In a Nutshell

pros

- Attorney support available

- Access to deceased member’s account

- User-friendly platform

cons

- No flat-fee option for a simple will, only bundles

- Requires a $19 annual fee for document updates

What Is Trust & Will?

Trust & Will provides a convenient platform for creating, editing, storing, and sharing your estate planning documents. This legal services platform lets you track your progress and easily change completed sections. Your documents are securely stored in one digital location, allowing you to manage them effortlessly.

Trust & Will's documents undergo rigorous legal vetting by estate planning experts to ensure they meet strict standards. For $300 per year, you can add attorney support to any plan for added peace of mind or personalized advice for complex estates. This gives you one-on-one access to a licensed attorney in your state.

Trust & Will Features

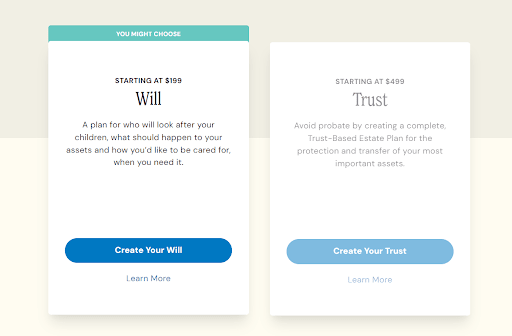

Will-Based Estate Plans

Only 32% of Americans have a will, with many believing they lack sufficient assets to need one. Trust & Will, a top online will maker, offers a comprehensive Estate Plan that stands out from competitors. While most providers charge extra for additional estate planning documents, Trust & Will's package includes:

- Last will and testament

- Living will

- HIPAA authorization

- Power of attorney

This all-in-one plan allows you to distribute assets, specify healthcare preferences, and name guardians for your children. It's customized to your state's laws and ensures that your assets and loved ones are fully protected.

Trust-Based Estate Plans

Trust & Will's comprehensive estate planning solution centers around a revocable living trust. This lets your assets bypass probate court and transfer directly to your beneficiaries. It includes an array of customized legal forms. With this plan, you can:

- Nominate guardians for your children and pets

- Itemize assets held in the trust

- Make specific gifts and determine asset distribution

- Exclude individuals from receiving property

Deed Transfer

Trust & Will has partnered with uDeed to simplify transferring real estate assets, like your home, into your trust. This crucial step maximizes your trust's protective benefits. uDeed's team guides you through the entire deed transfer process from the comfort of your home.

Simply schedule a call to provide basic information, and uDeed will confirm the details, explain what to expect, and ensure your most valuable assets are properly transferred into your trust.

Probate Services

Trust & Will provides customized support to simplify the probate process. To start, create an account and share details about your situation. Trust & Will will then recommend the most suitable probate plan for your needs.

The Concierge Support option ($1999) pairs you with a dedicated probate specialist who offers step-by-step guidance. For comprehensive assistance, the Attorney Support plan ($5000) grants access to both a licensed probate attorney and a probate specialist to manage the entire estate.

If you're unsure about the best course of action, schedule a free 30-minute consultation with a Trust & Will probate expert to discuss your options and receive personalized advice.

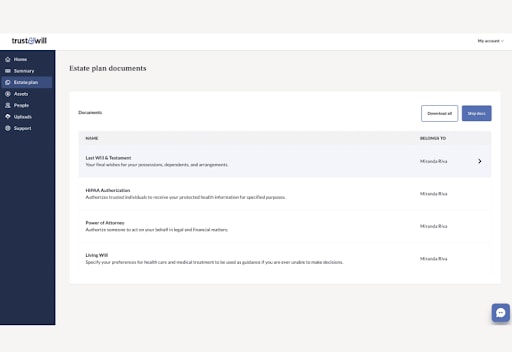

Document Sharing

Once you've created your estate planning documents, you must notify the individuals you've designated as decision-makers, beneficiaries, and executors about their roles. Trust & Will simplifies this process by allowing you to share access to your documents online.

Simply send an email invitation through the platform, permitting them to view your estate documents. If needed, you can easily revoke a person's access to your account at any time.

Document Management and Storage

Trust & Will's cloud storage service provides a secure place to store all your digital and scanned documents, including your estate plans. Bank-level encryption protects your valuable information, giving you peace of mind.

A third-party SOC 2 Type 2 audit has independently verified their robust, ongoing security measures. This makes Trust & Will an ideal choice for safeguarding essentials like your will, real estate deeds, IDs, and car titles.

You can also easily update your estate planning documents. Simply log in to your account and make any necessary changes. The company suggests updating your plan after any major life event or every three to five years.

Access to a Deceased Member’s Account

If a Trust & Will member passes away, their account can be accessed by someone with legal authority to act on the deceased's behalf. They should contact the Member Success team and provide the required legal documentation to gain access.

Is Trust & Will Safe and Reliable?

Trust & Will takes data protection seriously, using 256-bit encryption for stored data and secure protocols for data transfer. It leverages Amazon Web Services for reliable cloud systems and holds an SSL/TLS certificate from DigiCert®. The company respects your privacy and won't share or sell your information without consent.

If you delete your account, Trust & Will ensures all data is completely removed within 35 days. It has undergone independent audits (SOC 2 Type II and HIPAA) to verify its strict security policies and procedures. The company's A+ Better Business Bureau rating further demonstrates its reputation as a top online willmaker.

It also has disaster recovery and business continuity plans in place. If you ever have concerns about your security, you can email the company at security@trustandwill.com.

How Trust & Will Works

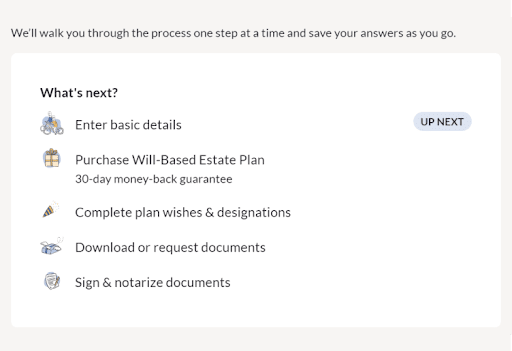

Trust & Will offers a simple, elegant estate planning solution. Its platform lets you create a legally binding trust or will from the comfort of your home without hiring expensive attorneys. You only need to gather your important documents and information, select your state of residence, and create an account.

This is followed by a click-through questionnaire to generate your desired documents. Depending on the level of detail provided, most users complete the questionnaire in 15 minutes to an hour.

Before you start filling out forms, Trust & Will presents an informational page titled "What happens if you die without a Will?" This ensures that you have a solid understanding of the importance of estate planning before purchasing.

The process begins with providing basic details, such as your name, birthdate, and relationship status. Each question offers a "Learn more" option, which includes FAQs that provide additional context and answers to personal detail-related questions.

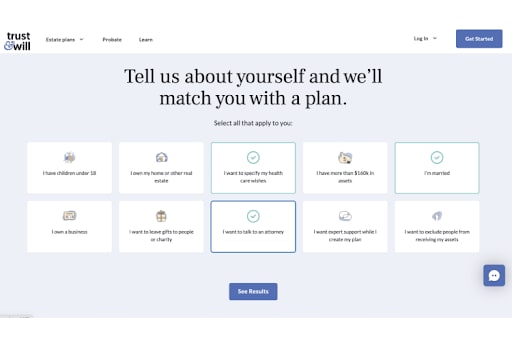

How to Get Started With Trust & Will

- Visit the Get Started page and select a category that suits your needs (e.g., "I want to leave gifts to charity").

- Click "Create Your Will" to begin the process.

- Enter your personal details, marital status, and location.

- Purchase your desired Estate Plan (will or trust-based).

- Complete your specific plan wishes and designations.

- Download the documents immediately or request printed copies with complimentary shipping.

Your Estate Plan purchase also provides one year of free updates. This allows you to modify your documents as life circumstances change, add an up-to-date list of assets, and store important files for loved ones to access. After the first year, updates have an annual fee of $19 to maintain this service.

Trust & Will Customer Service

Trust & Will's customer service is available through live chat during these hours:

- Monday - Friday: 7 am - 5 pm PST / 10 am - 8 pm EST

- Saturday: 7 am - 2 pm PST / 10 am - 5 pm EST

Emailing support@trustandwill.com will get you a response within 1-3 business days. For immediate assistance, you can chat with Will-E, the 24/7 chatbot that can answer common questions. Phone support is also available Monday through Friday from 8 am to 5 pm PST / 11 am to 8 pm EST at 1-866-908-7878.

Additionally, a helpful Learn Center covers many topics, including trusts, wills, probate, guardianship, and estate planning. The company's extensive FAQ page provides answers and detailed how-tos for your estate planning needs.

Is There a Trust & Will App?

Trust & Will doesn't have an app at the moment.

How Much Does Trust & Will Cost?

What Can You Do With Trust & Will for Free?

Trust & Will offers a free consultation to help you determine which service best suits your needs. During this session, you’ll speak to a legal expert who can answer any questions about creating a will or trust.

Optional Add-Ons

Attorney Support

If you need additional help planning your estate and getting your affairs in order, Trust & Will offers estate planning attorney support, which you can add to any plan for $300. This service provides you with one-on-one time with a licensed estate planning attorney in your state and unlimited phone access to an attorney in your state for 12 months.

With this service, you'll receive detailed and specific advice on funding your trust, access to customized legal advice, and an understanding of specific state laws to help you protect yourself and your estate.

Deed Transfer

To fully protect your home with your trust, you must retitle the deed in the trust's name. Trust & Will's experts will handle retitling your real estate into the trust for an additional $265 per deed.

Discounts

Trust & Will offers the following discounts:

- First-time users: If you’re new to Trust & Will, use the code "Gimmie10" for a 10% discount.

- Healthcare Worker Discount: A 25% discount on a will or trust for healthcare workers. Employment verification is required via VerifyPass.

- Educator Discount: A 25% off voucher for US educators working in K-12, higher education, or another classroom setting. Employment verification is required via VerifyPass.

Bottom Line

Trust & Will is a top competitor in the online estate planning industry, offering a convenient and efficient solution for creating wills and trusts. The platform is easy to use and assists at every step of the process, ensuring a hassle-free experience.

If you're dealing with probate court after a loved one's passing, its experts will guide you. Once your documents are finalized, the platform organizes them neatly and provides clear signing instructions. Trust & Will's summary gives your legal representative the essential details of your decisions, making it easier for them to understand and execute your wishes.