Pay Cost?

Kibo Pay keeps things simple with a flat rate of $29.99 per month. For that price, you can eliminate up to 100% of your credit card processing fees and handle unlimited transactions. No hidden fees, no surprises—just straightforward pricing that helps your business keep more of its revenue.

That monthly fee also includes free EMV-compliant terminals and next-day funding, so you’re ready to go as soon as you sign up. Plus, Kibo automatically qualifies your business for a working capital advance, giving you quick access to extra cash if needed.

Here’s a breakdown of what you get:

Service

Cost

Details

Kibo Pay Plan

$29.99/month

Unlimited transactions, no processing fees

EMV-Compliant Terminals

Free

Provided with service, pre-programmed

Next-Day Funding

Included

Get funds deposited by the next business day

Working Capital Advance

Based on sales

Auto-qualified, flexible repayment terms

POS Systems (various providers)

Contact for pricing

Tailored POS options available

Kibo Pay’s flat-rate plan is straightforward and designed to save your business money. For a fixed monthly fee, you eliminate processing fees and handle unlimited transactions, which is especially valuable if your business has a high volume of card payments. The included EMV terminals and next-day funding ensure you're not only saving on fees but also getting quick access to your earnings.

The option to qualify for a working capital advance is another perk, providing financial flexibility without the need for lengthy applications or good credit. Overall, the simplicity and transparency of Kibo Pay’s pricing make it a solid choice for small businesses looking to cut costs and keep operations running smoothly.

Optional Add-Ons

Kibo Pay offers additional services that can be added to its standard plan. These options provide more flexibility and cater to specific business needs:

Point of sale (POS) systems: Custom POS solutions available from providers like Clover, Revel, and NCR Silver Pro (pricing upon request).

Working capital advance: Automatically available based on your future sales, with flexible repayment terms.

Additional terminals: Need more EMV-compliant terminals? You can add more to your setup (pricing based on equipment needs).

Bottom Line

After looking into Kibo Pay, it's clear that it’s a strong option for small businesses that want to cut down on processing fees without much hassle. The $29.99/month fee is straightforward, and the setup is quick with the free EMV terminals. I like that you’re not locked into any contracts or cancellation fees, which takes the pressure off. The dual pricing model is a great way to shift fees to customers, and the next-day funding keeps cash flow moving smoothly.

That said, the lack of live chat or additional support resources like FAQs could be a drawback if you prefer more self-service options. Still, if you need a simple, affordable way to keep more of your revenue, Kibo Pay delivers. It’s a no-nonsense solution that’s easy to work with, and the working capital advance adds a nice layer of financial flexibility.