- Continuously scans over 140 data broker databases

- Hides your identity while you browse

- Handles data deletion on your behalf

- Limited Time Sale: Buy now and save up to 68%

- Deletes personal info from data search sites

- Scans popular data broker sites for your info

- Get 52% off your first year

- Reduces your online footprint with opt-outs

- Spam and junk mail list removal service available

- Save up to 73% on Ultra Protection

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Proactive monitoring & real-time alerts

- 24/7 customer & recovery Services

- Stolen funds reimbursement up to $2M

- Offers data broker removal services

- Up to $1M reimbursement

- A+ rating from the Better Business Bureau

- Continuously scans over 140 data broker databases

- Hides your identity while you browse

- Handles data deletion on your behalf

- Limited Time Sale: Buy now and save up to 68%

What are identity theft and data removal services?

Identity theft protection services combine digital monitoring, insurance-backed recovery, and data removal, and data deletion recovery support to safeguard your personal and financial identity. These platforms track activity across credit reports, the dark web, social media, and data broker directories. When suspicious usage, stolen info, or public exposure is detected, you receive real‑time alerts and access to recovery specialists. Additionally, many services include tools for removing personal information from internet platforms to shrink your online footprint by deleting names, addresses, contact info, and public records listings.

Key Insights

- Identity protection and data removal services are no longer optional; they’re essential in 2025.

- Manual removal is possible but inefficient; professional services provide automation, broader broker coverage, monitoring, and restoration assistance.

- Choose platforms that combine data removal with identity monitoring, recovery support, and privacy tools for best results.

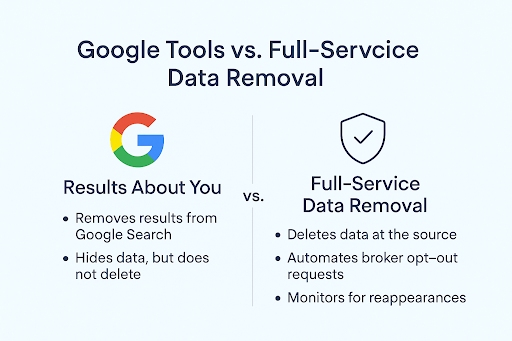

- Tools like Google’s “Results About You” help remove your info from search results, but don’t delete it from original data brokers; brokers reindex and re‑list aggressively.

- Services like Aura, LifeLock, and IdentityGuard automate opt‑outs from broker sites to reduce risk of identity theft, often as part of broader identity protection packages.

Why do identity theft protection and data removal services matter in 2025?

The identity theft landscape in 2025 is more sophisticated and more dangerous than ever. Cybercriminals now use AI-enhanced tools to scrape, reassemble, and exploit leaked personal profiles from data broker sites, public court records, and social media platforms. This puts individuals' internet privacy at greater risk than ever before. Unlike older scams focused solely on credit card theft, today’s identity fraud includes synthetic identity creation, medical fraud, and unauthorized access to retirement accounts or government benefits.

In 2024, the FTC reported over 1.1 million identity theft incidents in the U.S., with most linked back to publicly exposed personal data. Hackers and fraudsters frequently source this information from people-finder platforms and public aggregators, where names, addresses, emails, and phone numbers are readily available. Without proactive identity monitoring and automated removal of pages for personal information, individuals remain highly vulnerable to repeated breaches and financial loss.

In 2025, protecting your identity means shrinking your digital footprint as much as securing your credit.

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information.

We provide a range of services, including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

Should I DIY or use a paid data removal service?

Free tools like Google’s “Results About You” can help you remove personal details from search engine results—but they don’t delete the original data. These tools only delist URLs from Google’s index, making your information harder to find via search, but not removing it from broker databases or people-search sites. The actual data remains live on people-finder platforms, marketing databases, and public record aggregators, which are often re-scraped and re-listed by new broker sites.

Why that’s a problem:

- Data brokers continuously reindex profiles from public and semi-public sources like court records, social media, and marketing lists.

- Even after opt-out, many brokers resurface your data weeks or months later, requiring ongoing removals.

- New aggregators and mirror sites often republish old records, expanding your exposure.

Identity theft protection tools with automatic broker opt-outs

To address this, top identity protection providers like Aura, LifeLock, and IdentityGuard now include automated data broker removals as part of their plans. These tools:

- Scan, remove, and monitor your information across hundreds of data broker sites.

- Provide bundled features such as:

- Real-time fraud alerts

- Dark web and SSN monitoring

- Identity restoration agents

- Up to $1 million in identity theft insurance

This transforms identity protection into a comprehensive privacy solution, not just reacting to fraud, but actively reducing your risk by keeping your personal data offline.

DIY vs Paid: What’s the trade-off?

- Manual removal is possible, but can take hundreds of hours and requires constant follow-up as information resurfaces.

- Paid services offer automation and speed, but require sharing your data with a third-party, making it a trade-off between convenience and privacy control.

Bottom line:

Google’s tools are useful for hiding your information in search, but only automated removal services ensure deletion at the source. For full privacy protection, using both gives you the most robust defense against identity exposure and improves long-term success in removing pages for personal information.

How do these data-removal services work?

- Audit & identify: Scan search engines, people‑finder sites, broker listings for personal info like name, address, email.

- Opt‑out & removal: Submit legal requests or forms to remove your data from public broker lists.

- Continuous monitoring: Services re‑check broker sites regularly and re‑submit opt‑outs if re‑uploads occur.

- Identity protection backup: Monitor credit, dark‑web, public records; alert user; provide restoration support and insurance coverage.

Key features to look for in a professional identity/data removal service

- Data broker coverage: removal from hundreds of listings (e.g., WhitePages, Spokeo, people‑finder databases).

- Automatic opt‑out automation: continuous re‑monitoring and re‑submission.

- Combined identity monitoring: credit reporting, dark‑web scans, social media scanning, public records checks.

- Recovery assistance and insurance: legal support, fraud restoration, insurance coverage up to ~$1 million.

- Privacy-enhancing extras: VPN, password manager, anti‑tracking tools

Our Top 3 Picks

- 1

exceptional9.8

exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

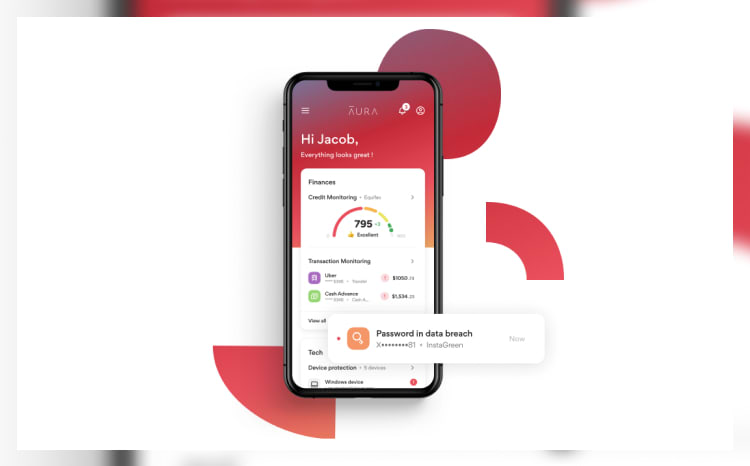

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

excellent9.2

excellent9.2 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

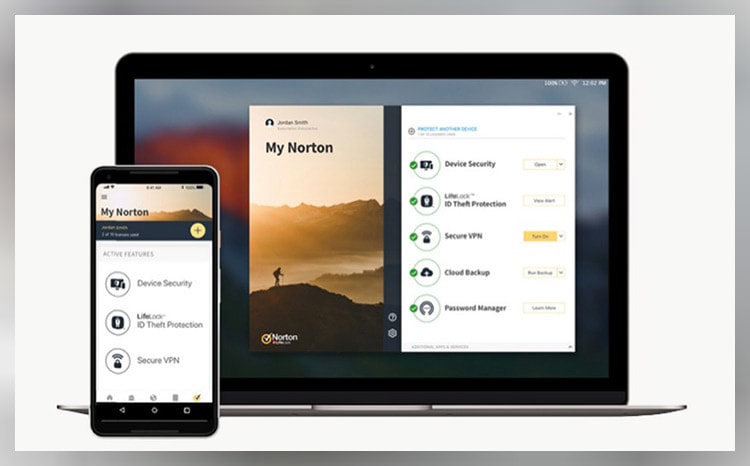

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

very good8.9

very good8.9 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

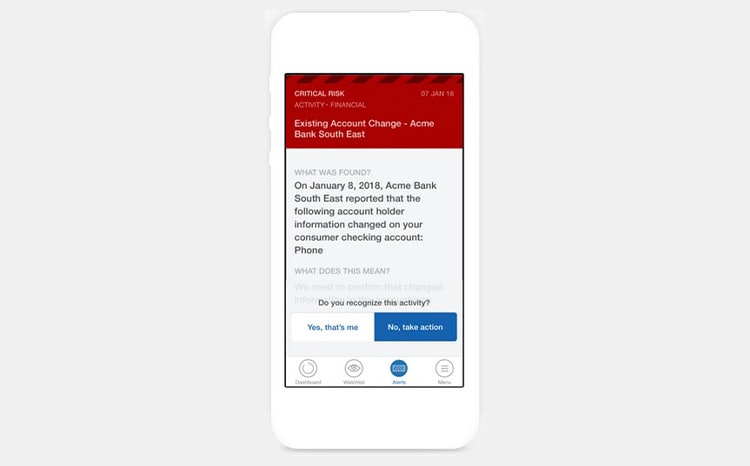

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans