- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

- 60-day money-back guarantee

- Up to $1M reimbursement

- Enjoy 52% off your first year

- Up to 3-Bureau Credit Monitoring

- Dark web monitoring & SSN alerts

- Special offer: Save 73% on Ultra Protection

- Scam Protection and Identity Theft Insurance

- View your digital footprint

- Try for only $1

- Proactive monitoring & real-time alerts

- Credit report reminders

- Repays up to $1M for stolen funds & expenses

- Regular credit monitoring & alerts

- Up to $1M reimbursement

- A+ rating from the Better Business Bureau

- Secures every account and interaction

- Online activity monitoring

- Personalized, all-around protection, try for free

- 3-bureau credit monitoring and credit reports

- Up to $5 million identity theft insurance

- Antivirus, VPN and password manager

- Save up to 68% today

What is identity theft protection?

Identity theft protection is a suite of digital services designed to safeguard your personal, financial, and online identity data. These tools actively monitor sensitive information, such as your Social Security number, credit report, and online accounts, for suspicious or unauthorized activity.

If a threat is detected, you're alerted immediately via text, email, or app notifications. This allows for rapid response, minimizing potential damage. Most providers also include identity restoration support, offering dedicated agents to guide victims through the recovery process.

Services often come bundled with identity theft insurance, which can cover legal costs, stolen funds, and out-of-pocket expenses related to resolving fraud.

Key Insights

- Identity protection services monitor your data, alert you to threats, and help with recovery.

- Unlike credit monitoring, identity theft protection covers broader threats plus recovery assistance.

- Warning signs include mystery charges, missing mail, unknown credit inquiries, and strange collection calls.

- Prevent theft with unique passwords, two-factor auth, safe Wi-Fi use, and document shredding.

Why is identity theft protection important in 2025?

Identity theft continues to evolve as cybercriminals find more advanced methods to access personal data. In 2024 alone, the FTC reported more than 1.1 million cases of identity theft in the U.S. The most common types were credit card fraud and unauthorized loan applications, often stemming from leaked data on the dark web.

As digital dependence increases, so does risk. Online banking, remote work, e-commerce, and social media all expose users to various vulnerabilities. Identity theft protection services help consumers detect breaches quickly, mitigate financial loss, and access expert help.

In 2025, these tools are no longer optional. They are essential for individuals, families, and businesses who prioritize financial safety and privacy.

Compare With Top10.com, Choose the Best for You

At Top10.com, we recognize the importance of thorough and accurate product and service reviews in guiding your choices. Our team, comprising editors and industry experts, conducts extensive research to provide comprehensive insights. Our content is continually updated to reflect the latest market trends, offering current information.

We provide a range of services including comparison lists and in-depth reviews, all tailored to meet your specific needs. Our goal is to empower you to make confident and informed choices.

How does identity theft happen?

Identity theft often starts with lapses in digital hygiene or sophisticated cyberattacks. Here are the most common methods:

- Phishing attacks: Emails or texts pretending to be from trusted institutions asking for personal info.

- Data breaches: Hackers gain access to company databases, leaking millions of personal records.

- Public Wi-Fi snooping: Hackers intercept data on unsecured networks.

- Weak passwords or reused credentials: Easy to crack or already exposed in other breaches.

- Social engineering: Scammers use public data to impersonate you.

Once your information is compromised, it can be used to open credit cards, file tax returns, or apply for loans—all in your name.

Sources:

How do I check if someone stole my identity?

Look out for these red flags:

- Charges on your statements that you don’t recognize

- Mail not arriving, or redirected without request

- Credit applications you didn’t make

- Debt collectors contacting you for unfamiliar accounts

- Alerts from ID protection services about your data being found on the dark web

Regularly reviewing your credit report and bank statements is a practical, early-detection step.

How do identity theft protection tools work?

Identity theft tools scan credit reports, the dark web, public records, and social platforms to flag threats. You’re notified instantly if suspicious activity is detected. Most services also provide recovery agents to help with disputes and offer extras like VPNs and password managers.

| Feature Category | Example Features | Benefit |

|---|---|---|

| Monitor & Detect | Credit checks, dark web scans, social media activity | Early fraud detection |

| Alert | Email/SMS/app notifications for suspicious activity | Real-time awareness |

| Restore | Identity restoration agents, legal help, insurance | Fast recovery and financial protection |

| Cybersecurity Tools | VPN, password manager, antivirus, anti-phishing tools | Prevents fraud before it occurs |

| Additional Coverage | SSN tracking, lost wallet help, mail redirection alerts | Full-spectrum identity safety |

Not every provider includes all features, so compare plans based on your risk profile.

What key features should I look for when choosing an identity theft protection service?

When evaluating services, look for these features:

- Comprehensive Monitoring: Includes credit activity, dark web, bank accounts, social media, public records, and more.

- Real-Time Alerts: Immediate notification for suspicious activity via multiple channels.

- Dedicated Recovery Assistance: Expert help for filing disputes, restoring identity, and liaising with institutions.

- Theft Insurance: Up to $1 million in coverage for legal fees, lost wages, and stolen funds.

- Cybersecurity Tools: VPNs, antivirus software, password managers, and anti-phishing tools to prevent fraud.

What’s the difference between identity theft protection and credit monitoring?

Many people confuse credit monitoring with identity theft protection. While similar, they differ significantly in scope:

- Credit Monitoring: Tracks your credit report and scores for unauthorized changes. Alerts you if someone opens a loan or credit account.

- Identity Theft Protection: Covers a broader range, including SSN misuse, address changes, dark web activity, and more. Also includes recovery support and insurance.

Credit monitoring is a subset of identity theft protection, not a replacement.

Why should I get identity theft protection?

Identity theft protection is a proactive way to guard against the rising threat of personal data misuse. It offers continuous monitoring, early fraud alerts, expert recovery assistance, and financial reimbursement. You should consider it if any of the following apply:

- Your data has been exposed in a breach: Even one leak can put your identity at risk for years.

- You shop or bank online frequently: Regular digital transactions increase your exposure to cyber threats.

- You handle sensitive information remotely: Remote workers are more vulnerable due to shared networks or unsecured devices.

- You’re a caregiver or parent: Children and seniors often have clean credit histories, making them prime targets for fraudsters.

- You have a high financial profile or public visibility: Wealthy individuals and public figures attract identity thieves looking for bigger payoffs.

In these cases, identity theft protection acts as both a watchdog and a safety net, spotting threats early and helping you recover quickly and securely.

How do I protect myself from identity theft

Preventive measures reduce your chances of falling victim:

- Use unique, complex passwords and update them regularly.

- Enable two-factor authentication on all major accounts.

- Avoid public Wi-Fi for sensitive transactions unless using a VPN.

- Shred documents containing personal data before discarding.

- Use a reputable identity protection service to monitor, alert, and respond to threats.

Even basic steps like reviewing bank statements monthly can dramatically reduce fraud risks.

Top 10 simple tips to protect your identity:

What should I do if my identity is stolen?

If you suspect your identity has been stolen, immediate action is crucial to limit the damage and begin recovery. Follow these steps:

- Report the theft to the FTC by visiting identitytheft.gov. The site will guide you through creating a personalized recovery plan and filing an official report.

- Notify your financial institutions (banks, credit card issuers, lenders) to freeze or close any compromised accounts. Request new cards and change passwords on all financial platforms.

- Contact the three major credit bureaus: Experian, Equifax, and TransUnion, to place a fraud alert or initiate a full credit freeze. This step helps prevent further unauthorized accounts from being opened in your name.

- File a police report, especially if you have concrete evidence (e.g., unauthorized accounts, stolen documents, or physical ID theft). Bring a copy of your FTC report and all supporting documentation.

- Document all communication and steps taken with institutions, law enforcement, and services. This record will support any insurance claims or legal actions you might need to pursue.

- Use an identity theft protection service to monitor ongoing threats and access expert recovery help. These services often provide restoration agents, legal advice, and identity theft insurance to ease the process.

Some identity protection providers will manage many of these steps for you, saving you time and reducing stress during what can be a highly overwhelming situation.

Your identity is your most valuable asset—shield it with a protection plan that keeps pace with modern threats. Don’t wait until it’s too late.

Our Top 3 Picks

- 1

exceptional9.8

exceptional9.8 All-in-one ID, financial, and device protection

All-in-one ID, financial, and device protection- Best for - Best identity theft protection company overall

- Starting price - $9/monthly or $108/year

- Free trial - 60-day money-back guarantee

All-in-one ID, financial, and device protectionRead Aura ReviewAura - Best identity theft protection company overall

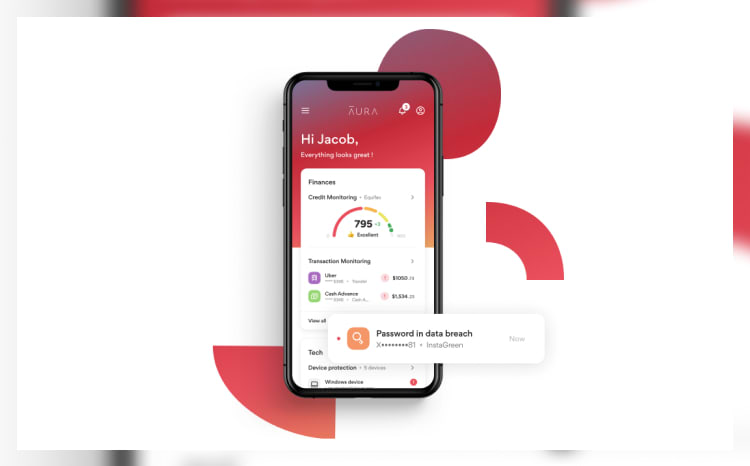

Aura provides robust protections against identity theft, including online account surveillance, financial transaction monitoring, and a secure digital "vault" for storing sensitive personal data.

The suite also features a password manager that simplifies the generation and storage of multiple robust passwords. Moreover, Aura's VPN utilizes high-grade encryption to safeguard your online activity, particularly on public Wi-Fi networks. Additionally, they offer AI-powered antivirus and safe browsing tools, which serve as a digital fortress against unwanted site trackers and fraudulent sites.

Aura monitors all three credit bureaus—Experian, Equifax, and TransUnion—as the Consumer Financial Protection Bureau (CFPB) recommends to detect identity theft. The CFPB also advises vigilance for credit check inquiries from unfamiliar companies and suspicious accounts, all of which Aura can oversee for you.

Why we chose Aura: In the event of a data breach, Aura promptly intervenes with security alerts, comprehensive fraud resolution services, and up to $1 million per person in premium identity theft insurance. The platform's sleek, user-friendly interface also showcases a "Protection Summary," conveniently displaying active anti-identity theft measures on a central dashboard.

Our experience: We were impressed with Aura's 24/7 customer support service. We appreciated that their U.S.-based fraud resolution team was always ready to assist us personally in the event of fraudulent incidents. If a breach occurs, the team would collaborate directly with us to develop a recovery plan and resolve the issue.

Aura Pros & Cons

PROS

Full suite of tools to protect your identity and finances60-day money-back guarantee for annual plan24/7 U.S.-based customer supportCONS

Fixed plans, no mixing, and matching - 2

excellent9.3

excellent9.3 Full-spectrum protection from Norton

Full-spectrum protection from Norton- Best for - Best for Norton antivirus users

- Starting price - $9.99

- Free trial - 60-day money-back guarantee

Full-spectrum protection from NortonRead LifeLock ReviewLifeLock - Best for Norton antivirus users

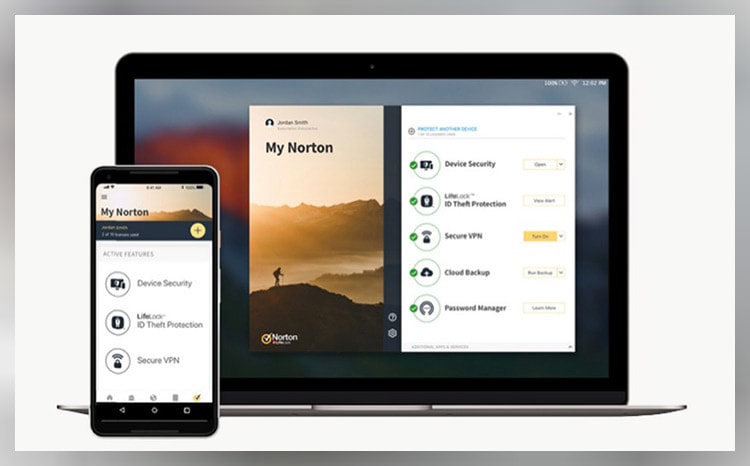

A product of anti-virus heavyweight Norton, LifeLock boasts the tech, accessibility, and ease that you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only blend online security and ID theft protection but offer more flexibility than usual.

Lifelock’s plans include ID and Social Security number alerts and are offered in tandem with Norton’s 360 suite. This means that combo plans net you VPN services plus solid ID theft features like stolen funds reimbursement that ranges from $25,000 to $1 million dollars, bank account and credit card activity alerts, and even 401(k) investment account alerts on the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes

Dark web monitoring and file-sharing network searches. All plans include 24/7 live member support and the aide of US-based identity restoration specialists.

LifeLock Pros & Cons

PROS

Reimbursement up to $1 millionAntivirus and protection from cyber threats60-day money-back guaranteeCONS

Only worth it if you want Norton 360Pricing can be confusing - 3

excellent9.1

excellent9.1 Effortless AI-backed data protection

Effortless AI-backed data protection- Best for - Best for full-spectrum protection

- Starting price - $7.20/monthly or $79.99/year

- Free trial - Free trial: Yes

Effortless AI-backed data protectionRead Identity Guard ReviewIdentity Guard - Best for full-spectrum protection

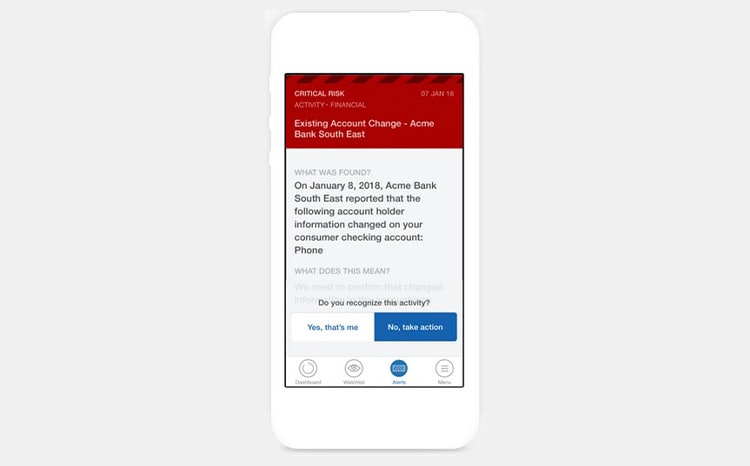

Identity Guard has safeguarded over 45 million identities and resolved more than 140,000 cases to date. They collaborate with IBM Watson's AI technology, leveraging its advanced data analysis and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercrime activities) and alerting you if criminals are selling your personal information. Identity Guard also continuously monitors your personal and financial data, with their U.S.-based support team always at the ready to handle any emerging issues.

Why we chose Identity Guard: With 20 years of industry experience, Identity Guard stands out for providing effective identity theft protection and monitoring services, powered by AI. These services promptly alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: We found that even Identity Guard's most budget-friendly plan provides top-tier protection from ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

Identity Guard Pros & Cons

PROS

Monitors credit score with all 3 credit bureausUtilizes IBM’s Watson AI tech for optimal performance$2,000 emergency cash fundCONS

No 24/7 customer service3-credit reporting only with premier plans