QuickBooks Review - Invoicing Platforms For Small Business

November 11, 2025

•

4 min

November 11, 2025

•

4 min

Target Users: Entrepreneurs, freelancers, and businesses of all sizes seeking financial automation

Key Features: Invoicing, expense tracking, payroll, inventory management, budgeting, CRM tools, and financial reporting

New for July 2025: Smart search, AI-driven customer and accounting agents, anomaly detection, business feed, finance/project profitability tools, and enhanced CRM functionality including eSignatures

Integration: Compatible with over 750 third-party apps, including PayPal, Shopify, and Stripe

Accessibility: Available via web and mobile apps (iOS and Android), supporting remote access and real-time sync

Support: Tiered live support depending on plan, with extended access for Advanced users

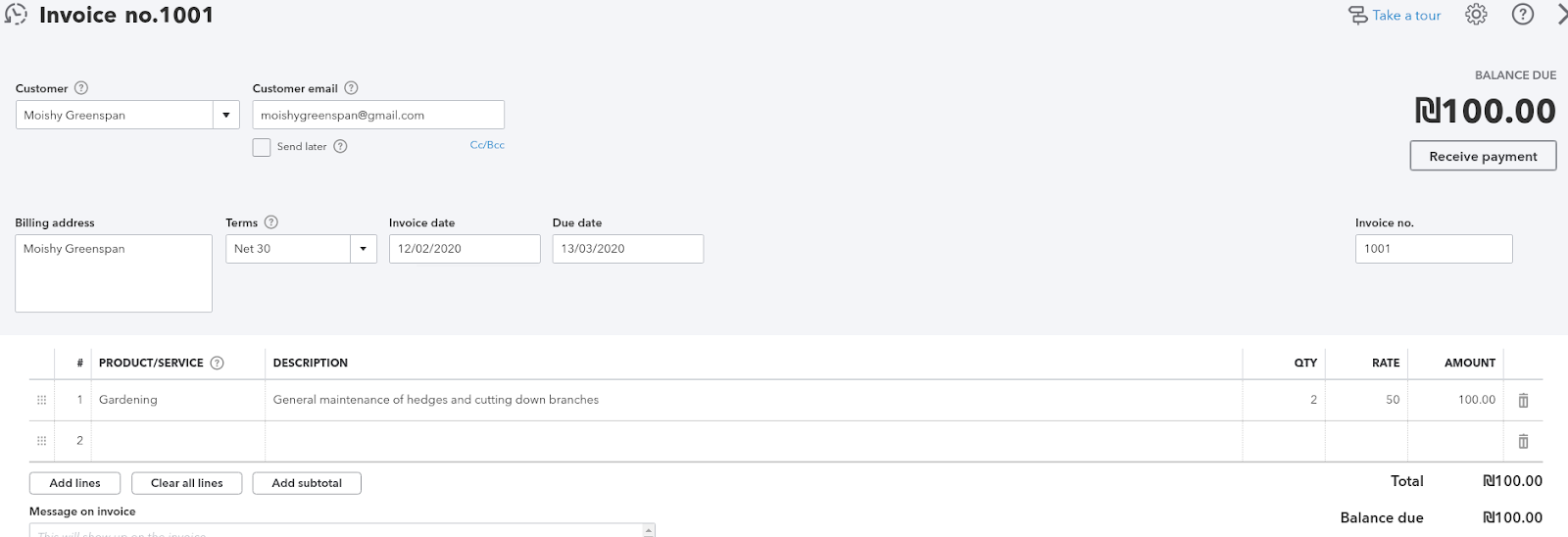

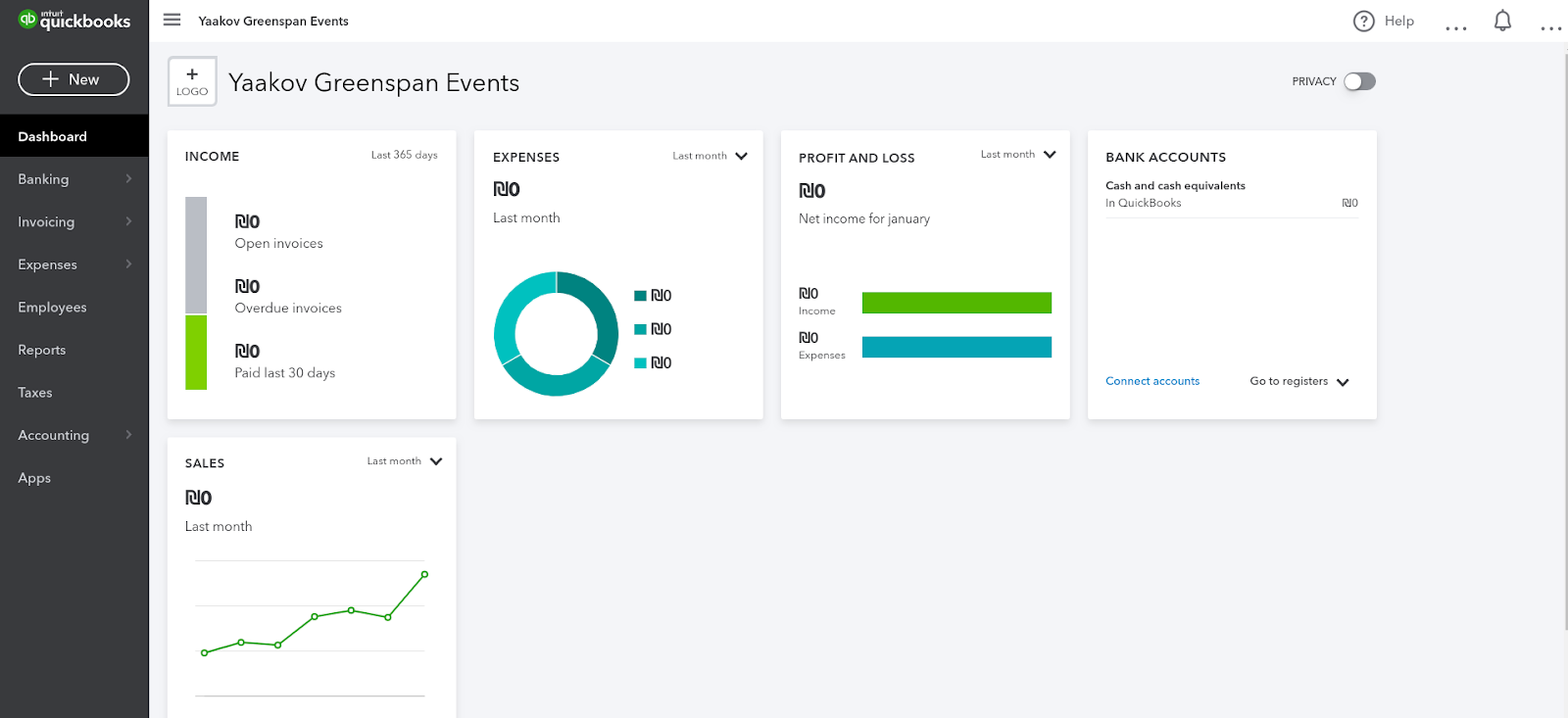

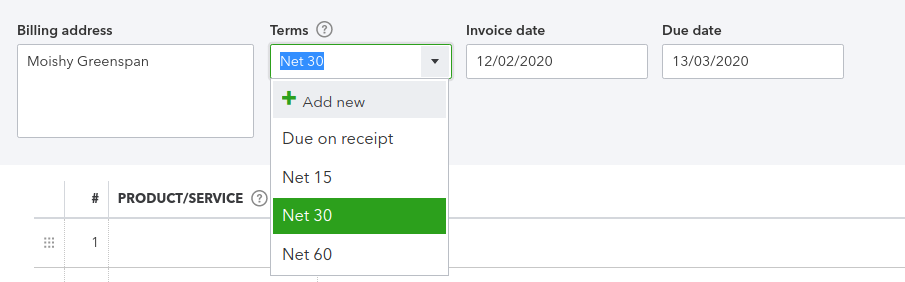

Invoices generated through QuickBooks integrate with the accounting side of the platform which is also hosted on the cloud.

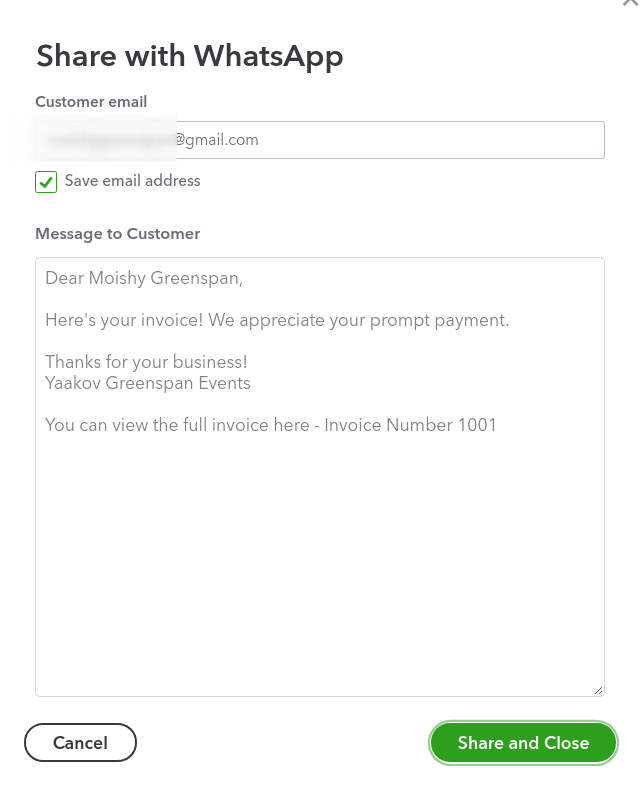

Modern business is conducted by email, over the phone and …. By WhatsApp! QuickBooks gives users the ability to quickly download a copy of the generated invoice, send it by email or quickly send it through the WhatsApp messaging system.

Additionally, users can choose to send the invoice over traditional email. When they do so, the preview screen provides an overview of what the finished document’s appearance is going to look like.

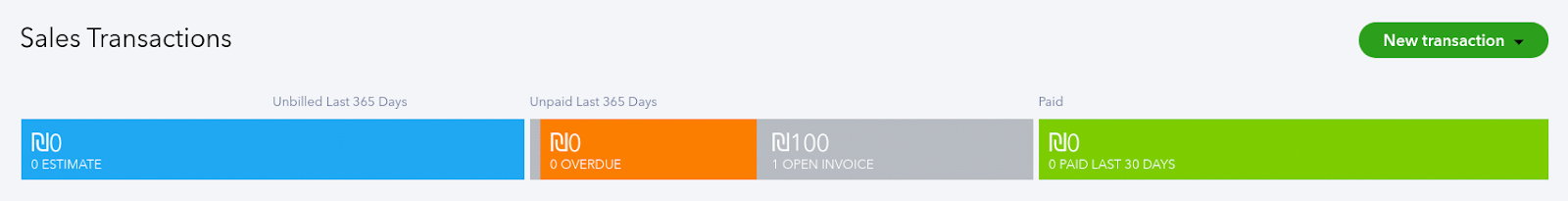

Users are also able to obtain a high level overview of current invoicing totals including the total amount outstanding, the total amount overdue, and the total paid in the last 30 days:

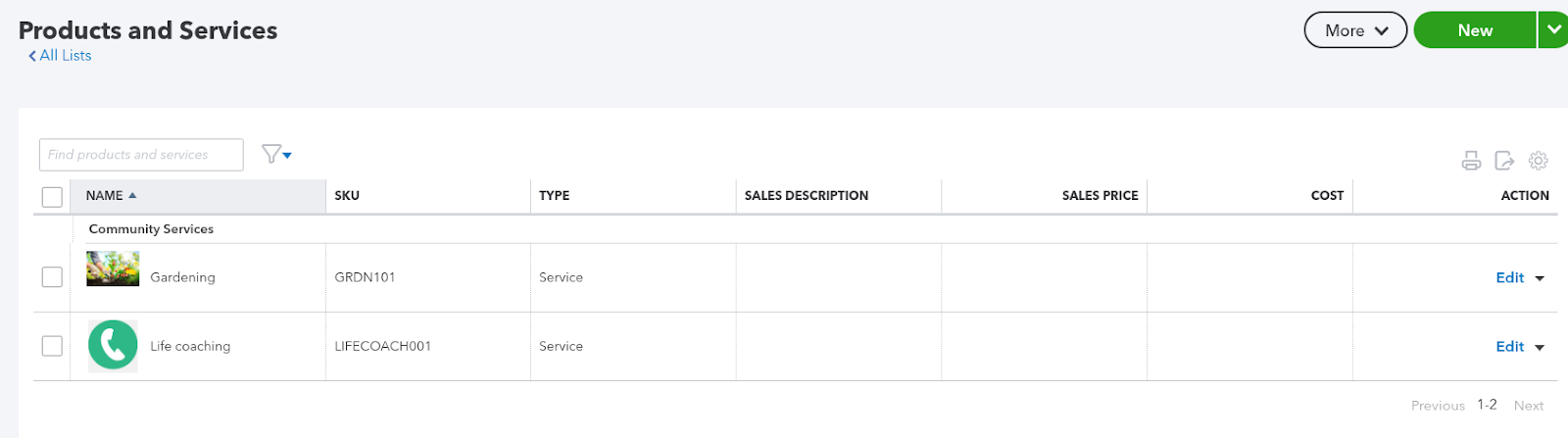

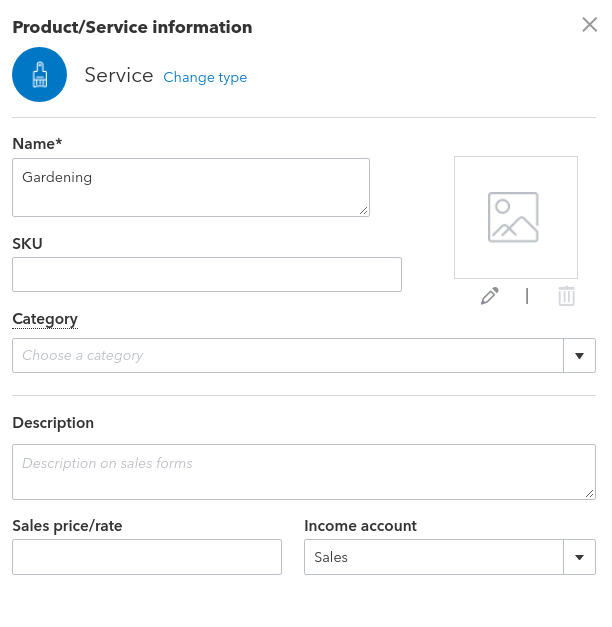

Forget dull lifeless stock-keeping lists. Quickbooks allows users to assign photos to their stocklists making it fun and visually exciting to pull together invoices.

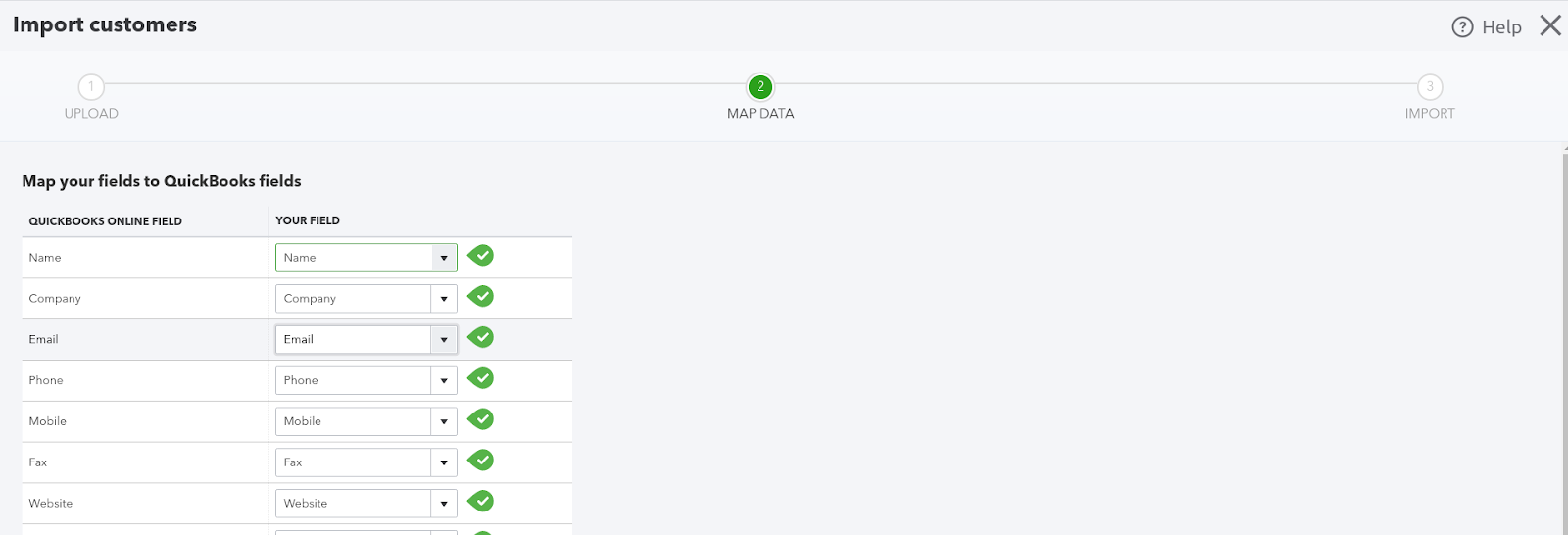

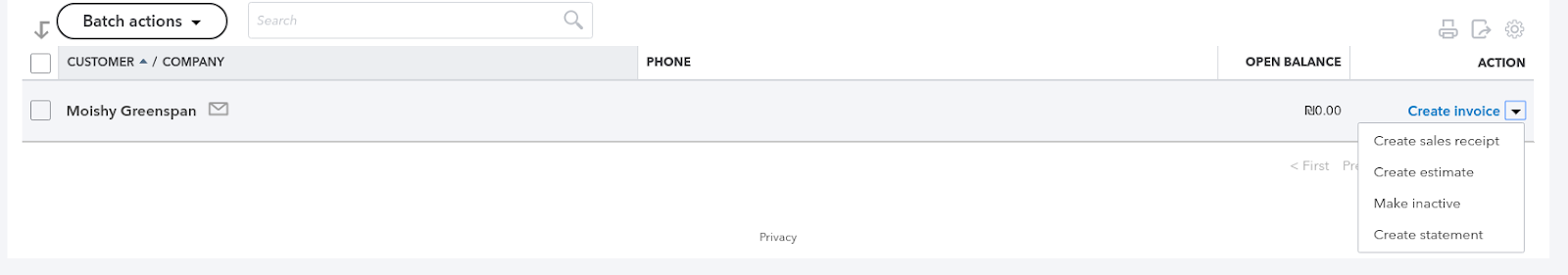

Customers that have a lot of customer records to import and start billing will appreciate QuickBooks’ CSV and Excel importer. All users have to do after uploading their customer records is to map the fields.

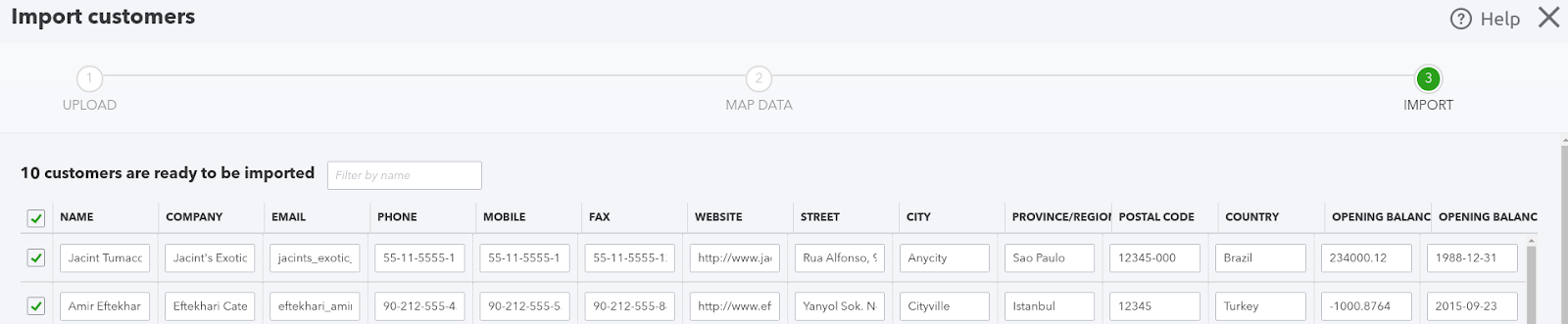

Finally, all users need to do is click ‘Import’ in order to finish the upload process and add the customers as billing entities for invoicing purposes.

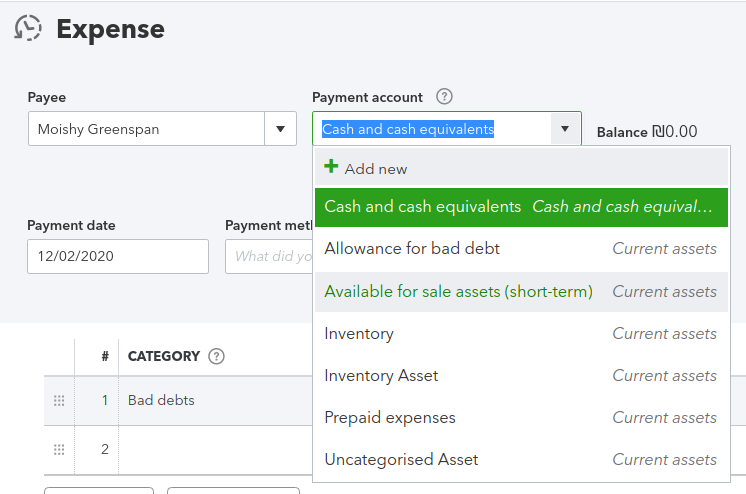

One area in which Quickbook excels is its ability to produce a variety of commonly requested accounts completely automatically. The list of accounts that can be generated includes:

Cash and cash equivalents report

Accounts receivable report

Bad debt allowance report

Inventory asset report

Prepaid expense report

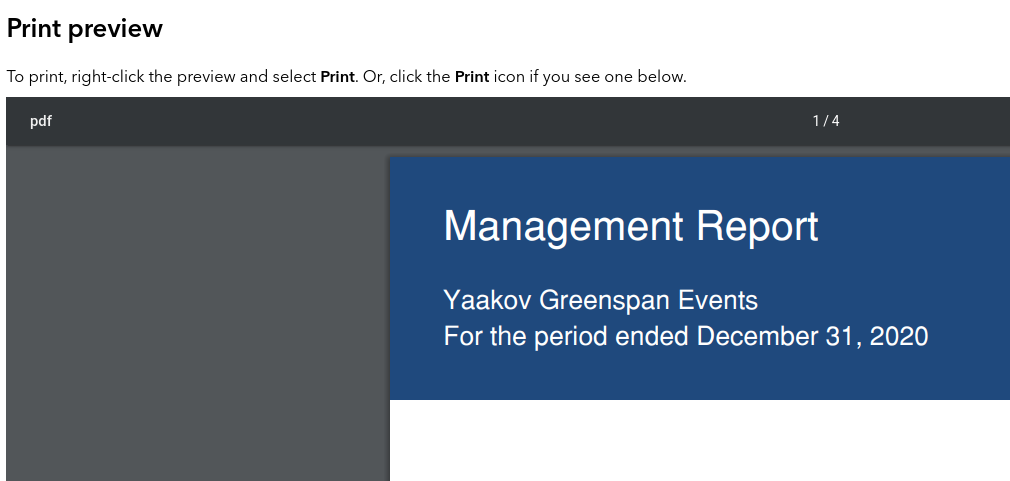

In order to generate reports for the first time, users simply click on the ‘Run Report’ button. After that, users are able to download the reports in PDF or spreadsheet format. They can also call up a PDF preview window to show what the finished report document will look like:

If users make customizations to any of the standard reports, they will be prompted to save them. They can then be recalled and automatically generated from the Customized Reports list.

In the course of creating invoices for clients, many users are also likely to remember business expenses that should be input into the system. This is another area in which QuickBooks has staked out a well-deserved reputation as one of the leaders in the space. The QuickBooks mobile app, for instance, allows users to take photographs of receipts. These will then sync automatically up to the cloud-based platform and the system will even parse the contents by itself.

The system comes prepopulated with a number of expense categories. For those adding expenses that are dual personal/business use this makes it easier to prepare the end of year accounts and work out exactly what can be written down—and to what percent.

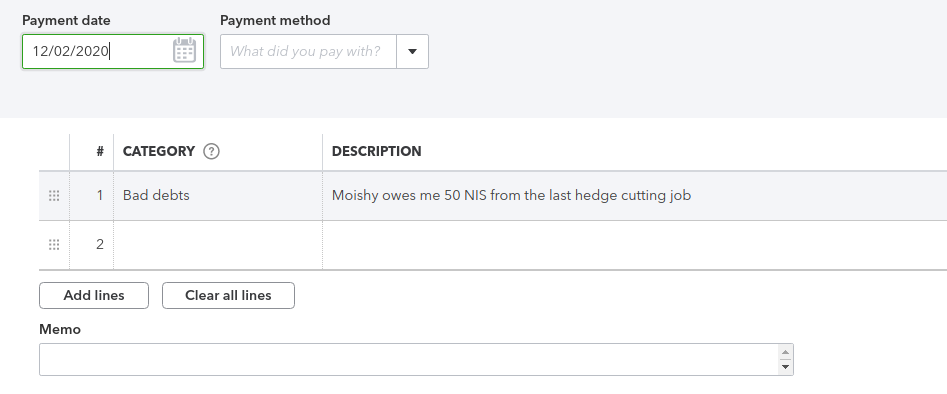

Additionally, users are also able to make note of what expense account was used to pay out from. Users can also use the expense functionality to write down bad debts that have not been collected.

QuickBooks can also be connected to a bank or credit card provider in order to automatically receive details of inbound transactions. Once the integration has been successful, users can flag what kind of account it is and transactions will automatically populate within the system. Users can manually match inbound payments with invoices to customers, although the system will also try to do this automatically.

| Package | Price | Who It’s For / Key Features | July 1, 2025 Feature Updates |

|---|---|---|---|

| Simple Start | $38 | Best for solo entrepreneurs: invoicing, expense tracking, and general reports. | Smart search, business feed, progressive onboarding, tax readiness, basic automation |

| Essentials | $75 | Best for small teams needing time tracking, bill management, and multi-user access. | Accounting & payments agent, auto-posting, customer CRM (referrals, tasks, appointments) |

| Plus | $115 | Best for growing businesses managing projects, inventory, and job costing. | Customer agent (beta), AI reconciliation, anomaly detection, CRM with contracts, and eSignatures |

| Advanced | $275 | Best for scaling businesses requiring advanced analytics, automation, and support. | Finance & projects agents (beta), KPI scorecard, enhanced automation, and reporting tools |

Beginning July 1, 2025, Intuit QuickBooks Online is launching a new suite of features across all tiers to enhance user experience and reduce manual tasks through AI-driven tools.

Simple Start now includes:

Smart Search: Customizable filters and column visibility for faster access to transactions, accounts, and help topics.

Business Feed: Consolidates updates from AI agents with actionable next steps and key highlights.

New Suite of Apps: Adds more utility to business workflows.

Progressive Onboarding: Streamlined setup experience for faster deployment.

Basic Automation & Tax Readiness Tools: Prepares users for smooth compliance and fewer manual entries.

Essentials adds:

Accounting & Payments Agent: Enhances real-time organization of books, facilitates faster payments with proactive recommendations.

Ready to Post / Auto-post & Collaboration Tools: Enables quicker transaction finalization and improved accountant communication.

Customer Hub (CRM): Centralizes referrals, feedback, scheduling, and relationship management with built-in task tracking.

Plus includes:

Customer Agent (beta): Scans emails to identify leads, drafts follow-ups, and logs status.

AI Reconciliation and Anomaly Detection (beta): Identifies transaction irregularities and streamlines bank reconciliations.

Insights Dashboard: Offers P&L and balance sheet intelligence to highlight trends and financial risks.

Expanded CRM Functions: Adds lead tracking, contract uploads with eSignatures, and a unified customer management interface.

Advanced upgrades with:

Finance & Projects Agents (beta): Provides profitability tracking and bookkeeping automation for project-based businesses.

KPI Scorecard: Visual dashboard for instant assessment of key performance indicators.

These updates are designed to reduce reliance on third-party tools and introduce AI-powered efficiency across accounting and client management processes. They reflect a significant shift toward automation and business intelligence within the QuickBooks ecosystem.

QuickBooks is a platform that has enough features to satisfy both small users and enterprise clients. Its user interface is uncluttered and easy to navigate around. Overall, it’s a highly usable invoicing platform.

QuickBooks is not the most feature-rich of the invoice solutions that we have tested. However, it does provide a well-rounded basic suite of functionalities for invoicing clients, tracking expenses, and generating reports. In fact, its rich suite of accounting reports and its app-based expense capture system are its 2 standout features. This is a tool that we strongly recommend.

Top10.com's editorial staff is a professional team of editors and writers with dozens of years of experience covering consumer, financial and business products and services.