Is Melio Worth It?

Melio Pros & Cons

Pros

Cons

Melio at a Glance

Products

Features

Promotions

Integrations

Customer Support

Overview

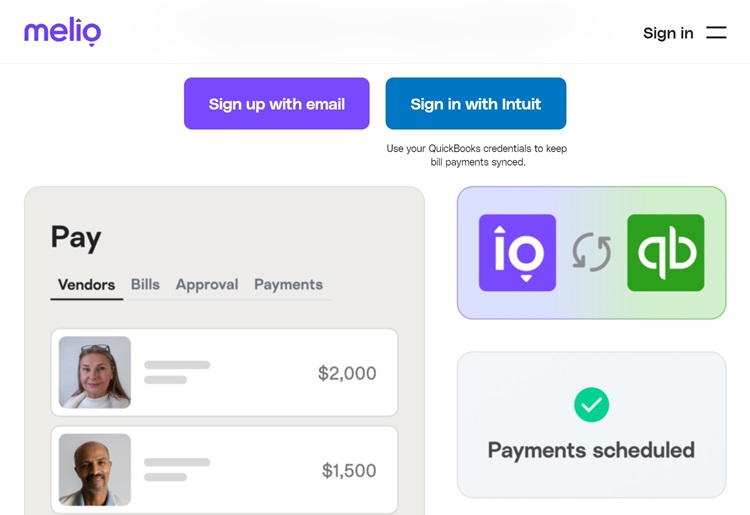

What is Melio?

Founded in 2018 and headquartered in New York, Melio is a business-to-business digital payment platform. It aims to help small businesses view, manage, and pay their incoming and ongoing payments from a single location.

The company could be a great option if you occasionally struggle with your business cash flow as it allows you to defer payments for up to 45 days when you pay by credit card. You can also split bills into multiple payments, which could provide you with extra breathing space when expenses are high.

Melio Features

Melio offers most core features needed to make and receive business payments, including accounts payable and receivable, and international payments. We’ve outlined some of the key ones below.

Accounts payable and receivable

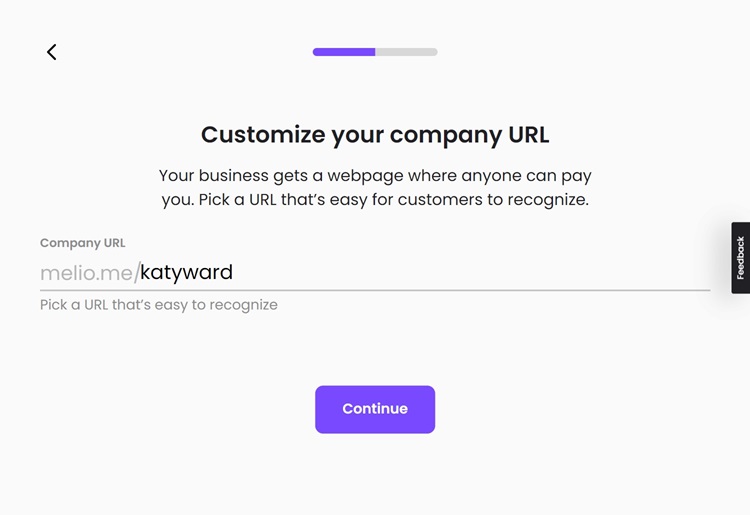

Once you’ve created a bill for your customer, you can share all the information they need to pay via a customizable URL (to which you can add your company’s logo or any other details about your business).

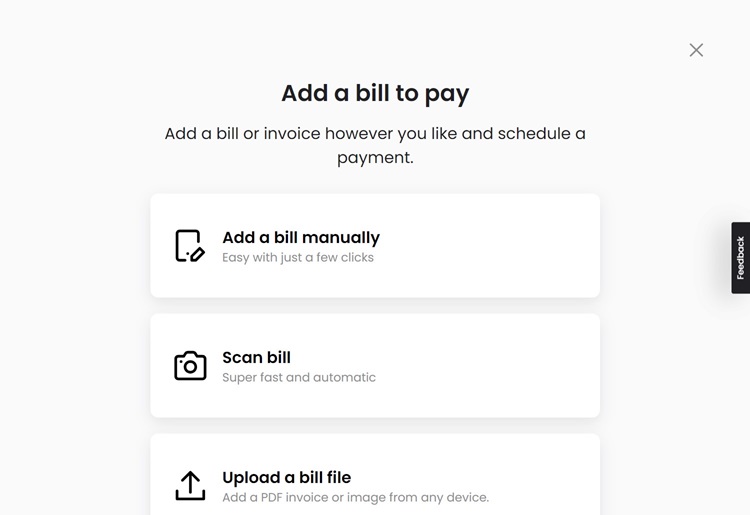

Melio’s accounts payable tools allow you to pay your vendors through ACH transfer or by card. To pay a bill, you’ll need to take a photo of the bill and send it to your Melio inbox. The company will then send a check or bank transfer to your payee.

There are, however, some gaps in its offering. For example, it doesn’t support payroll transactions or offer bank reconciliations, and international payments are only available in US dollars.

Although Melio doesn’t provide 1099 forms or offer financial reporting, it can help you prepare the information you need to submit your annual tax return. Its downloadable CSV forms will help you view, classify, and export your business expenses.

Integrations

Melio’s software works automatically with QuickBooks and Xero, which means you only need to enter payment data once if you’re also using these platforms.

The company’s integration with American Express also enables you to create virtual credit cards to use for business payments. What’s more, your purchases will qualify for eligible credit card rewards.

Melio also works with a network of more than 7,000 verified billers, allowing you to quickly pay your bill without entering the payee’s details. Some of the largest companies within the network include AT&T, Verizon, Capital One, and Chase.

Again, there are some gaps in the company’s offering as it doesn’t integrate with inventory management or CRM software.

User interface

Melio has a sleek, uncluttered dashboard, which allows you to see all your payments at a glance. You can also create easily accessible contact lists for your vendors and contractors from your dashboard.

As Melio allows you to add unlimited users to your account, the company could be a suitable option if you’re planning to grow your business in the future.

Is Melio Safe and Reliable?

Melio uses robust encryption during data transfer and on its databases (SHA 2048-bit and 256-bit, respectively).

As well as providing 24/7 monitoring on its data centers, the company places all customer funds in a protected bank account before they reach their destination.

If you’re paying by credit card, Melio won’t store any of your information on its servers and uses a card processor with the highest level of security compliance (Level 1 PCI). As well as receiving an annual independent audit, the system is tested daily.

The company also allows you to add user controls to your account, which means you can grant permission for different team members.

Melio currently has a rating of 4.3 out of 5 stars on Trustpilot. Many of those who scored the company highly praised the affordability of its service and the efficiency of its customer service.

The company isn’t accredited by the Better Business Bureau.

How Melio Works

As Melio isn’t a subscription-based service, you only pay for its tools as and when you use them (with many available for free). This means you won’t need to commit to any set time frame or choose from a range of packages when you open an account.

Unlike some of its competitors, Melio doesn’t require you to download any software, and you can access all its features online or through the company’s app. Once you’ve created an account, you can manage functions relating to your accounts receivable through the “get paid” tab, while accounts payable is under the “pay” tab.

How to Sign Up for Melio

You can create an account via Melio’s website. After entering your email address, you’ll need to provide information such as:

- Your name

- Your mobile number

- Your company name

- Your business address

- Your industry

- Your estimated monthly billing volume

Overall, this process takes less than five minutes. When I tested the service, I felt confident that I would be able to start using its tools immediately and save time on my freelance admin.

You can also sign up via your Google account or using your Intuit credentials.

Melio Customer Service

You can contact Melio via live chat or email between 9am-8pm, Monday to Friday. Be aware, the company doesn’t offer phone support. If you email the company during business hours, you should receive a response within 24 hours.

When I contacted Melio over live chat, I was immediately connected to a helpful agent who provided me with an extremely detailed response.

Melio also has a useful online help center that contains how-to guides and articles on topics such as account management, integrations, and making payments.

The company also explores subjects relevant to small businesses on its blog. Recent topics have included a beginners’ guide to ACH payments and shoplifting prevention.

How to Cancel or Pause a Melio Subscription

As Melio doesn’t work on a subscription basis, you won’t need to cancel or pause your service. You can use many of its features for free and will pay for others as and when needed.

Is There a Melio App?

You can download Melio’s app from the App Store or Google Play. The app allows you to:

- Schedule payments through bank transfer

- Track payments

- Pay by credit card

- Approve payments

- Scan and pay invoices

You can also add facial and fingerprint recognition to your account.

The app currently has a rating of 4.6 out of five stars on the App Store. Users who rated the app highly praised its user-friendly interface and simple payment process. In contrast, dissatisfied reviewers spoke of delays when contacting in-app support.

Melio Pricing

Melio doesn’t charge a monthly subscription fee and many of its features are available for free.

However, it does charge a flat rate on some of its services.

We’ve outlined these below.

| Feature | Cost |

|---|---|

ACH bank transfer (standard) | Free |

Fast ACH bank transfer (vendor receives payment by end of day) | 1% fee (up to $30) |

Card payment | 2.9% fee |

Instant transfer | 1.5% fee (up to $50) |

Fast check (vendor receives check within three business days) | $20 |

International payments (US dollars only) | $20 2.9% fee applies when paying by Mastercard |

Check mailing | $1.50 (first two per month are free) |

Whether Melio offers value for money will depend on your business’s needs. It could make financial sense if you make a high number of standard ACH transfers. However, its $20 fee for international payments could make the company an expensive option if you have a global business base.

When comparing accounting software, you may also want to consider solutions that charge a flat rate as these may offer better value for money (depending on your business’s circumstances). Although monthly fees vary, prices are often between $20 and $75 per month

What can you do with Melio for free?

The company offers the following free services on all accounts.

- The ability to add unlimited users

- Workflow approvals

- The ability to scan and send bills to your inbox

- Payment tracking and updates

- Data and form export

- Bill management

- Customized payment requests

Bottom Line

Melio has a great deal to offer if you’re looking for an affordable way to make unlimited ACH transfers. Its intuitive platform could be an excellent way to streamline your payment processes from a single location.

It was particularly impressive that the company allows you to add unlimited users to your account. However, its fairly limited integrations mean you may need to look elsewhere if you’d like to merge your accounting software with payroll processing or CRM software. Although Melio doesn’t offer phone support, it has a live chat service and a detailed online help center.

How do I know I can trust this review?

Oxford graduate Katy Ward is a seasoned journalist and editor covering personal finance and software topics for Top10. Over a 15-year career, Katy has worked with several finance titans, including Barclays, Tandem Bank, and Yahoo! Finance.